John Lloyd and John Kerschner, Fixed Income Portfolio Managers at Janus Henderson Investors review the best-performing US fixed income sectors of 2024 – what worked, what didn’t – and what it means for investors going forward.

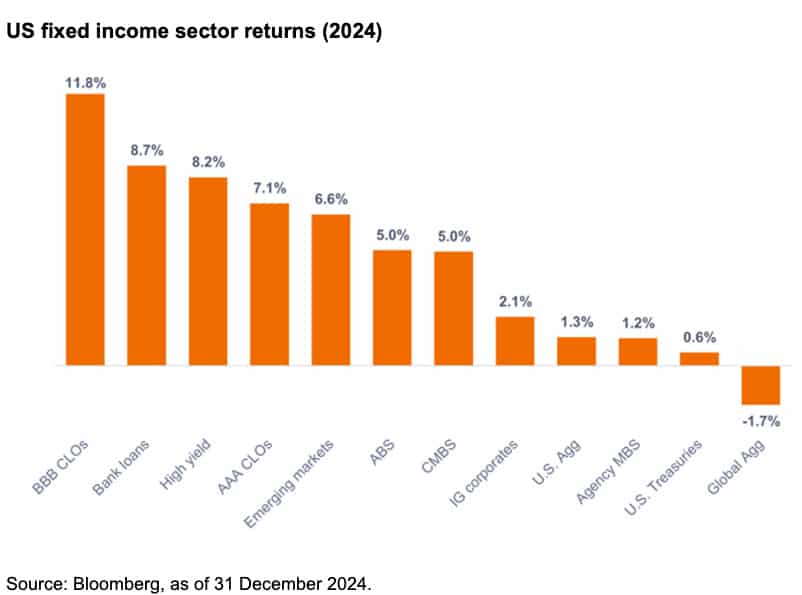

There was significant dispersion in returns among various fixed income sectors in the United States in 2024.

Notably, investors who hold portfolios that track the Bloomberg US Aggregate Bond Index (US Agg) or the Bloomberg Global Aggregate Bond Index (Global Agg) may be frustrated by their lagging performance.

By contrast, investors who adopted a multi-sector approach with exposure to a wide array of securitised, corporate, and sovereign fixed income assets have generated solid positive returns in 2024.

What performed well?

Securitised credit sectors – had been trading cheap relative to corporates for some time, offering opportunities for attractive risk-adjusted returns. Securitised credit spreads tightened in 2024, leading to outperformance, while their inherently shorter duration shielded them from the adverse impact of rising bond yields.

Also read: More Rate Cuts Likely in 2025 – But Don’t Expect a Bond Rally

High yield and bank loans – despite high-yield credit spreads trading near their historical tight levels and investor concerns around bank loan defaults, the high-yield and bank-loan sectors outperformed. Robust economic data, strong corporate fundamentals, and favourable demand-supply dynamics supported returns in these sectors.

Dollar-denominated emerging markets debt – had also been trading cheap relative to corporates heading into 2024, while many developing economies are ahead of developed-world central banks in their rate-easing cycles. Standout performers included countries with improving fundamentals and ratings potential and countries in the sub-investment grade portion of the EM index.

What lagged?

The Global Agg was the only major index to register a negative calendar year return as its foreign currency exposure suffered amid the late, strong rally in the US dollar. Within the US, longer-duration sectors such as agency MBS and Treasuries lagged as the 10-year US Treasury yield rose 69 basis points to 4.57%.

Much of the rise in Treasury yields came in Q4 to account for the risk of higher inflation stemming from the incoming administration’s policies on immigration, trade, and taxes.

Despite lagging credit sectors in 2024, agency MBS outperformed US Treasuries and, in our opinion, is trading cheap relative to Treasuries and investment-grade corporates.

Three takeaways for investors this year

First, we believe it is important to maximise income per unit of risk and limit drawdowns in the present environment. In our view, investors will be rewarded by clipping relatively high coupons and picking individual bonds with positively skewed risk-return expectations, as opposed to making macro bets.

Second, we think allocating to sectors that are trading at cheaper relative valuations – such as loans over high yield, CLOs and ABS over corporates, and agency MBS over Treasuries – will be key in 2025. Even with the strong performance in 2024, the yields in fixed income remain compelling versus historical yields, inflation expectations, and the S&P 500 Index forward earnings yield.

Finally, the US and Global Aggregate Bond Indexes are not fully representative of the fixed income universe. For example, the US Agg is comprised of 45% Treasuries, 25% agency MBS, 25% investment-grade corporates, with no high yield or loan exposure, and only around 2% in securitized credit sectors.

We believe investors should think beyond static indexes and consider an active, multisector approach that seeks to capitalise on the broad range of opportunities in fixed income.