On Friday, the RBA let Australian banks know that by the end of next year the committed liquidity facility (CLF) will be phased out.

After the GFC and the near collapse of the global financial system, regulators deemed banks needed to hold greater percentages of high quality liquid assets (HQLA) to make them stronger and more self reliant in the case of another global credit crisis.

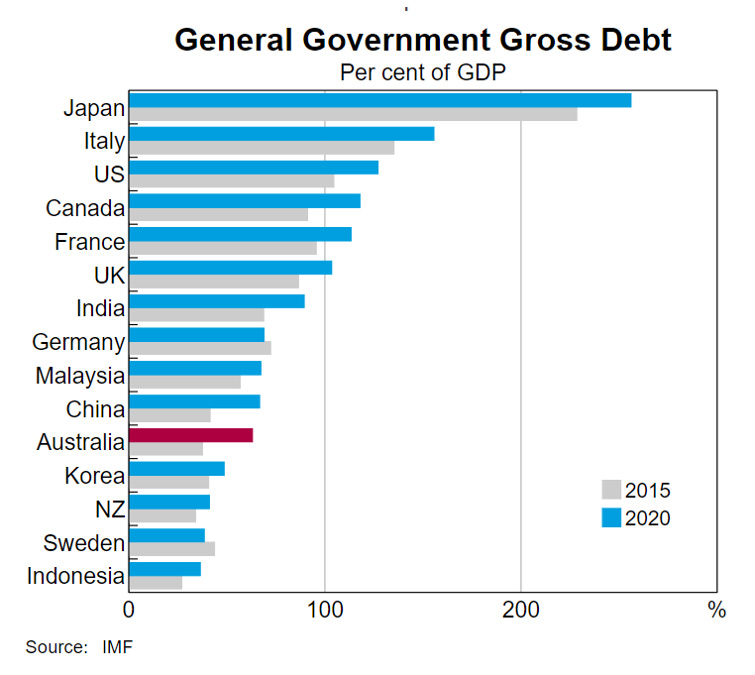

At the time, Australia had relatively low government debt levels which were insufficient to meet the bank’s HQLA standards. In response, the RBA allowed the banks to hold less liquid assets including other bank bonds, that the RBA would accept as collateral in exchange for cash, if it was needed.

Fast forward, post massive debt funded COVID stimulus, and much larger federal and state government bond issuance programs and the RBA has determined that the CLF is no longer needed. There should be enough government debt available for the banks to meet liquidity requirements.

APRA has reviewed the CLF on a yearly basis and reduced the available funding as government debt has increased.

Also read: An Element Of ‘Groundhog Day’ And The Economy To Contract

Overall, the size of the CLF has declined from $274 billion in 2015 to $139 billion in April 2021. Nearly two-thirds of this decline occurred from 1 December 2020.

The fee for the LCF has been charged to provide banks with an incentive to manage their liquidity risk appropriately. The fee has increased in increments – from 15 basis points in 2019 to 17 basis points in 2020 and to 20 basis points in 2021 – to ensure a smooth transition.

What does this mean for the fixed income market?

Chris Joye, in an article for Livewire Markets commented key take-aways are probably as follows:

- Banks were one of the biggest buyers of 5-year bank senior bonds and 3-to-5-year AAA rated bank and non-bank issued RMBS in Aussie dollars for their CLF books. This demand is likely to shrink dramatically, normalising the credit spreads on 5-year bank senior paper and 3-year AAA rated RMBS back to pre-COVID levels (eg, at least 30 basis points higher than current spreads, which would still be very, very low for the post-GFC period). One could see 5-year major bank senior spreads back at circa 70bps above BBSW and AAA rated, 3 year major bank RMBS back to say 80 to 90bps over BBSW.

- Banks have, somewhat bizarrely, sold over $100 billion of government bonds since mid 2020. They are going to now be net buyers of Commonwealth and State government bonds in potentially very large size, which should support these sectors.

For more information, see Joye’s Livewire article here.