The Bank of Japan (BoJ) raised interest rates for the first time since 2007 and has eliminated the yield curve control framework.

Franklin Templeton Fixed Income Economist Rini Sen expects the bulk of further tightening will likely come in 2025 as the BoJ seeks to reach a sustainable 2% inflation target by end of fiscal year 2025.

Sen notes, “In our opinion, three major factors guided BoJ pivot, and it had been slow to accept growing inflationary concerns as enough to warrant a change.

“The first was the upward revision in the final fourth-quarter gross domestic product numbers, which showed that Japan averted a technical recession. In fact, the BoJ noted that the economy has recovered modestly, although some weak points remain. Industrial production and machinery orders are subdued as auto production disruptions continue to impact shipments. Business investment has been largely flat with housing and public investment weak.

“However, we do expect business sentiment to turn, as corporate profits gather steam and firms look to enhance production and productivity leading to higher wage growth, rather than suppressing investments and costs, as has been the case in Japan for decades. Domestic demand will likely improve in the second half 2024, which we believe should give the BoJ further ammunition to move ahead in its tightening path.

Also read: Buy Point for Fixed Income

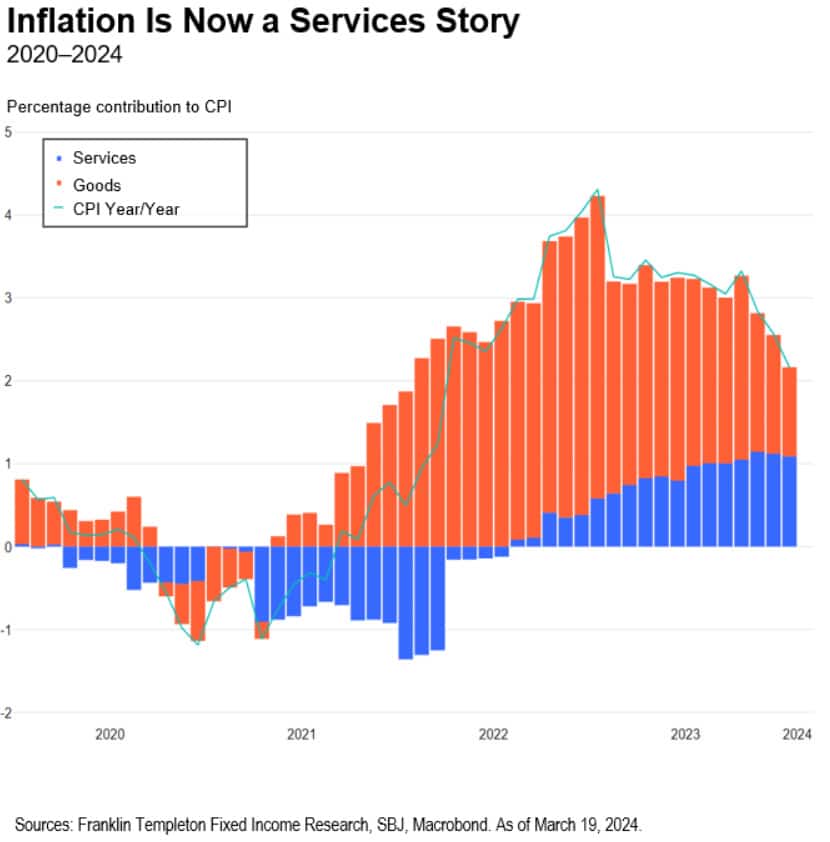

“Second, after successive revisions to its inflation forecasts and assessing whether what initially started as a supply shock did turn into a demand-pull inflation problem, the BoJ has found that a virtuous wage price spiral is in the works. We have long argued that a structural change is underway in Japan’s inflation dynamics—firms are passing on higher input costs to end users, utility companies are revising tariffs periodically, inflation hedges are gaining popularity, and wages are lifting slowly. Although many would argue that Japan’s demographics should have already pushed the inflation risk higher, the tailwinds from extensions in the retirement age and more working women are wearing off (labor-force participation rates for men and women aged 55-64 stood at 80.8 in January 2024 and that of women aged 15-64 stood at 74.9, both up from 68.1 and 62.1 in January 20121). A part of this is already evidenced in rising services within the Consumer Price Index (CPI), which is now the bigger contributor to overall inflation as goods prices recede.

Exhibit 1

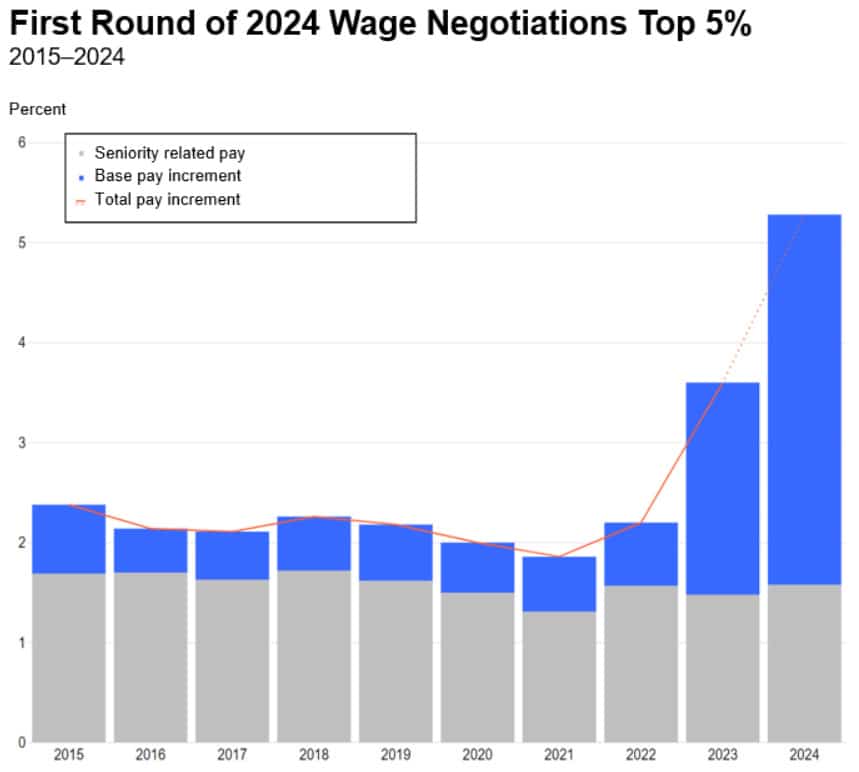

“The third and admittedly (by the BoJ) the biggest driver for the policy move was the strong wage gains in the first round of this year’s Shunto wage negotiations (see Exhibit 2 below). As reported by Rengo, Japan’s Trade Union Confederation, the first round yielded a total wage hike of 5.28% with base wages at 3.70%. For perspective, the 2023 average wage gains stood at a total 3.60%, with 2.12% gains in base pay. Larger firms including the likes of Toyota and Nissan do make up the bulk of the initial rounds of negotiations, and past data has shown subsequent rounds drag the overall averages lower (as smaller firms make up the majority in later rounds and are usually unable to match the magnitude of hikes). However, the central bank has mentioned it expects sharp gains even from smaller firms in the weeks ahead, as heard anecdotally.

“Even if we consider a marginal adjustment lower, a full year pay increase of close to 5% will still be the highest recorded wage gain since 1991. The second and third rounds of the negotiations will be declared on March 22 and April 4, respectively.

Exhibit 2: Wage Negotiations in Japan

Note: 2024 numbers are the results of the first round of negotiations, released March 15, 2024. Sources: Franklin Templeton Fixed Income research, RENGO, MHLW, Macrobond. As of March 19, 2024.

“These developments helped the BoJ to finally make a move, but we think the pace of adjustment will be gradual. Governor Kazuo Ueda’s press conference largely bordered on neutral, mentioning that future rate hikes will be contingent on inflation. We remain of the view that inflation will be stubborn and sticky, with the path of wage gains, household spending, private consumption and the extension of subsidies (especially energy which are due to end in April) governing the trajectory. The BoJ will likely be data-dependent in its future course of action. We will be also watchful of incoming data, which is why we expect the bulk of the tightening to come in 2025 (with likely two smaller hikes in 2024).

“In the next few months, wage data should start to reflect the ongoing Shunto gains, energy and other COVID-19 related subsidies (like on travel, accommodation, etc.). And, their impact on CPI would have worn off and growth would have sufficiently turned a corner.

“The markets have seemingly taken the huge buildup of the end to negative Japanese rates in their stride. We think in a way, the BoJ warmed markets into it, not least because of its tedious decision-making. We expect this watchful process to continue, with subsequent policy tweaks to give enough backdrop to not spur a surprise.”