Inflation and the cash rate continually hit news headlines at the moment, but are you aware of what is happening to one of our key interest rate benchmarks, the Bank Bill Swap Rate? Practically every day, the rates are moving higher, which is good news for investors.

The Bank Bill Swap Rate (BBSW) is used widely in lending rates and helps determine interest income on a range of securities including floating rate capital notes and bonds. In just the last 10 days, it’s jumped from 1.8639 per cent to 2.1718 per cent, or by 30.79 basis points. That is a whopping 16.5 per cent. No wonder the latest Macquarie Capital Note was oversubscribed.

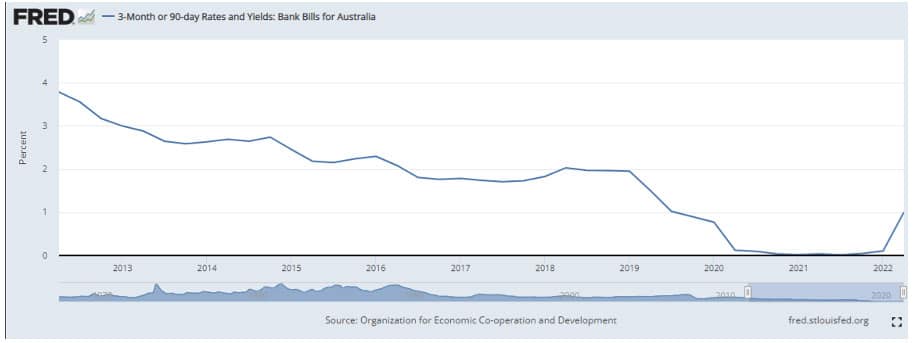

BBSW over the last 10 years

For much of the last 10 years, 3 month BBSW has been declining. It’s high for 2Q 2012 was 3.7833 per cent, moving steadily lower until 1Q 2019, when it then fell dramatically from 1.9533 to 1.0233 per cent in just six months.

Also read: Capital Notes – Advantages and Disadvantages

In March 2020, when the covid pandemic struck, BBSW was 0.12 per cent and for many quarters the rate was close to zero. Three month BBSW turned a corner in 2022 and has seen sharp rises in 2Q 2022 to finish at 2.1718 on Monday 18 July.

How is BBSW Calculated?

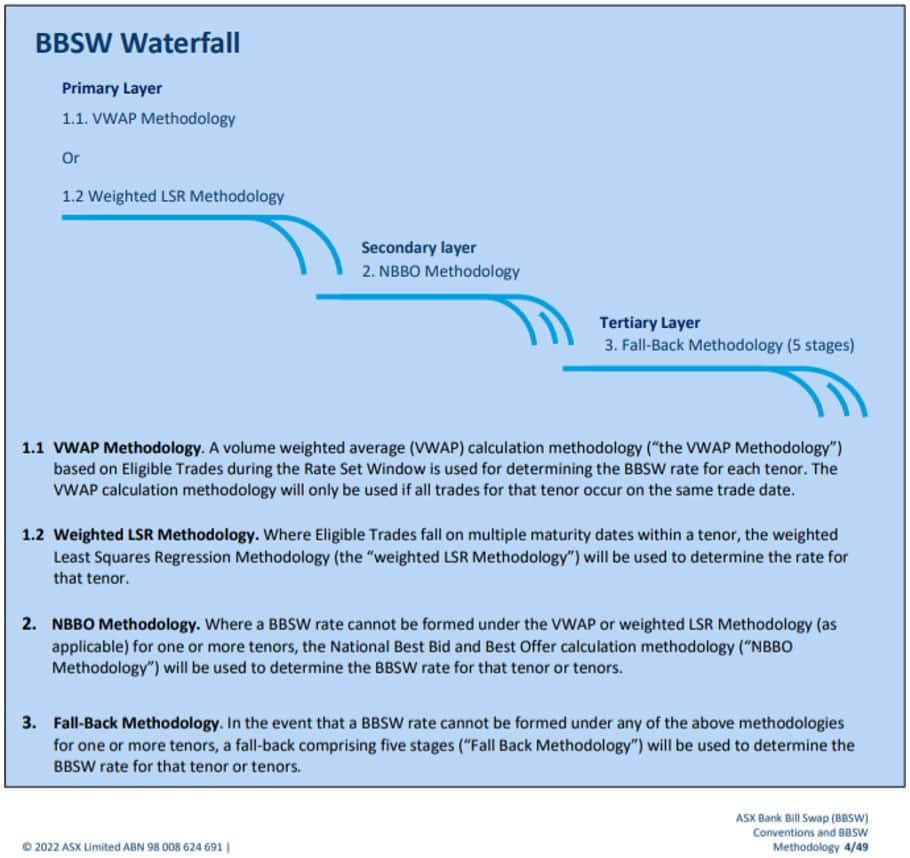

BBSW is calculated by observing eligible trades within a rate set window for each of the six time periods – 1, 2, 3, 4, 5 and 6-month tenors. If for some reason there is insufficient data, the methodology falls the waterfall sequence below.

For more information on the Bank Bill Swap Rate see the ASX and RBA websites.