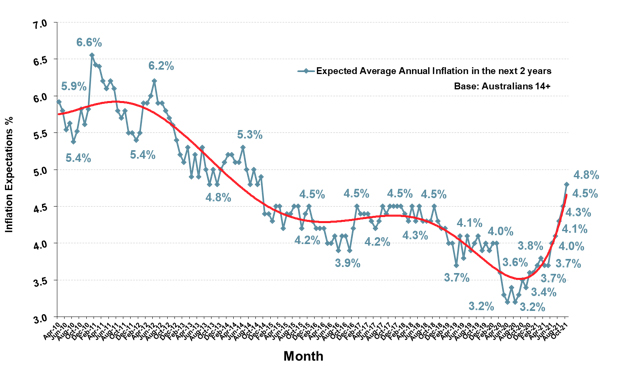

Roy Morgan research has found that in October 2021 Australians expected inflation of 4.8% annually over the next two years, up 0.3% points, and the highest Inflation Expectations for seven years since November 2014. Inflation Expectations are now a large 1.3% points higher than a year ago in October 2020 (3.5%).

The research found that inflation expectations are now 0.1% points above the long-term average of 4.7%, the first time the measure has been above the long-term average for more than nine years since June 2012.

Inflation Expectations Index long-term trend – Expected Annual Inflation in next 2 years

Roy Morgan CEO Michele Levine said, “Inflation Expectations have increased rapidly over the last year and are now up 1.6% points since August 2020 (14 months ago) – increasing at a rate faster than 0.1% points per month. This is the largest cycle of increases in the history of the index, easily beating an increase of 1.2% points during the ‘Mining Boom’ in 2010-11 (from 5.4% in August 2010 to 6.6% in January 2011).

“There are several factors driving the increase in Inflation Expectations which are related to the emergence from the COVID-19 pandemic which provided a huge negative impact on economic growth in 2020-21. There is every reason to suspect the measure will continue to increase over the next few months heading into 2022 as these factors continue to impact the Australian economy.

Also read: Australian Economic View – November 2021: Janus Henderson

“The transition to ‘COVID-normal’ in Australia is being driven by high vaccination rates and the lowering of restrictions as we see lockdowns end in Sydney, Melbourne and Canberra and domestic border restrictions are set to end in several States over the next seven weeks.

“The increased demand has been driven not only by the emergence from COVID-19 restrictions but also the ability to spend the savings built up during the pandemic. The Federal Government pumped hundreds of billions of dollars of stimulus money into the economy to prevent a crash over the last two years to support people in financial difficulties who may have been forced out of work.

“The barriers to people spending this money are finally being removed in Australia, and in other countries around the world, and this is driving a surge in spending, and demand. The surge in demand is running up against supply constraints from exporting countries such as China and this pressure is stressing the supply chain and forcing prices to increase.

“Another factor at play is the impact the early stages of the pandemic had on investment in energy infrastructure. The lack of investment in oil and gas exploration and development during 2020 when the global economy ‘crashed’ is having a continuing impact now as energy shortages – particularly in Europe and China – are increasing energy costs worldwide.

“The impact of rising energy costs is being felt most directly at the petrol pump with prices in Australia at record highs: $1.70 per litre (Sydney), $1.75 per litre (Melbourne) and $1.77 per litre (Brisbane). October was a month of transition as the long lockdowns in Sydney, Melbourne and Canberra ended and as travel picks up with restrictions ending there is set to be more upward pressure on demand, and prices, over the months ahead.”