By Ken Hanton, Independent Fixed Income Specialist

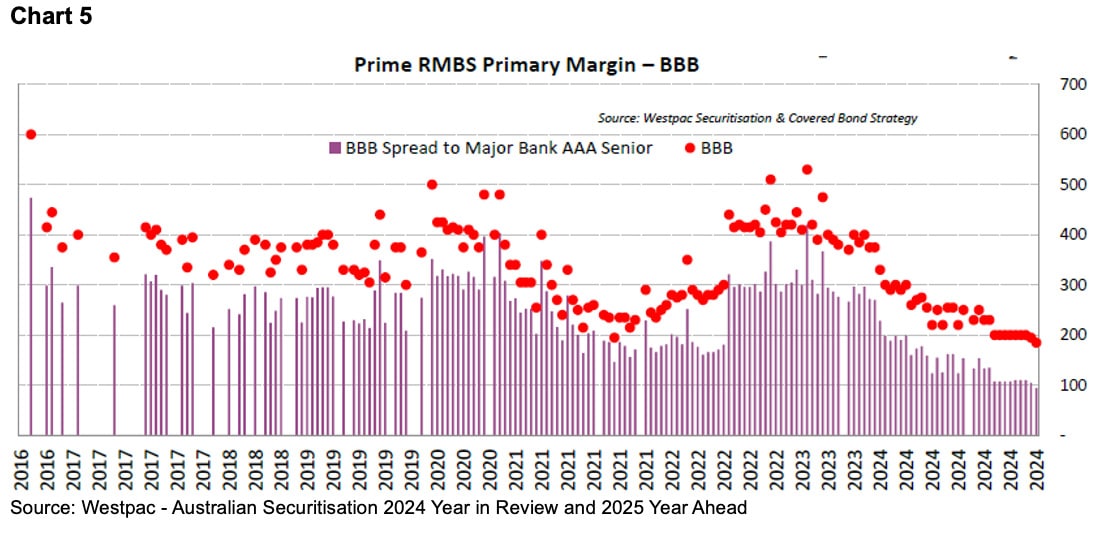

What a year 2024 turned out to be for the Australian securitisation market. For the first time ever, there were 100 new Residential Mortgage Backed Securities (RMBS) and Asset Backed Securities (ABS) deals priced in the Australian public market for a record breaking $77.6bn (excludes refinance notes), easily smashing the previous highwater mark of $64bn set back in 2006. Sixty two of these were RMBS deals for total issuance volume of $59.2bn (AUD equivalent) and 38 were ABS deals for $18.5bn.

There were various elements that allowed 2024 to be such a strong year – stable credit quality, elevated yields, the end of the Term Funding Facility; but for me, it was the increased depth and strength of investor demand that was key to the record-breaking year for the whole of the Australian credit market, not just securitisation.

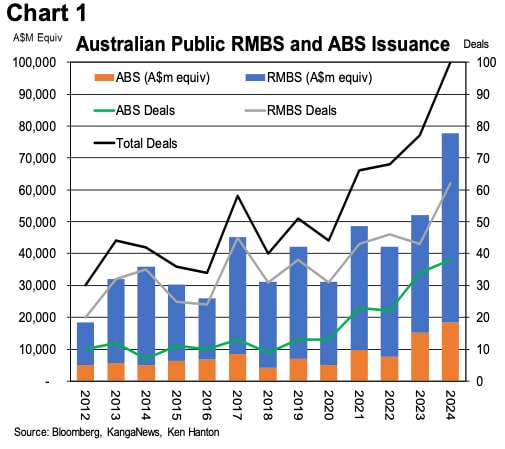

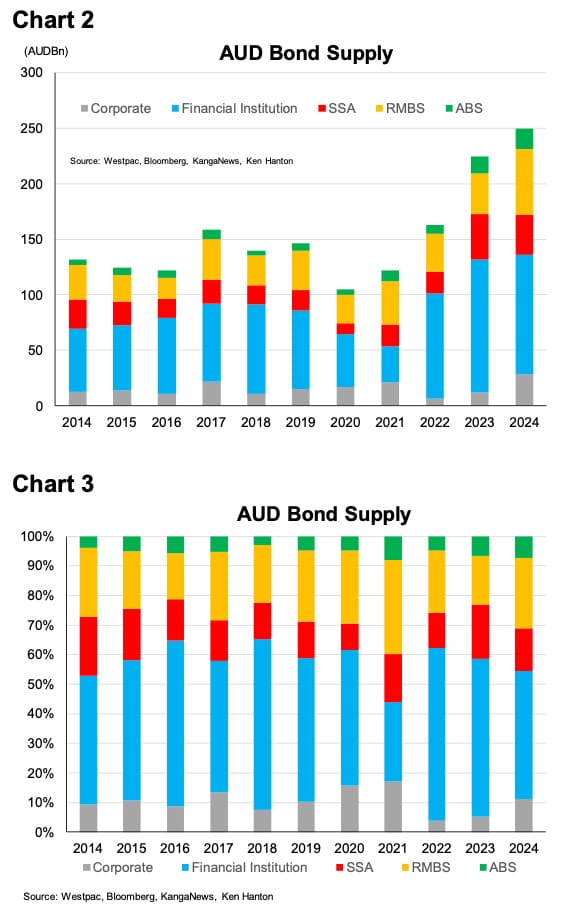

Using the non-government AUD bond issuance data contained in Westpac’s 2024 year-end credit and securitisation reports and adding the securitisation data (nearly all of it was in AUD), shows that securitisation made up 31% of the Australian credit market’s issuance in 2024, which was above its 10-year average of 27% and a little above its pre-COVID 2019 high of 29%.

So, what will issuance in 2025 look like? At the Australian Securitisation Forum conference in Sydney in December, there was some excited participants saying $100bn will be achievable in the coming years. I’d be pleasantly surprised if this turns out to be the case as it would require an even further strengthening of investor demand which would also benefit other parts of the credit market. By the same token, at the beginning of 2024, I would have probably said 100 public deals for the market in a year might be a bit of a stretch given there were 77 deals priced in 2023 which at the time was a post GFC record. Even more so, as progressively more activity is finding its way into the private markets.

Assuming current macroeconomic and capital market conditions continue, Westpac said in its 2024 year-end securitisation report that its expectation for 2025 is for “another strong year with total public activity to land in the AUD62bn-75bn range”. Notably, the lower end of this range is still $10bn above 2023’s $52bn and as such, should still be considered a very strong outcome for the market if it happens.

Also read: ASIC Puts Private Markets Under The Microscope

As this note goes to publication, the market has opened 2025 already with four mandates announced. Three of these are RMBS deals and one is an auto -backed ABS deal. The Australian Office of Financial Management (AOFM) has also conducted a Bids Wanted in Competition (BWIC) auction of notes it holds from three Firstmac RMBS transactions last week. It was a successful auction with all $60.5m of notes spread across 11 tranches pricing comfortably above the AOFM’s reserve prices.

Indications of Interest (IOIs) have been released for the Plenti Auto ABS 2025-1 Trust, with guidance of the senior Class A notes in the 1m BBSW +115-120bps range and the deal expected to launch and price next week.

For RMBS, and normally at this time of the year, the market opens with a series of major bank or larger (top 5) non-bank issuers and these deals establish the pricing benchmarks for other issuers. The Suncorp Apollo RMBS 2025-1 transaction is the only announced transaction that comes from a bank and its launch and price timing has yet to be disclosed. So with all this in mind and without the need for the major issuers to establish the new pricing benchmarks, it’s fair to state that the market is looking to a confident start 2025.

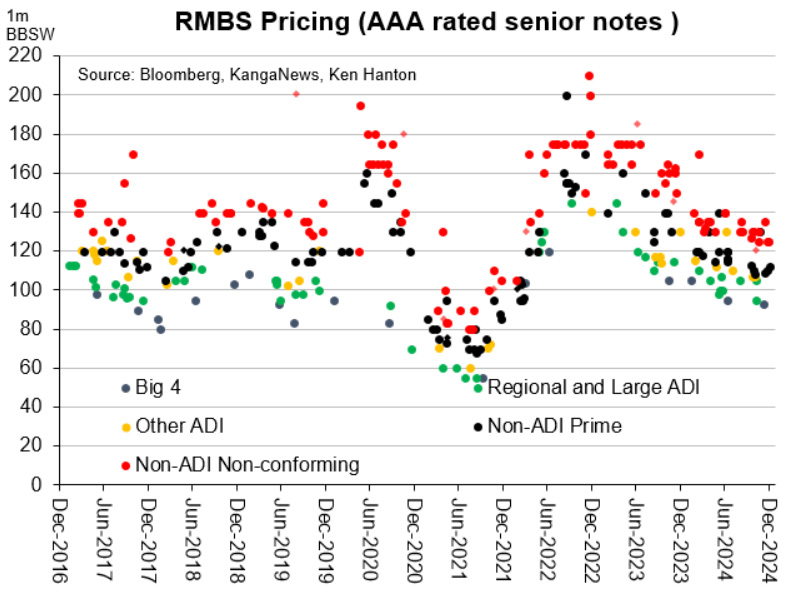

The strength of investor demand also allowed RMBS and ABS spreads to tighten in 2024. Long Weighted Average Life (WAL) senior AAA rated major bank RMBS spreads began the year at 1mBBSW +105bps and ended at 93bps. Non-ADI prime spreads opened at around 120bps and ended at around 110bps and non-conforming spreads opened at around 135bps-140bps and ended around 125bps-130bps. Similar moves were seen in the Auto and Auto and Equipment ABS classes as well, all of which was impressive yet unremarkable when compared to historic data as spreads have been tighter.

However, it was what happened to junior note pricing that really stood out in 2024.

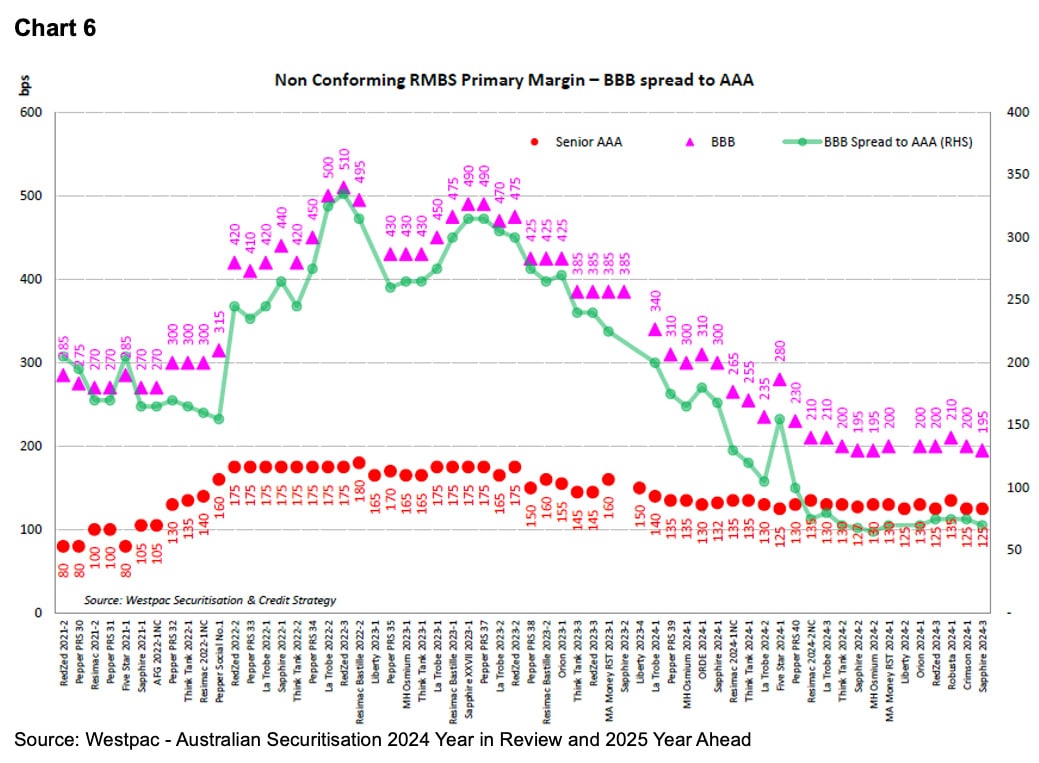

At the beginning of the year, single ‘A’ rated and ‘BBB’ RMBS prime spreads were being priced at around 125bps and 180bps wider than their long WAL ‘AAA’ senior tranches. For non-conforming RMBS, ‘A’ notes were pricing between 125bps to 145bps wider than the senior ‘AAA’ tranches and ‘BBB’ notes were pricing between 175bps to 200bps wider. In the auto and auto-equipment ABS categories, single ‘A’ notes were pricing around 95bps to 115bps wider than ‘AAA’ notes and ‘BBB’ notes were pricing around 150bps to 200bps wider.

Throughout the year, junior note pricing tightened by considerably more than senior note pricing and by year-end, prime ‘A’ notes were pricing around 60bps wider than the ‘AAA’ senior counterparts and ‘BBB’ notes around 75bps wider. For the non-conforming RMBS category, ‘A’ notes were also pricing around 60bps wider than their ‘AAA’ counterparts and ‘BBB’ notes around 70bps to 75bps wider. For the established auto and auto-equipment issuers, the differentials ended the year at similar levels of around 60bps and 80bps for the single ‘A’ and ‘BBB’ categories.

As the below charts from WBC’s Securitisation review and outlook report shows, the pricing differentials between ‘AAA’ and ‘BBB’ are now at all time tights. And whilst there is room for ‘AAA’ note pricing to tighten further (should conditions allow), it will probably take a repeat performance of the exceptional level of investor demand seen in 2024 for the current ‘A’ and ‘BBB’ pricing differentials (to ‘AAA’ notes) to hold in 2025.