From Matthew Macreadie, Executive Director, Credit Strategy and Portfolio Management – IAM Capital Markets

- Australia’s inflation problems may see 50bps of further monetary tightening, but for investors it really depends on where you are on the credit pendulum.

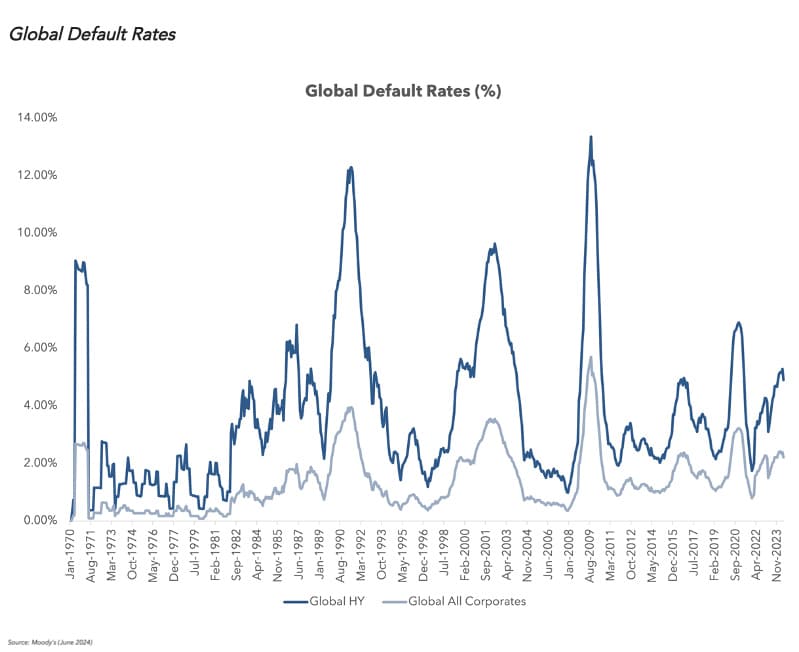

- Given Australia’s credit market is largely investment-grade, higher interest rates are likely to remain a net positive. In contrast, there could be some stress in the Australian high-yield market, but you are being paid for the risks.

- At this stage, I’d propose a balanced exposure to fixed and floating, or 50% fixed / 50% floating bonds for new investors with an overall interest rate duration of around 3 years. In our view, keeping corporate maturities short to medium-term would be advisable to manage credit spread risk.

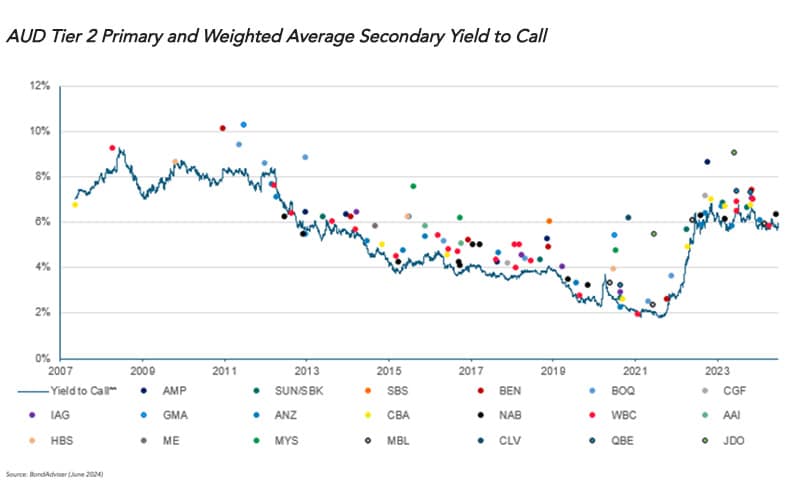

- We are constructive on the Australian Tier 2 Subordinated Market and see it performing well over the course of 2024/2025.

A distinctly Australian context

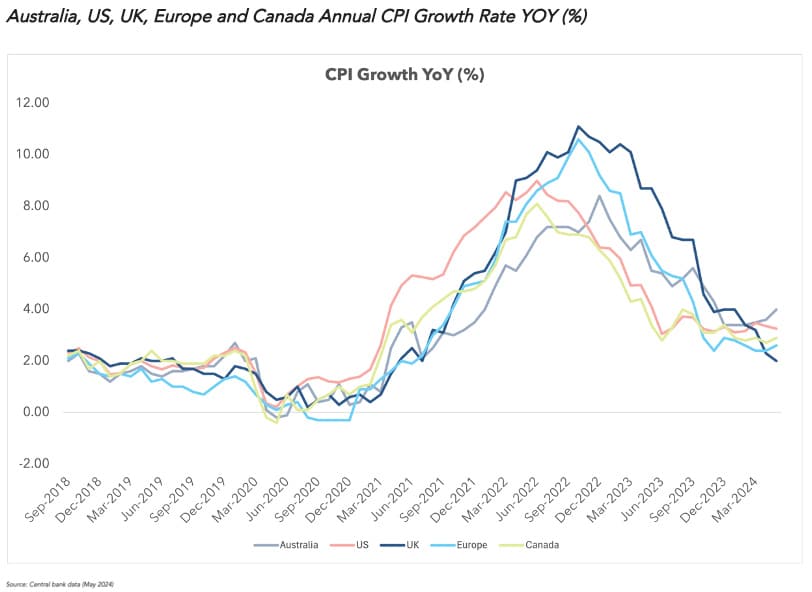

Central banks around the developed world have finally begun or at least signalled their intention to cut interest rates. The battle against inflation that has circulated global markets since 2020 is nearing its final stages for most developed countries, however not for Australia. Inflation remains persistently high with the latest data point of 4.0% YoY for May 2024 above market expectations of 3.8%. The trimmed mean inflation (RBA’s preferred measure) was 4.4% well more than the central bank’s target of 2-3% and 4% reported at the end of 2023. Australian interest rate markets have now repriced the potential the possibility of a new interest rate hike by the end of 2024 from 10% to 50%. This would leave Australia as one of the few developed countries to have a contractionary monetary policy. The timing and magnitude of interest rate hikes remains unknown, but Australia will face a higher-for-longer interest rate environment.

Higher interest rates are a net positive for the Australian credit market. Australia has managed to avoid a recession, even though data has been somewhat weak. This would normally imply weaker credit conditions (and credit spreads), but Australian credit market spreads have been robust and have driven tighter over 2023/2024. Our view is that this has been driven by the relationship between yields and credit spreads, which will remain a net positive in a higher-for-longer interest rate environment:

- Higher yields = higher demand. Australian ETFs and credit funds have received additional cash flows in 2023.

- Credit duration and interest rate duration could offset each other. In a sell-off, wider credit spreads could be offset by tighter interest rates (on the expectation of rate cuts) if duration is positioned correctly.

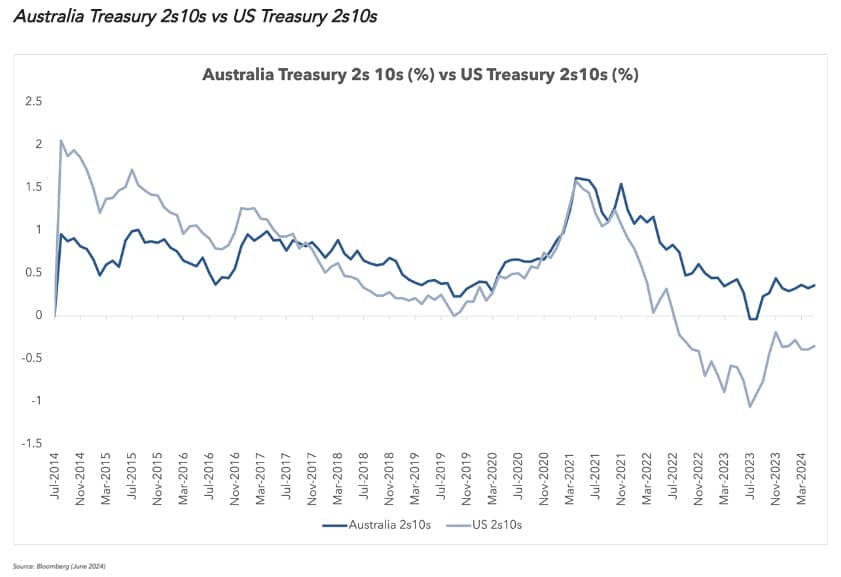

- Additional interest rate hikes could be a net positive, particularly for short-dated/floating rate instruments. If further increases to the cash rate mean the RBA is catching up with global peers, then the Australian Treasury curve (2s10s) will likely invert versus the US Treasury curve (2s10s) equivalent. Thus, the impact for fixed rate medium and long-term bonds could be somewhat curtailed. Moreover, this could result in further yield demand for short-dated and/or floating-rate securities given higher BBSW rates.

What does it mean for portfolios?

If today is your starting point, and you are trying to determine the outlook for interest rates, it’s important to know that the markets’ expectations are already priced in. At this stage, I’d propose a balanced exposure to fixed and floating, or 50% fixed / 50% floating bonds for new investors with an overall interest rate duration of around 3 years. It is very hard to have any strong conviction/certainty over the inflation outlook which makes interest rate positioning especially challenging and the need to be appropriately hedged. Investors can tinker around with the slope of the yield curve by taking a position on how overweight or underweight they would like duration at the short, medium, or long end of the yield curve.

In our view, keeping corporate maturities short to medium-term would be advisable to manage credit spread risk. Government and semi-government bonds typically appreciate as economies enter recession; and whilst I don’t believe this is a base case outcome for Australia, it could help offset other losses in your portfolio from equities and property. Thus, a small portion of short to medium-term government and semi-government bonds, maybe 10-20% is useful as a hedge.

Australian Tier 2 Subordinated Market Set to Perform

There are strong underlying reasons why Tier 2 sub debt credit spreads (5-year equivalent) could rally into the low 100bps from the current 170bps credit spreads over the course of the next financial year. Current Tier 1 securities such as listed hybrids, offer credit spreads (5-year equivalent) at 220-270bps (which include franking) which seems tight for the risk going forward. For indicative purposes, if you buy a Tier 2 sub debt at 170 credit spread (5-year equivalent) now and Tier 2 margins go into 100 credit spread in 1-years’ time, this equates to an annualised return of 10% given a 6% coupon.

- Ratings are now in the A bucket. Recent upgrades by rating agencies have now pushed T2 sub debt to A3 (Moody’s) | A- (S&P Global Ratings) | A- (Fitch) which places them three notches above T1 instruments. Three-notches = 50bps differential = mispriced.

- Demand/Supply T2 supply. The major banks are largely done on T2 sub debt issuance for this year (outside of ANZ). Alongside new institutional support for the T2 product (with ratings now in the A bucket), this should see increased demand versus prior years and place downward pressure on credit spreads to perform.

- APRA. APRA has made it very clear that they want to distinguish the risk profile of T2 sub debt versus T1 in line with other offshore banking jurisdictions. This will mean that T1 becomes more equity-like to preserve capital buffers, T2 sub debt becomes more debt-like and quasi senior unsecured debt.

- Stress Testing. APRA recently released a speech by Chair John Lonsdale at the AFR Banking Summit titled “Severe but plausible: Taking a wider view of risk”. The main highlight was details around APRA’s ADI stress testing. All banks incurred a three-notch downgrade from the rating agencies. APRA reported that of the 11 banks tested, “all had sufficient capital to withstand the severe downturn and support an economic recovery.” Specifically, CET1 fell -330 bps toward 9.0%, chewing through capital buffers. Note – Common Equity Tier-1 (CET1) consists of ordinary share capital, retained earnings, and T1 capital. So T1 (or hybrids) were chewed through in the process of stress tests, and credit losses were Macquarie Private Sample Portfolio Fixed Income Proposal July 2024 incurred, with profits and dividends falling significantly. Importantly, no interest payments on T2 sub debt or T2 refinancing needs were missed, but dividends were heavily curtailed.

- Relative Value. T2 sub debt credit spreads (5-year equivalent) are currently 170bps versus senior unsecured credit spreads (5-year equivalent) of 70bps and T1 credit spreads (5-year equivalent) of 220-270bps. Historically, the T2 sub debt / senior unsecured credit spread multiple has been at 2x so anything over 2x is generally seen as a buy signal.