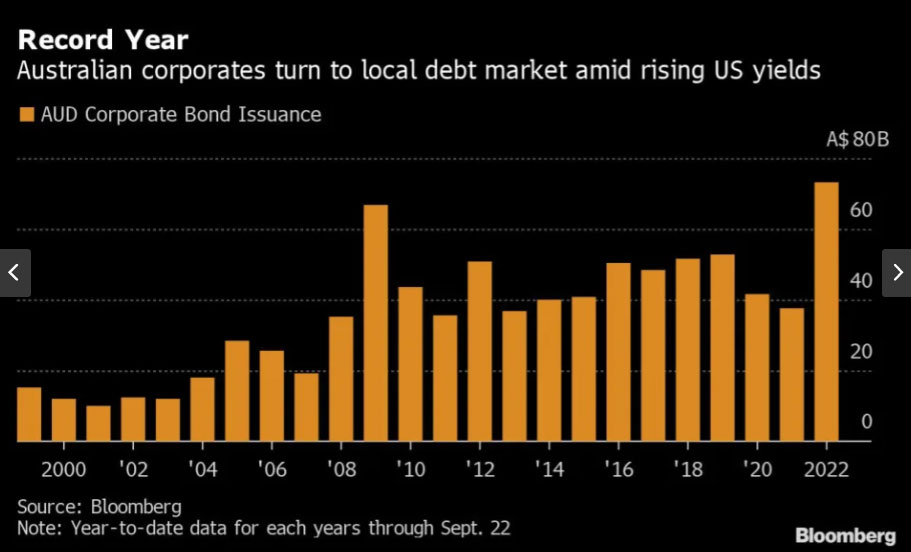

Companies in Australia have turned to the local debt market this year selling a record amount of local currency bonds as domestic borrowing costs rise more slowly than the US and banks replace funding that was cheap due to Covid-era measures.

According to Bloomberg AUD$73 billion has been raised so far in the first nine months of 2022 which is a record dating back to their available data from 1999. August was the strongest month of the year so far.

With high inflation numbers, the Reserve Bank of Australia has lifted its benchmark rates by 2.25 percent so far which is below levels seen by the US Federal Reserve. Bloomberg reports that lenders are looking to replace the cheap funding initiated by central banks which was available following Covid-19 and that starts rolling off in 2023.

Also read: Three Floating Rate Bond ETFs – FLOT, QPON, SUBD

The full-year record for deals as tabulated by Bloomberg is AUD$82 billion for 2009, which now could be exceeded in 2022 at the current rate.