S&P Dow Jones Indices has launched the SPIVA(R) Australia Year-End 2023 report. The report measures the performance of actively managed funds relative to benchmarks over various time horizons, covering equity, real estate and bond funds, and providing statistics on outperformance rates, survivorship rates and fund performance dispersion. In this year-end 2023 edition, domestic equity funds in New Zealand are included for the first time.

2023 Highlights

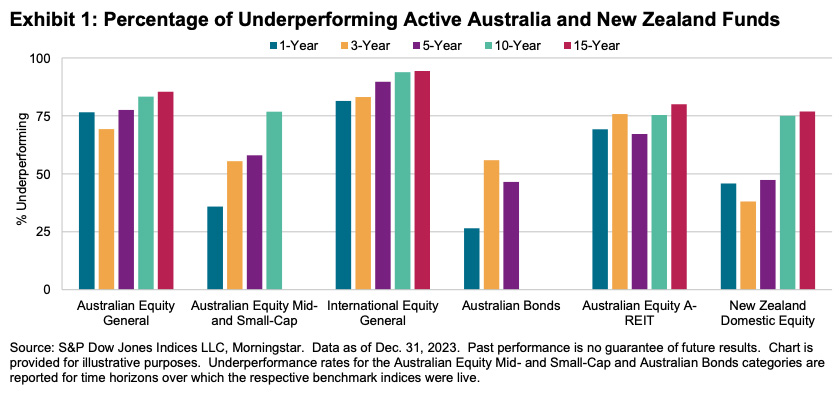

It was among the best of times and the worst of times for actively managed funds. In the Australian Equity General category, more than three-quarters of active managers failed to keep up with the S&P/ASX 200, and a similar story was seen in the International Equity General category. Meanwhile, active bond managers had an exceptional year, with almost three-quarters of Australian Bonds funds beating the S&P/ASX Australian Fixed Interest 0+ Index. Exhibit 1 summarizes the results across all our reported categories.

Australian Bonds Funds: Active managers in the Australian Bonds category posted their lowest one-year underperformance rate since the 2015 launch of the S&P/ASX Australian Fixed Interest 0+ Index, with just 26% of funds lagging the index. The longer-term record was also better relative to other categories, with 56% and 46% underperforming over the three- and five-year periods, respectively.

Market Context

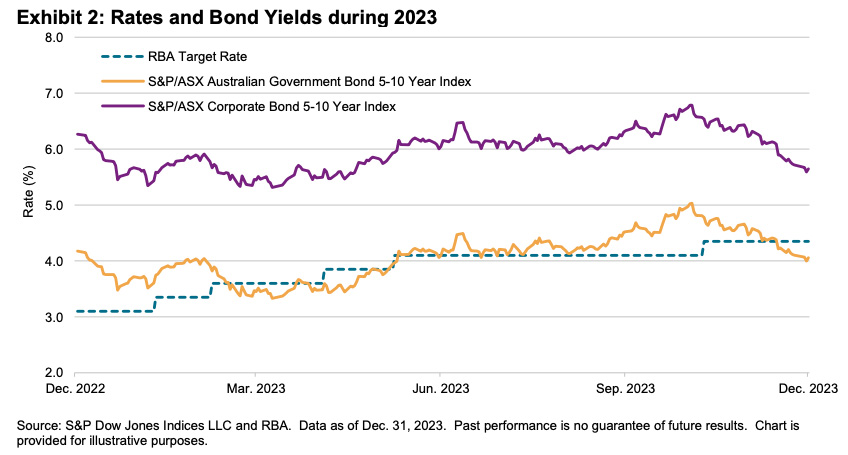

In 2023, as in many previous years, central bank policy decisions domestically and abroad dictated much of the market sentiment. The Reserve Bank of Australia (RBA) increased its target rate five times during the year, while fluctuating long-term inflation and economic expectations sent longer-dated government bond yields lower, then higher, before they ended the year close to where they began. Credit spreads moved mildly lower, with the spread between the S&P/ASX Australian Government Bond 5-10 Year Index and S&P/ASX Corporate Bond 5-10 Year Index falling from 209 bps to 159 bps over the year.

The full SPIVA Australia scorecard can be accessed here.