Sonal Desai, Chief Investment Officer, Franklin Templeton Fixed Income believes markets have been excessively worried about stagflation risk and are now too confident that the Fed would rush to support growth even if inflation turns back to a rising path.

“Financial markets saw this week’s Federal Reserve (Fed) policy meeting as dovish. I’m not so sure. The Fed now projects slower growth and higher inflation compared to its December forecasts. The reduction in expected growth is meaningful, by 0.4 percentage point (pp) this year and 0.2 pp next year—though the unemployment forecast is virtually unchanged, with a mere 0.1 pp uptick for this year, probably reflecting tighter immigration policy. Core personal consumption expenditure inflation has been revised higher by 0.3 pp this year, but with no change for 2026 and 2027. In other words, the likely bump in inflation caused by tariffs is expected to be, yes, transitory. Some reporters baited Fed Chair Jerome Powell on the “transitory” label, which became infamous after the persistent inflation of 2021-2024. This time, however, there are solid reasons to expect that an acceleration in inflation would not last. Unlike in the post-pandemic period, the supply shock (from tariffs, in this case) is not expected to be validated by a massive expansion in government expenditures.

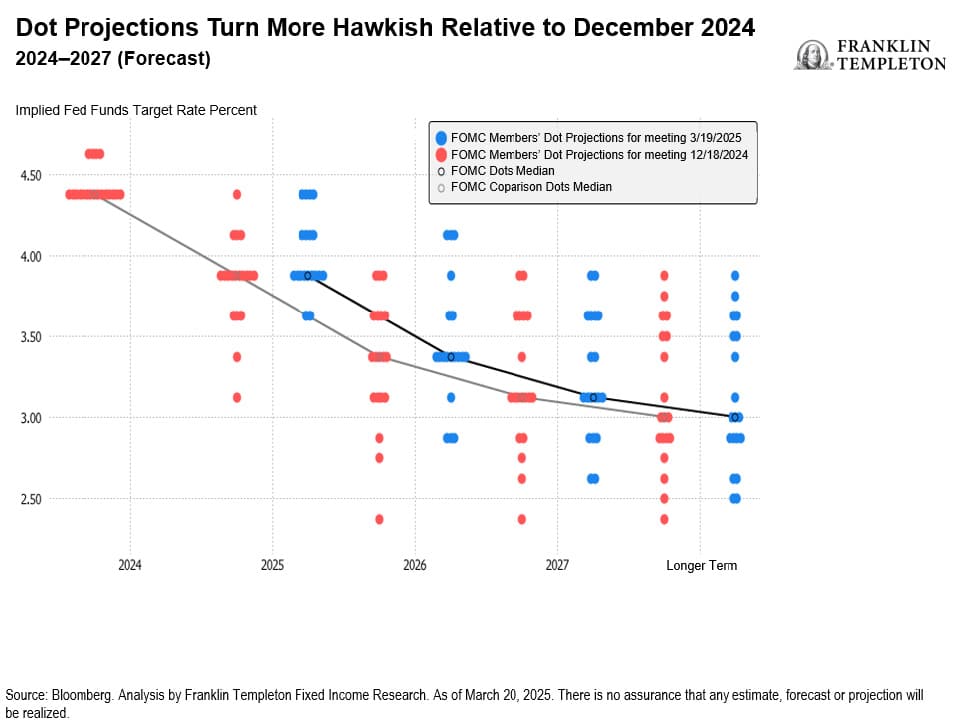

“On policy interest rates, the median of the “dots” still signals two rate cuts this year, the same as last December. That’s why most investors saw this as a dovish shift: The Fed projects higher inflation but still intends to cut rates, and by the same amount as previously.

Also read: EM Resilience and Potential Despite Chaotic US Tariffs

“I disagree with this interpretation. Powell explained that, first, the Fed’s baseline expectation for now is a temporary shock to inflation, which the central bank would rightly look through; but second, more importantly, the main reason why the policy forecast is unchanged is that policy uncertainty is now so high that the Fed cannot yet predict with any confidence whether it will need to keep rates higher or lower. In other words, the Fed is keeping all its options open.

“I would also point out that, while the median of the dots still indicates two rate cuts this year, the mean has shifted clearly in a hawkish direction, toward one rate cut only.

“Several Federal Open Market Committee members clearly acknowledge that it would be especially risky to cut rates given the possibility that inflation might reaccelerate. Moreover, the Fed does not think that a significant growth slowdown should be taken for granted yet, for two reasons.

“First, that while surveys have recorded weaker consumer confidence, hard data show the US economy is still in good shape, with a solid pace of economic activity and the labor market in a “low hiring, low firing” equilibrium with a still low unemployment rate.

“Second, that the macro outlook will depend on the administration’s entire economic policy package, including not just tariffs and immigration, but also fiscal policy and deregulation.

“Unsrprisingly, I agree on both counts, as I have pointed out earlier that, while tariffs and immigration have come up-front, concrete action on deregulation and tax policy is expected to follow, and these are the two elements that should help lift growth and contain inflation.

“The key issue right now is that “uncertainty is remarkably high,” as Powell put it—the fog of trade war. The question is how to handle it.

“For the Fed, as for private companies, the key question is how long to wait before taking action. The Fed is, in a way, forced to wait longer, even at the risk of finding itself behind the curve. Not knowing yet whether the risks will be skewed toward significantly lower growth or sharply higher inflation makes it much harder for the Fed to act pre-emptively on rates.

“For companies, the defensive strategy is to cut back on investment first, and then on employment. As long as there is a good prospect of pro-growth policies kicking in, companies have reason to wait, so as not to miss out on the upside. The longer we go with volatile threats of tariffs and no concrete progress on deregulation and taxes, the more companies will need to worry about the slower growth scenario and will be tempted to pull back.

“Equity markets rallied after the Fed’s press conference, but perhaps for the wrong reason. I don’t see the Fed as turning more dovish. I have argued for some time that inflation pressures are set to remain elevated above the Fed’s comfort zone. If higher tariffs compound these pressures, the Fed will have to think twice about any further rate cuts. And if growth slows significantly at the same time, the Fed might find it has run out of silver bullets.

“Downside risks and flagging sentiment bear watching; the longer the uncertainty, the higher the risk. But the reason to be more optimistic on the outlook is that growth is still solid and pro-growth policy measures are still in the cards. Therefore, I am still sticking to my call for at most one rate cut this year, with some probability of none.”