By Mitch Reznick, CFA; Robin Usson, CFA; and Sophie Demare of Federated Hermes

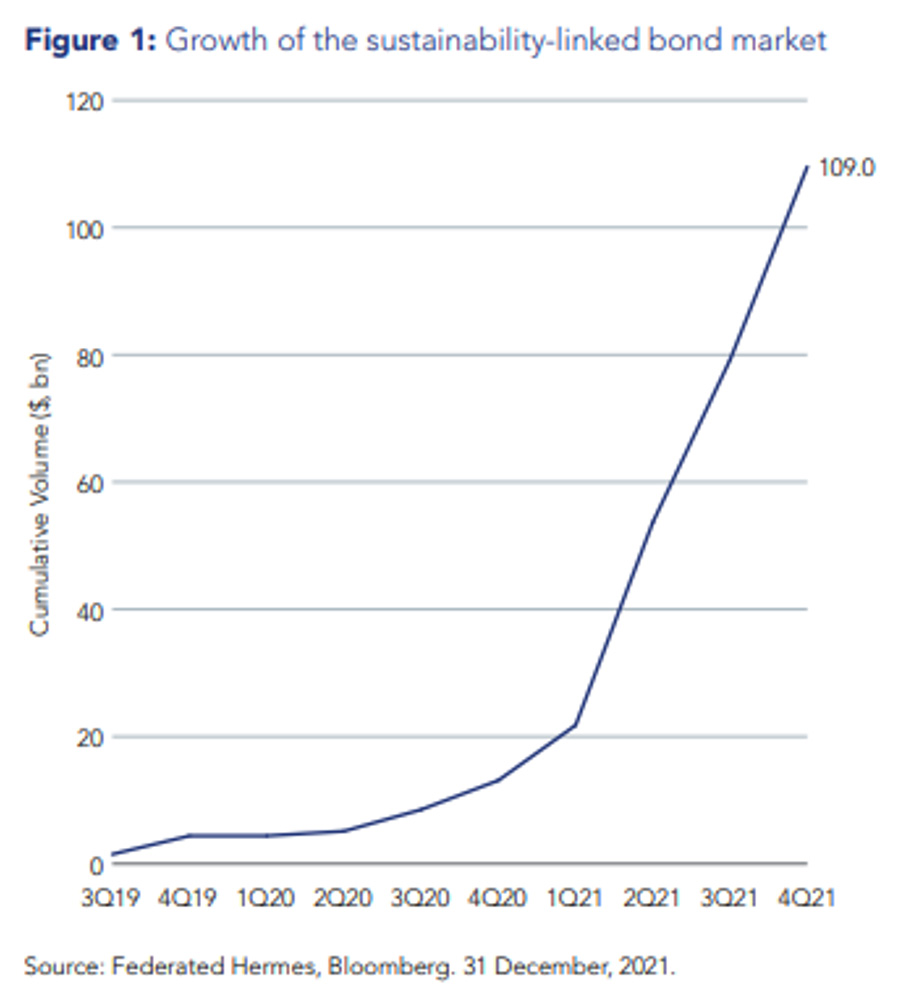

After record issuance in 2021, the Green, Social, and Sustainability bond market (GSS) has grown to a market capitalisation of just under US$2 trillion. The fastest growing security type in this market is the sustainability-linked bond (SLB). The bonds debuted in 2019 by Enel, an Italian utility company – and, by the following year, companies had issued some US$10bn of SLBs into capital markets.

By 2021, that figure had risen more than ten-fold and expectations are for a similar or even higher level of issuance this year. Without question, SLBs have found a permanent place as part of the GSS market.

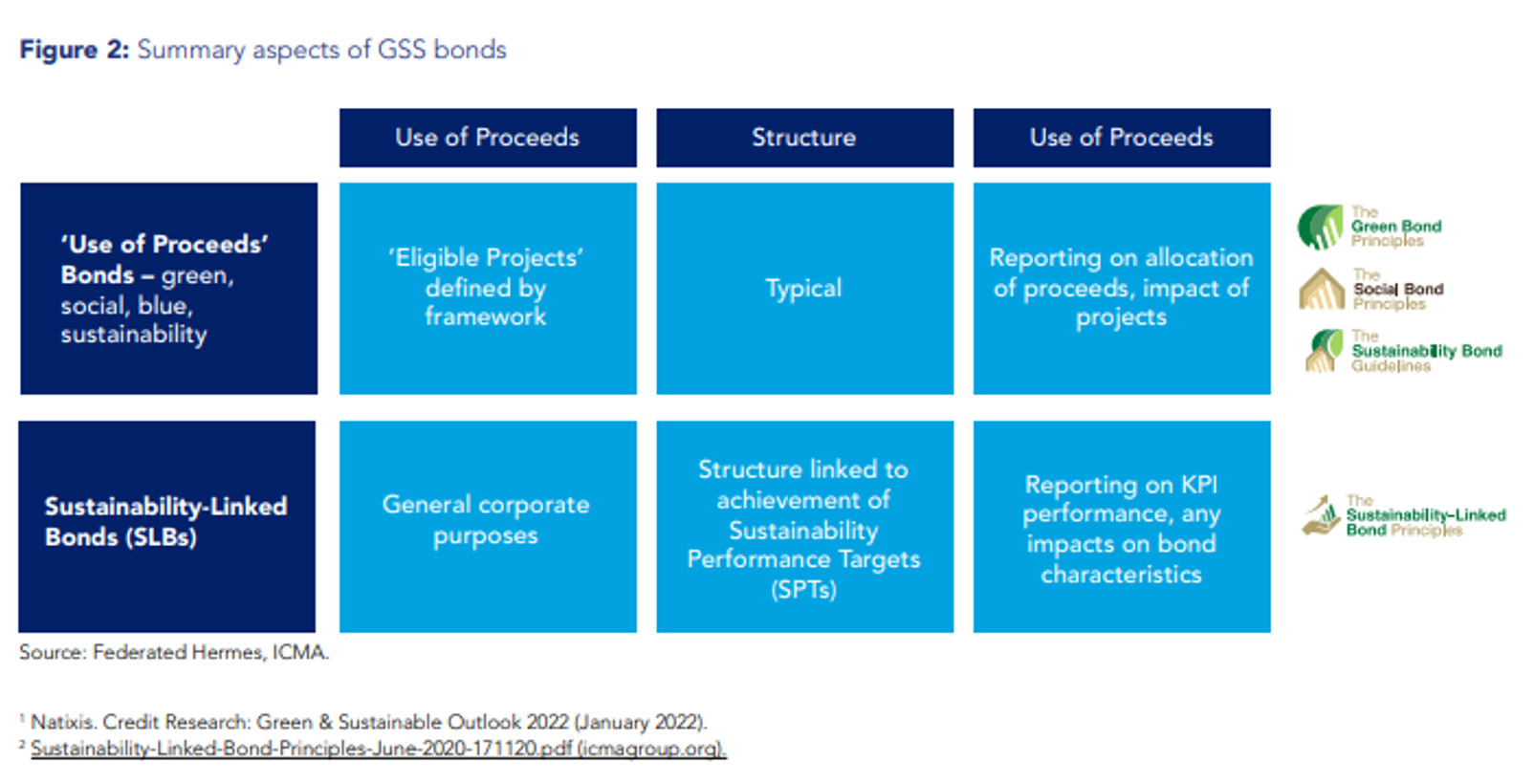

Sustainability-linked bonds (SLBs) bond instruments for which the financial and/or structural characteristics can vary depending on whether the issuer achieves predefined sustainability objectives. In that sense, issuers are thereby committing explicitly (including in the bond documentation) to future improvements in sustainability outcome(s) within a predefined timeline. SLBs are a forward-looking, performance-based instrument.

Unlike ‘use of proceeds’ bonds, such as green bonds and social bonds, proceeds from SLBs can be used for general corporate purposes (GCP). SLB issuers attach their cost of capital to sustainability by having to pay punitive changes to debt service obligations if they miss specific sustainability targets.

Love them or leave them

SLBs have attracted a Marmite-like reputation: market participants either love them or hate them. Some take issue with the fact that proceeds of these sustainability-linked securities can be used for any corporate purpose that the issuer decides – sustainable or not. Others point to a lack of ambition in the sustainability targets the companies set for themselves, or note that issuers’ self-imposed, punitive features (e.g., coupon step-ups) lack financial materiality. On the other hand, proponents of SLBs highlight how companies in hard-to-abate sectors – or those that have no specific ‘green’ projects – now have a path to align their sustainability objectives with their cost of capital. For these issuers, SLBs provide an opportunity to demonstrate their seriousness about sustainability.

Also read: Why Has The Price In iShares Inflation Linked Bond ETF (ASX:ILB) Dropped?

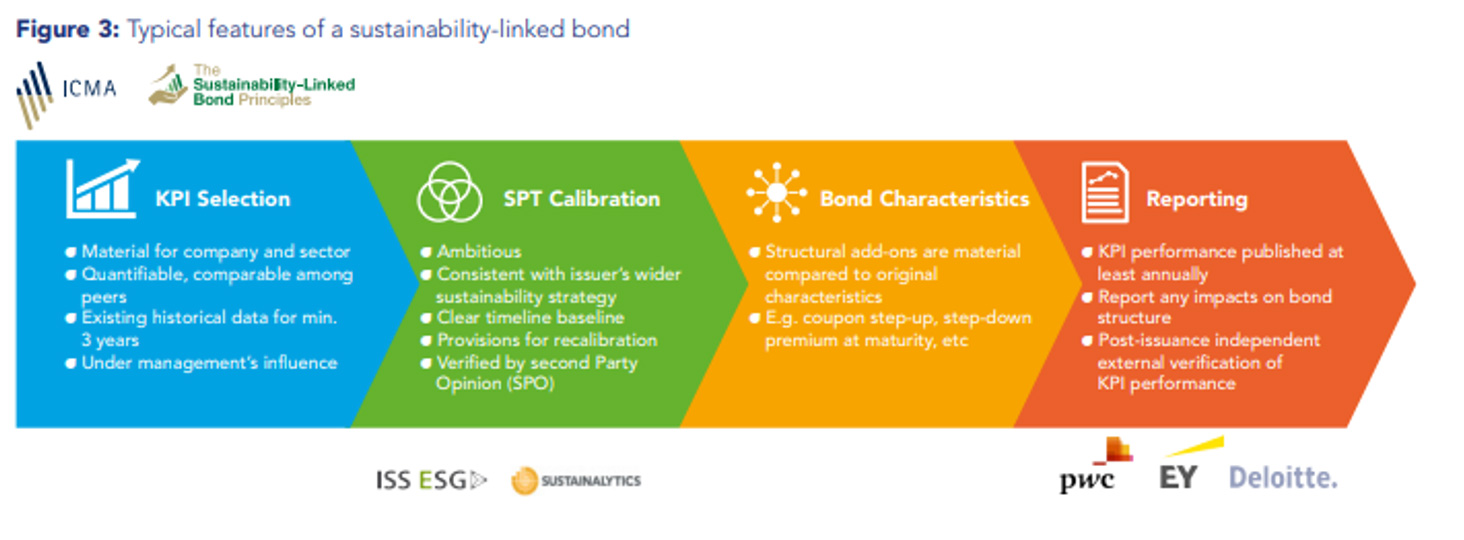

The International Capital Markets Association (ICMA) has published several excellent framework documents that establish best-in-class principles, structure and key performance indicators (KPIs) for such bonds. Even so, no matter the structure, bond issuers set their own level of ambition and accountability via sustainability performance targets (SPTs) and KPIs and bond structure. In coordination with their relationship banks, they also set changes in financial features of the bonds were the issuer to miss those SPTs. As a result, the components of SLBs have been largely designed between companies and banks with little input from the buy side. However, as we do with the financial aspects – structure, covenants, documentation – of any bond, we investors must assess the features of an SLB and determine what it says about the ambition and accountability of the issuer’s sustainability policies and actions.

The Sustainability Linked Bond market in more detail

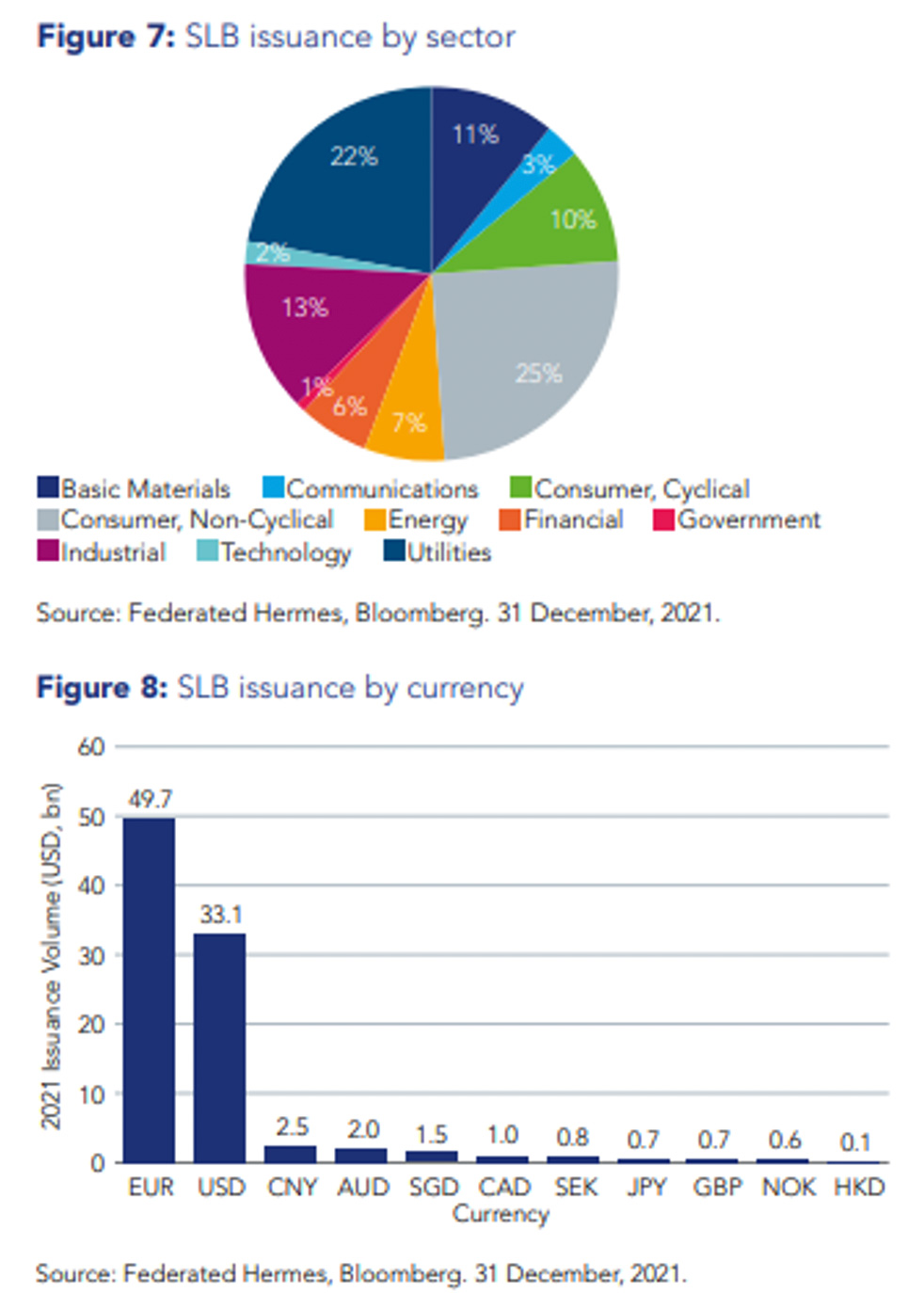

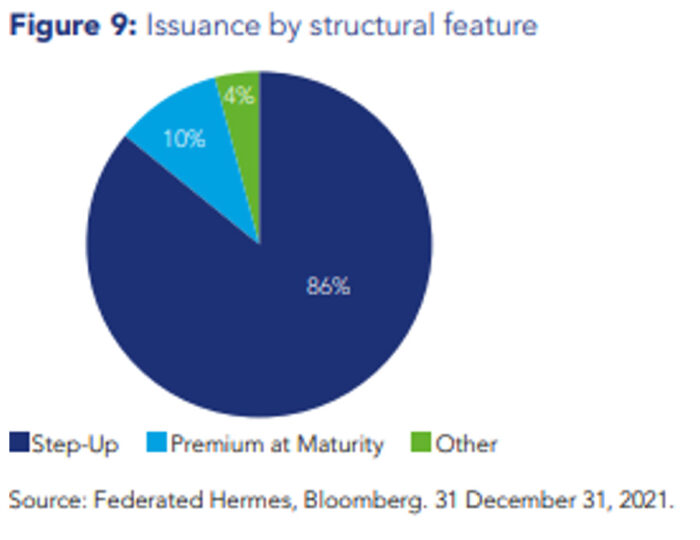

The sustainability linked bond market as at 31 December 2021, was dominated by bonds issued in Euros, 86% of which had a step up and Consumer Non-Cyclical and Basic Metals were the top two sector to issue.