From Chief Investment Officer, Michael Goosay. This is an extract from Principal Asset Management’s 4Q24 report.

It has certainly been an eventful quarter for fixed income. A significant repricing of Fed expectations and the start of the rate-cutting cycle has finally brought the return of positive-sloped yield curves. The combination of positive sloped yield curves and elevated yields has been a rare sight in the past few years, but this is, in fact, a return to more normal times for fixed income and implies that investors should take advantage of more traditional fixed income strategies.

We anticipate the Fed moving from restrictive to slightly accommodative policy and expect the Fed Funds rate to reach 3.25% by mid-2025. Historically, when the Fed begins to ease monetary policy, it often becomes an important tailwind for fixed income. Given that investors have heavily favoured money market funds and short-term maturity products in recent years, the onset of the rate-cutting cycle should encourage savvy investors to extend further out on the yield curve. By reallocating funds into assets with higher yields and greater sensitivity to interest rate changes, they can better position themselves to benefit from the evolving market environment.

Core fixed income, including mortgage-backed securities and investment grade corporates, stand to perform well in this environment. Although they have some sensitivity to changes in economic conditions, their performance is more driven by interest rate changes—investors should seek to lock in yields before the Fed gets too far into its cutting cycle.

Other, riskier fixed-income segments, such as high yield and emerging market debt, can also deliver positive returns if the U.S. economy can achieve a soft landing. While meaningful spread compression is unlikely from here, the extra yield offered by those lower-quality assets is still a prudent consideration for investors.

Given the current environment of gently slowing economic growth and monetary easing, maintaining exposure to fixed income is prudent for investors. Fixed income assets provide a reliable source of income and yield, offer mitigation against widespread market volatility, and present opportunities to enhance returns within investment portfolios.

Also read: Hurricane Milton and the Catastrophe Bond Market

Summary of investment implications

INVESTMENT GRADE CREDIT

Despite tight valuations, fundamentals and technicals are on sound footing. Although off its high, yield remains a stable factor from a technical standpoint. With the asset class likely to thrive in the lower-but-positive U.S. growth environment, investors should seek to lock in yields now ahead of further policy action.

HIGH YIELD CREDIT

High yield bonds offer compelling income opportunities as relative yields remain attractive, although capital appreciation may be limited. Investors should focus on high-quality issuers with solid fundamentals, given potential volatility in spreads. Strong technical support from inflows should sustain performance, even as deal activity increases.

SECURITISED DEBT

Agency mortgage-backed securities are poised to perform well given their government guarantee of credit risk and tendency to outperform credit sectors during an economic slowdown. With more stable cash flows and lower prepayment risks atypical for the asset class, the sector should be able weather a substantial decline in interest rates. Investors should consider Mortgage Backed Securities for portfolio diversification and mitigation against credit risk.

EMERGING MARKET DEBT

Emerging market (EM) debt stands to benefit from widening growth differentials between emerging and developed markets as global rates fall. Investors should focus on economies with resilient fundamentals, especially in regions where inflation is moderating. EM debt provides a strong diversification opportunity with potential for yield outperformance as U.S. rates decline.

PRIVATE CREDIT

Private credit, particularly in the lower and core middle market, continues to offer attractive relative value compared to public markets. Investors should capitalize on tighter spreads, lower leverage, and favorable credit terms in these segments. Given the resilience of private credit amid economic volatility, it remains a valuable component for income-focused portfolios.

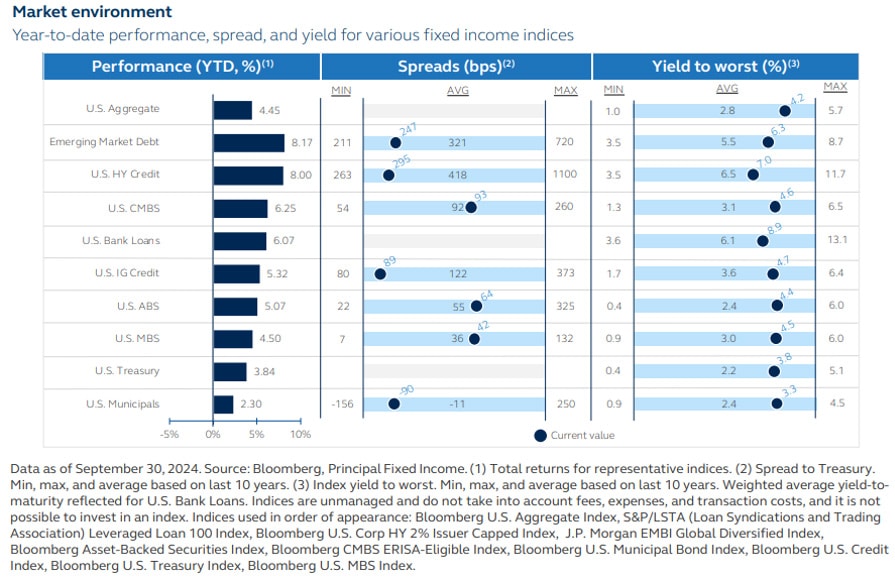

Below is a chart showing year to date performance of various sub sectors, spreads over benchmarks, in basis points, including minimums and maximums and averages. The third column shows a yield to worst, that is the yield if the bond is repaid at the the worst possible time.