This month AMP issued a new hybrid. AMP planned to raise $200m via an issue of Capital Notes 2 (ASX code: AMPPB) securities, which it exceeded, raising $275m. The securities are perpetual, convertible, subordinated, non cumulative, unsecured notes and the proceeds used to fund “one or more APRA-regulated entities within the AMP Group.”

Hybrids are complex beasts that need to be understood before investing, as are additional specific business risks.

Understanding the terms of fixed income securities or interest rate securities and how the returns are calculated are crucial. This article provides a guide to help.

AMP hybrid example

In November 2019, AMP launched an ASX listed hybrid seeking to raise $200m.

At the time the deal was announced, AMP indicated pricing of the hybrid was up to 450 basis points (bps) over the 90-day bank bill swap rate (BBSW). The coupon is floating rate and the hybrid has an optional exchange on 16 December 2025 and mandatory conversion to AMP shares two years later.

The hybrids can be redeemed after a little over six years but only if early redemption is approved by APRA. The notes are also Basel III compliant, which means they include a capital trigger and a non-viability trigger and can be converted into ordinary shares at APRA’s discretion.

BBSW (and thus the total distribution payable) for floating rate notes is set on the first day of issue for the coming quarter. At the first distribution payment date and each quarter thereafter it will be recalculated for the coming quarter based on the fluctuating BBSW rate. So, interest income will depend on BBSW although the margin over BBSW (of 450bps) will not change for the life of the hybrid.

The distribution is paid quarterly in arrears and can be missed and never paid. However, there is a dividend stopper clause in the prospectus, meaning dividends on ordinary shares will cease if there is no hybrid distribution – a disincentive to the bank to forgo the distribution to investors.

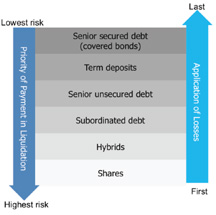

The notes qualify as Additional Tier 1 (AT1) capital under the Basel III bank regulatory framework, which means they have the standard clauses which may lead to early conversion into ordinary shares or a write-off should APRA require it. In the event AMP is wound up (and APRA had not already forced a write-off), the hybrids would rank above ordinary shares but below ordinary subordinated bonds and other liabilities.

One interesting and unusual addition to the standard hybrid exchange clauses is the requirement for shareholder approval at AMP’s next annual meeting vote and any annual meeting thereafter if approval is not granted. In the absence of approval, conversion clauses will not apply unless in reference to a ‘non-viability event’.

The hybrids started trading on the ASX mid-December 2019. They had a first issue or par value of $100, and if investors hold the notes until first call, which is the expected maturity date, this is the amount they can expect to be returned to them. Although repayment at expected maturity is not guaranteed and there is a range of possible outcomes, adding to the complexity of the securities.

When new fixed income securities start to trade in the secondary market, the price moves up and down, and impacts the returns investors achieve if they purchase the bonds in the secondary market.

Because floating rates note coupons fluctuate over time with BBSW, brokers use forward expectations of BBSW for secondary market investors to estimate returns over the life of the bond. Fixed rate bond coupons, on the other hand, do not fluctuate.

Key definitions

APRA

The Australian Prudential Regulation Authority (APRA) is an independent statutory authority that supervises institutions across banking, insurance and superannuation, and is accountable to the Australian Parliament.

APRA was established by the Australian Government on 1 July 1998 following the recommendations of the Wallis Inquiry into the Australian financial system. Prudential regulation is concerned with maintaining the safety and soundness of financial institutions, so that the community can have confidence that they will meet their financial commitments under all reasonable circumstances.

For more information see: https://www.apra.gov.au/about-apra

Bank bill swap rate (BBSW)

The bank bill swap rate (BBSW) rate is a major interest rate benchmark for the Australian dollar and is widely referenced in many financial contracts. BBSW is calculated based on observable market transactions during a rate-set window of 8:40:00 am until 10:00:00am and involves a large number of participants. The benchmark is anchored to real transactions at traded prices. The ASX is now the administrator of BBSW. See [BBSW note]

The purpose of BBSW is to provide independent and transparent reference rates for the pricing and revaluation of Australian dollar derivatives and securities.

Call date

Any bond can have call dates but they are commonly found in subordinated bonds and hybrids. This is the first date the issuer of the security has the option to repay investors. If a callable security is not repaid at the first opportunity, maturity is therefore extended and could see a decline in the value of the security on the secondary market.

Capital trigger

To qualify as regulatory capital, hybrid securities need to include a capital trigger event clause in the prospectus.

A capital trigger event occurs when a bank determines, or APRA notifies the bank in writing, that the bank’s common equity Tier 1 ratio is less than or equal to 5.125%.

If a capital trigger event occurs, a bank may be required to convert some or all of its Tier 1 hybrids into ordinary shares. Conversion of Tier 1 hybrids following a capital trigger event is not subject to conversion conditions being satisfied. Following a capital trigger event, the number of hybrids that are converted into ordinary shares will be the number (or percentage of face value) that is sufficient to restore the bank to a common equity Tier 1 ratio above 5.125%.

If Tier 1 bank hybrids are converted into ordinary shares, investors will receive a variable number of ordinary shares, limited to a maximum conversion number.

Convertible

A fixed income security that can converted to equity at a later date. The conversion can be at the investors option or can be forced by the regulator, APRA.

Coupon

Is the rate of interest paid on a fixed income investment or bond. Coupons can be paid annually, semi annually, quarterly or monthly as agreed in the terms of the security. The coupon rate can be fixed or floating for the term of the security. If it is a floating rate then it is likely that it will be linked to a benchmark such as the 90 day BBSW, expressed, for example, as BBSW +3.25%. The coupon rate is set by the issuer, based on a number of factors including: prevailing market interest rates and the company’s credit rating.

Australian fixed rate bonds predominantly pay a semi annual coupon whereas floating rate bonds predominantly pay a quarterly coupon. Indexed linked bonds usually pay quarterly coupons.

For example, a $500,000 bond with a fixed rate semi annual coupon of 4% will pay two $10,000 coupons each year.

Cumulative / Non cumulative

1. Cumulative

Missed dividend payments/distributions must be made up at a later date.

2. Non cumulative

Missed dividend payments/distributions are forgone. The issuer of the security is not obliged to pay the unpaid amount to the holder.

Distribution

The quarterly income payment made on ASX listed hybrids.

The distribution rate on Tier 1 Bank Hybrids, assuming they are fully franked, is typically determined as the sum of BBSW plus a margin, together multiplied by (1 – tax rate). In effect, the distribution rate is adjusted to take into account the franking credits that are attached to the distribution payments. As distribution payments are based on BBSW, distribution payments are likely to vary over the term of the hybrid.

Face value

Is the initial capital value of the bond or hybrid and the amount repaid to the investor on its maturity, usually $100.

Discount to face value

Bonds and hybrids may trade at a discount to face value in secondary markets where coupon, demand and market perception of the entity influence the price of secondary trades. Bonds usually have a face value of $100. If a bond is acquired at a discount price, say of $75, then the bondholder will make a capital gain of $25 assuming the company makes a full repayment of $100 face value at maturity.

Premium

A bond’s value in the secondary market can be greater than its face value. The bond is then deemed to be selling at a premium. This will occur if the coupon is higher than the yield of a fixed income security.

Fixed/floating interest rates

Rates on bonds can be fixed (set at the time of issue), floating or inflation linked. If they are floating then they will be set as a constant margin to a variable benchmark such as the 90 day bank bill rate expressed, for example, BBSW +2.25%.

Maturity

This is the date when the bond is due for repayment by the issuer. The principal plus any outstanding interest will be repaid on this date.

Non viability trigger

This is an untested structural feature of subordinated debt and hybrid securities implemented to meet Basel III/ APRA regulations to provide loss absorbing capital for the financial institution when it is considered non viable or requires public funds or support to survive. The point of non viability is unknown and at the discretion of APRA. Once deemed the securities convert to ordinary shares. This could result in up to a 100% loss of capital for investors.

Perpetual security

A security with regular periodic payments for an infinite number of periods with no maturity date.

Purchase price

Purchase price is the amount that a bondholder pays to purchase a bond. Price can be quoted on a ‘clean’ basis meaning that this is the capital price of the bond, or it can be quoted on a ‘dirty’ basis meaning that it includes both the capital price plus the accrued interest.

Regulatory capital

A bank’s capital, in its simplest form, represents its ability to withstand losses without becoming insolvent. APRA, the Australian regulator, promotes resilience and confidence in the banking sector by specifying a minimum amount of capital that banks must hold and the form that capital should take.

Return

The amount earned on an investment or made on a transaction (realised or unrealised) relative to the amount of money invested. Generally assessed as yield to maturity.

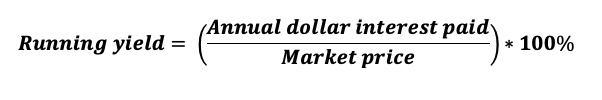

Running yield

Running yield uses the current price of a bond instead of its face value and represents the return an investor would expect if he or she purchased a bond and held it for a year. It is calculated by dividing the coupon or distribution by the market price.

Subordinated debt

A bond or loan that ranks below senior debt and creditors. In the event of a wind up (insolvency) of an issuer, hybrid debt is not paid until all senior secured, senior and subordinated debt and unsecured creditors are paid first.

Tier 1

Tier 1 capital is core capital and includes equity capital and disclosed reserves that must be held by banks to meet regulatory requirements. Equity capital includes instruments that cannot be redeemed at the option of the investor and includes shares and hybrids.

Tier 1 bank hybrids are generally required to be converted into ordinary shares or written-off in certain circumstances, before Tier 2 bank hybrids, otherwise known as subordinated bonds. To qualify they must include a ‘capital trigger’ and a ‘non viability’ clause in the prospectus.

Tier 2

Tier 2 capital is supplementary bank capital and not as strong as Tier 1 capital, from the bank’s perspective. However, it is lower risk than Tier 1 capital from an investor’s perspective and thus would be expected to have lower returns. It includes subordinated debt/ bond securities. Tier 2 subordinated debt must include a ‘non viability’ clause where it converts to shares but does not include a ‘capital trigger’ clause.

Unsecured

If a hybrid or bond is unsecured it has no security attached and is reliant on the company’s integrity to meet its obligations.

Yield

There are four main yields quoted for fixed income securities:

- Yield to maturity (YTM) includes the capital gain or loss on the bond price, as few bonds trade at the par value of $100 except at first issue, plus the interest until maturity.

- Yield to call (YTC) used for bonds with a call date.

- Yield to worst (YTW) is commonly used for bonds with a call date, or multiple call dates where the bond can be repaid prior to final maturity and is the worst yield an investor can expect over the life of a bond.

- Running yield is the expected income if you buy the bond and hold it for a year and is dependent on the price you pay for the bond in the market. Running yield is similar to dividend yield.

The yield that is most relevant to you will depend on your investment strategy and the type of security.

If you buy with the intention of not trading and holding to maturity, then the YTM or YTW is the figure that will matter to you. If you’re more interested in income alone and might sell prior to maturity then running yield will be your focus. Depending on market conditions and various other factors, YTM can be higher than running yield and vice versa.