Communications from many central banks are trending that way: The Federal Reserve Governor Christopher Waller said the policy is “well-positioned”, while Bundesbank President Joachim Nagel said the inflation outlook is “encouraging”.

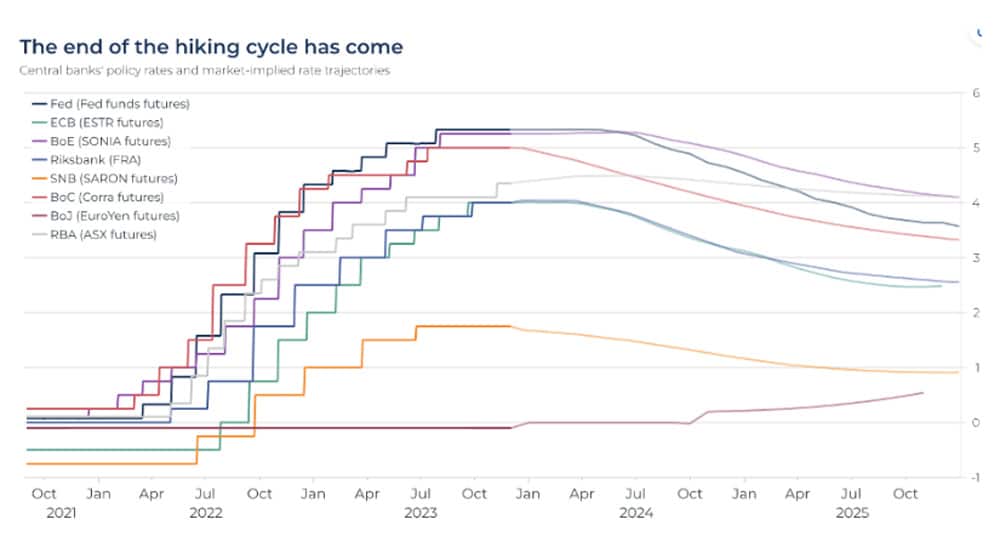

Futures markets are almost unanimously signalling we have seen the last of rate hikes. The chart below from Macrobond tracks various futures markets to show the rate path priced by different central banks. Not only is the current level seen as the peak rate in most cases, but the long-awaited “pivot” to rate cuts is priced in for 2024 for the Federal Reserve. Interestingly, the RBA is seen as staying on hold for slightly longer than its peers. The big outlier is Japan, which is the last central bank with negative rates.

Now, futures markets may end up being wrong and we could end up with more rate hikes if the inflation outlook indeed deteriorates worse than market expectations. However, it is a big bet to be taking at this stage in the monetary and economic cycle to be purely invested in floating-rate bonds.

On duration, now is not the time to have zero, and investors should build a position. In our view, there is a valid argument to have a 50% floating / 50% fixed rate portfolio at this stage for a balanced investor. We view monetary tightening as coming to an end in many developed economies (including Australia) but believe we will start to see economic data weaken. This means cash rates could remain high for the next year, but eventually fixed rate bonds will outperform on weaker economic data. Floating rate bonds still provide good income with 3m BBSW at 4.4% currently and a sufficient hedge should the inflation outlook deteriorate worse than market expectations.

The failure of the RBA governor, Phillip Lowe, and its Board, to foresee the rampant inflation of 2022 shows that even with the best information in the world, forecasts are a guess and there are unknown unknowns. Another reason why we propose a 50% floating / 50% fixed rate portfolio for a balanced investor rather than a 100% fixed rate.

Our model portfolio is a little bit more bullish and has a 40% floating / 60% fixed rate exposure to take advantage of the capital appreciation we expect to achieve via duration. However, this is a more targeted approach and has only increased to this point recently.

Bond yields are generally a function of cash rate expectations and the evolution of future monetary policy, risk sentiment, liquidity, bank/insurance regulation and other technical factors. A great example is to look at the US bond yield curve which is currently inverted (i.e., the 10-year government bond yield sits below the 2-year government bond yield). Australia is an exception here with the bond yield curve currently upward sloping due to the slower pace of rate hikes (versus the US and other developed markets) and Australia’s government-funded spending programs which should help Australian growth outperform the US and other developed markets. Nonetheless, if the RBA were to play catchup with respect to its cash rate, the 10-year government bond yield would fall as investors price in the impact of much tighter monetary policy. Thus, it is also important to be aware when adding duration which part of the government bond yield curve you would like to be exposed to.