A report from T. Rowe Price Head of Multi-Asset Solutions APAC Thomas Poullaouec and team covering an AU/APAC focus.

MARKET PERSPECTIVE

- The outlook for the global economy remains uncertain as central banks navigate battling stubbornly high inflation in the face of weakening growth expectations.

- Taming inflation remains the US Federal Reserve’s number one goal despite the risk of creating more economic pain. Energy-driven inflation gives the European Central Bank a more challenging task amid a divergence in fiscal flexibility across the Union’s members. While having held steadfast, the Bank of Japan may be forced to ease yield curve controls as inflation has started taking hold.

- Emerging market central banks are ahead in the global tightening cycle but may need to hold rates high to defend weak currencies. In contrast, China eases policy to balance growth risk from COVID-lockdowns.

- Key risks to global markets include central bank missteps, persistent inflation, potential for a sharper slowdown in global growth, China’s balance between containing the coronavirus and growth, and geopolitical tensions.

MARKET THEMES

When Bad News Is Good

On the surface, the better-than-expected rebound in U.S. GDP growth in the 3rd quarter would reinforce the Fed’s need to remain aggressive on tightening policy. However, looking at the details, there is growing evidence the economy is feeling the bite of sharply higher rates.

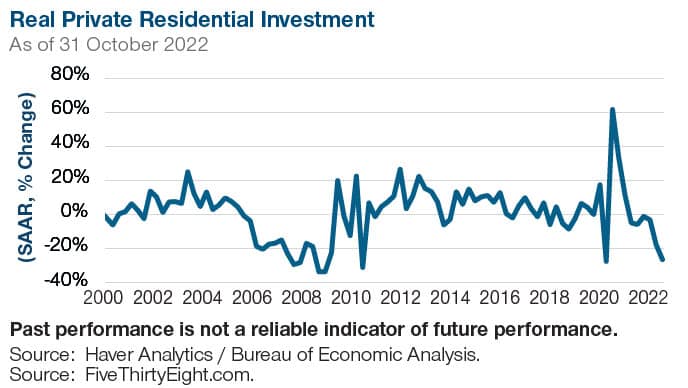

Consumer spending, comprising nearly 70% of GDP, declined while residential fixed investment, a broad measure of housing activity, slumped by more than 26%. Consumer confidence data last month also flashed warning signs that consumers were increasingly concerned about the impact of high inflation and are growing worried about the job market ahead. Signs of slowing were seen in the October ISM Manufacturing index that fell to levels last seen in May 2020, although did show promising signs on the inflation front with supplier deliveries and prices paid easing. U.S. markets have responded positively to the batch of bad news, with U.S. Treasury yields easing and equity markets higher. While the Fed remains vigilant in their battle to fight inflation, evidence is building that their front-loaded rate hikes are having an impact, at least on growth and potentially preceding softer inflation data. Meanwhile, investors are likely to continue to cheer bad economic data in hopes it brings good news of a Fed pivot in policy.

Also read:

Divided, We Rally?

U.S. markets have historically championed periods of divided government and with the mid-term elections imminent, polls suggest that may occur with increasing odds that Republicans take control of the House of Representatives – and the Senate now a toss-up. Amongst voters’ top issues are record high inflation and slowing economy which are weighing on Democrats, whose two-year reign saw them advance progressive policies and spending that voters may now blame for fueling inflation. Historically, a divided government has been seen as a positive providing checks and balances of power, reducing the likelihood of extreme policies being passed and for legislation that does requiring more bi-partisan compromise. Similarly, uncertainty that impacts corporate and household spending plans eases as the likelihood of significant changes to spending, taxation, and regulatory policies ebbs.

However, while gridlock may be welcomed by the markets, a divided government could raise the potential for volatility in other areas such as raising the debt ceiling limit, support for Ukraine, and regulation of the technology sector. China policy has been an area which has witnessed broader bipartisan agreement representing a potential risk to markets. So, while markets could rally on news of a divided government, we shouldn’t expect political uncertainty to go away, particularly in today’s world.

PORTFOLIO POSITIONING

- We are underweight stocks as we remain cautious on the environment for equities given still-aggressive central bank tightening and a weakening outlook for growth and earnings.

- Within equities, we are nearly balanced between value and growth. The slowing growth backdrop is unfavorable for cyclicals, while higher rates weigh on growth-oriented equities.

- Within fixed income we increased our high yield allocation. High yield bonds yields offer reasonable compensation for risks while fundamentals remain supportive. Defaults rates are expected to rise from today’s historically low levels, although yields at current levels help provide a buffer. We also hold a modest overweight to Australian bonds as a risk-off ballast to equities.

AUSTRALIA BACKDROP

Positives

- Consumer spending remains healthy despite the headwinds

- Consensus expects the RBA to moderate the pace of tightening going forward, reducing the pressure on yields rising

- Demand on industrial metals has room to expand given geopolitical developments

Negatives

- Expectations for future earnings are becoming more cautious to reflect the slowdown of the domestic economy

- Policy tightening is not over given inflationary pressures

- The housing market has peaked as evidenced by prices and activity levels.

From the T. Rowe Price Australia Investment Committee, as at 31 October 2022