From Harvey Bradley, Senior Portfolio Manager at Insight Investment

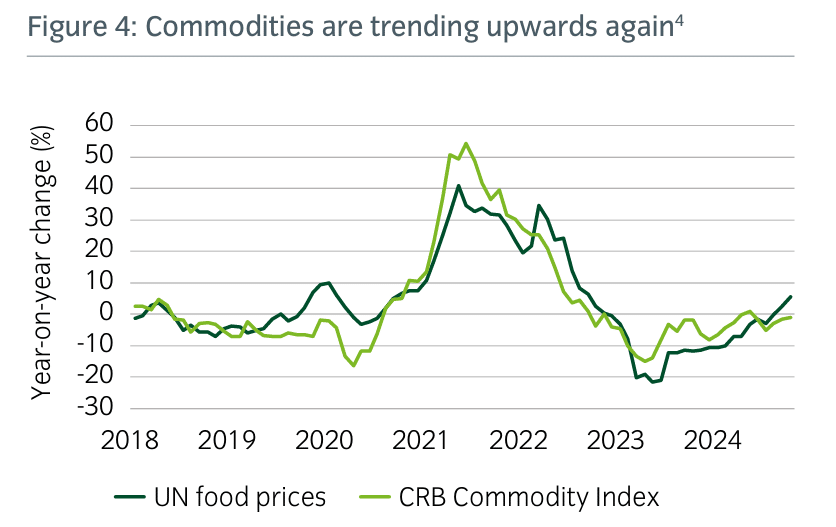

High real policy rates provide flexibility to cut

With inflation having declined significantly from peak levels, real policy rates have moved from deep negative territory to the highest levels seen since before the global financial crisis (see Figure 1). It is difficult to justify policy rates being at such restrictive levels given softer economic data, and this has provided central banks with the flexibility to start easing, despite ongoing inflation concerns.

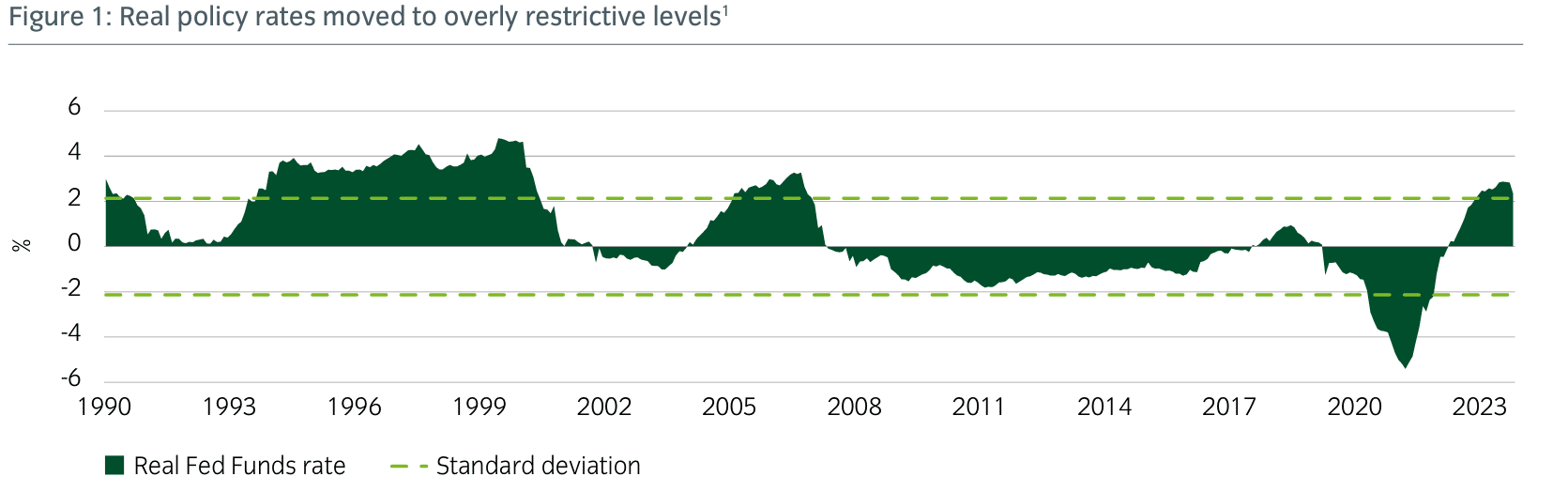

Did we miss the crisis?

Although we agree that prudent rate cuts are necessary at this stage of the cycle to underpin growth and ensure that central banks can engineer a soft landing or mid-cycle slowdown, we question the exuberance of rate markets. Looking back at history, markets are now pricing in a faster easing cycle than the tech bust, global financial crisis and pandemic (see Figure 2). This seems at odds with an economy that is still growing, and an equity market close to record highs.

Steeper yield curves ahead

Unless data meaningfully deteriorates in the months ahead, we believe markets are likely to be forced to reassess expectations for both how rapidly rates will decline and the terminal level of rates. We believe this is likely to put a floor under yields in the intermediate area of the curve and that yields at the very long end of the curve could even drift upwards, resulting in steeper yield curves.

Global Inflation: The Best News is Behind Us

Gravitating to central bank targets

With the post-pandemic inflation spike still fresh in investors’ minds, we believe many are underestimating the medium term inflation risks. Although headline rates of inflation have moderated and are gravitating to central bank targets in the short term, the longer-term outlook for inflation remains highly uncertain. In our view, factors such as the shift from globalisation to deglobalisation will keep inflation structurally high in the years ahead.

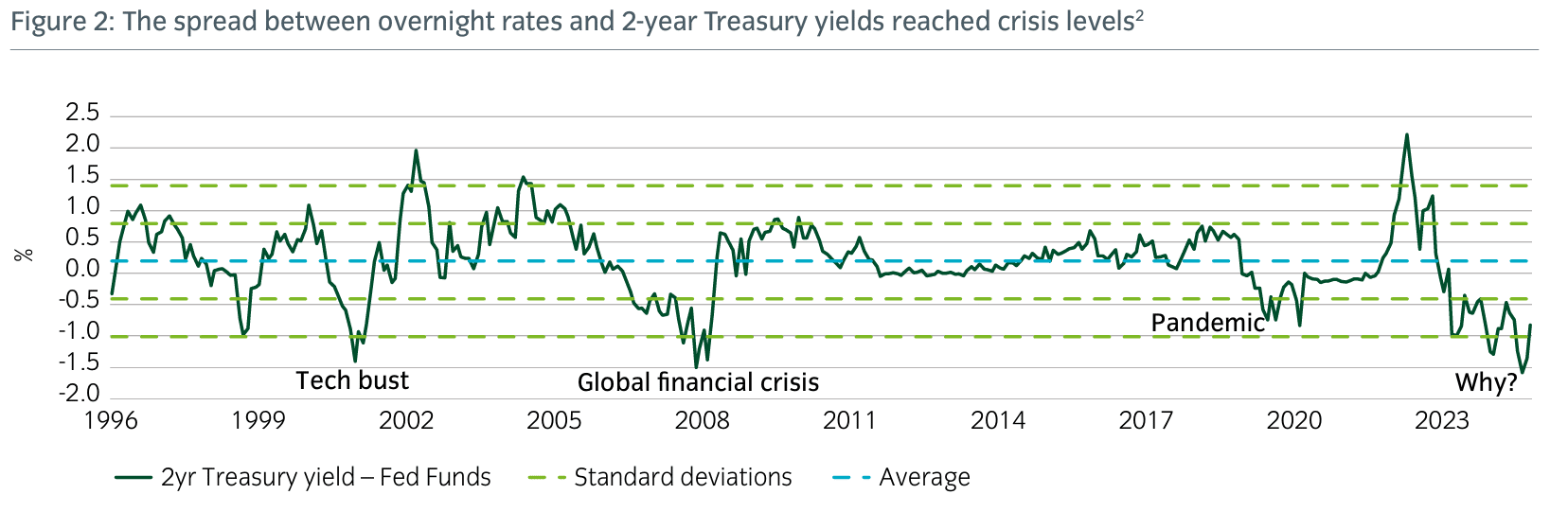

Inflation remains stubbornly sticky behind the headline numbers

In the US, the Atlanta Fed monitors ‘sticky inflation’, which is a basket of goods that normally change price relatively slowly. This index is declining at a far slower rate than the headline consumer price index and excluding shelter it has stabilised and started to trend sideways at around 3%.

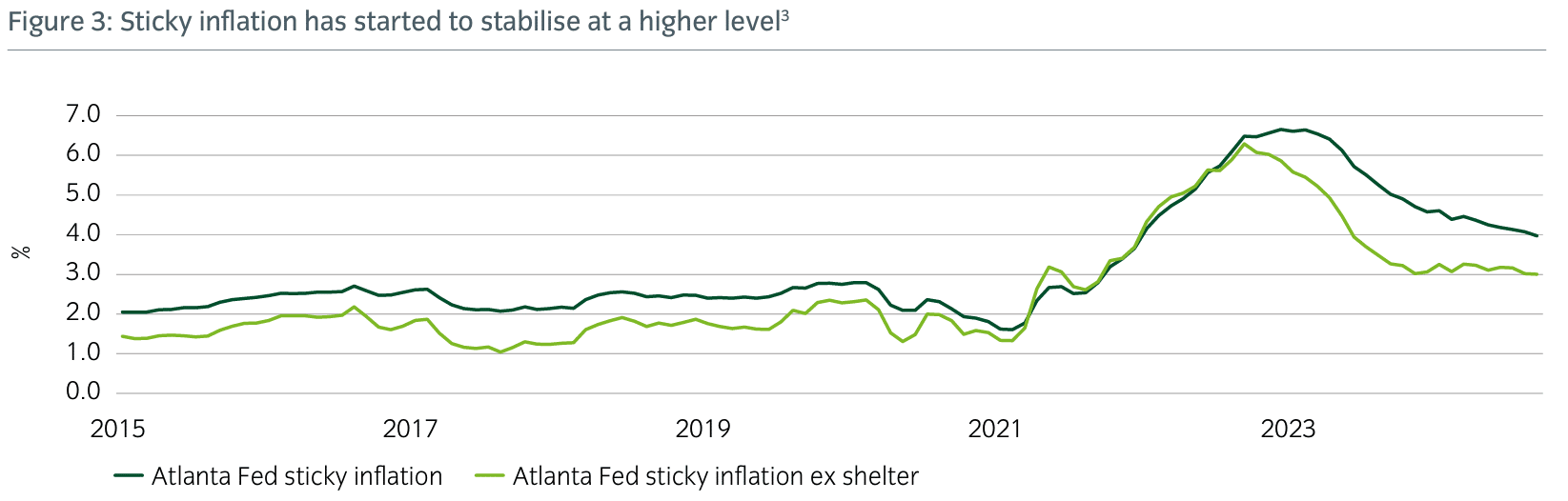

Central banks have a lot to worry about

There are other worrying signs for policymakers. September saw the fastest increase in global food prices since 2022, with sugar prices spiking by 10.4% due to drought and wildfires impacting Brazil. Food prices, and commodities more broadly, appear to have bottomed and are now slowly trending upwards again, along with the broader commodity complex (see Figure 4).

Also read: Income Under Uncertainty But Bonds Remain Attractive

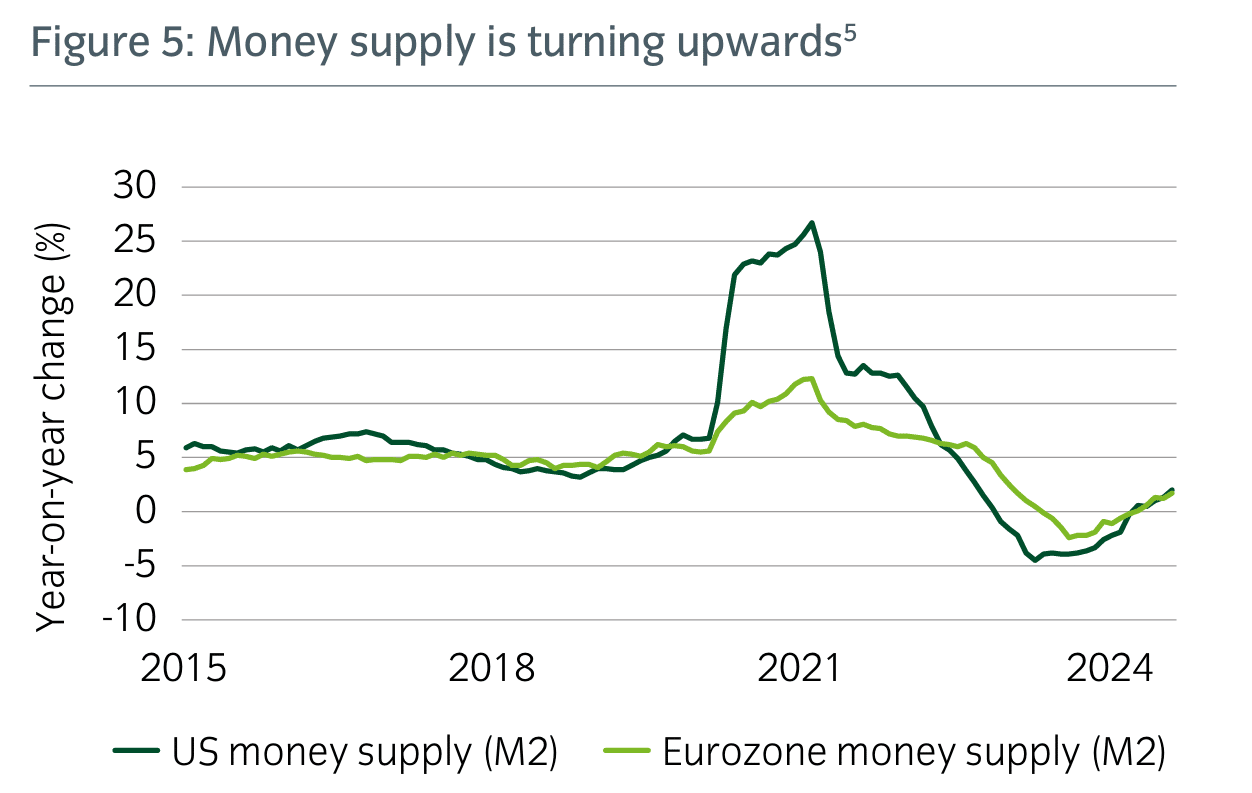

Money supply is another data series that some central bankers will be carefully watching. A surge in money supply was arguably one driver of the post pandemic inflation spike, and a contraction in money supply likely proved helpful in bringing inflation back down to earth. But money supply growth is now firmly in positive territory and tending upwards once again (see Figure 5).