As we look ahead to 2025, the forces that drive global credit are rife with mixed signals and extreme valuations. As evidenced over the last year, an unconstrained approach to credit investing can utilise a tactical approach, which has the potential to generate alpha amid dynamic market conditions.

Investors have had to contend with a lot of uncertainty in 2024, amid inflationary pressures, geopolitical turmoil, political uncertainty, debt vulnerabilities and the risk of US recession. But such testing market conditions can highlight the benefits of agile, active asset management.

Federated Hermes Unconstrained Credit Strategy invests across the fixed income universe – encompassing a range of credit products, risk-return profiles and responsibility outcomes – and the flexibility this approach allows has been utilised throughout the year to drive performance.

The active management of the long book is reflected in a various changes to the portfolio – the divergence between the price of emerging market and developed market debt, for example, prompted a reduction in the former in favour of the latter.

A similar approach was adopted with regards to the relative value between select investment grade and high yield opportunities.

In light of the spread compression that has been a feature of markets this year, the Strategy rotated out of some subordinated financial and corporate positions and into senior exposures to reduce risk, while select high carry, high yield names were added to the portfolio to boost yield. The Strategy has also benefitted from some tactical relative value trades in the government bond space.

Volatility protection

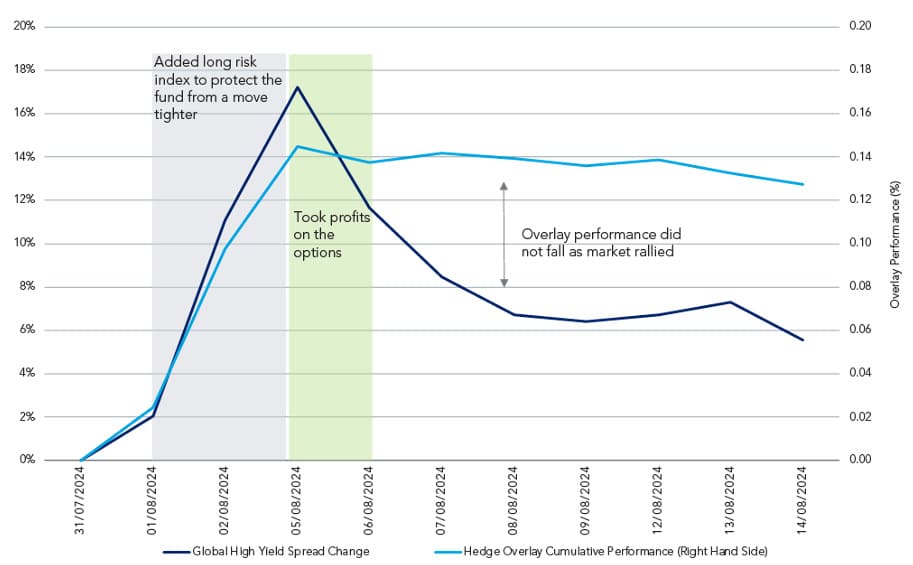

An unexpected volatility spike in August prompted fears that the US could slide into recession. The VIX Index – Wall Street’s ‘fear gauge’ – soared to highs not seen since the start of the Covid-19 pandemic following weak jobs data, and many market participants began pricing in a more aggressive rate cut cycle by the US Federal Reserve (the Fed).

Also read: Opportunities for Investors in Australian Banking Credit

The Strategy was protected from the volatility by a put option which delivered positive alpha. As the market moved wider, the Strategy was able to add to risk through the credit default swap index, whilst monetising and extending the maturity of the options book to take advantage of the spike in shorter-dated volatility.

Figure 1: Hedge overlay protection in action

Banking value

European banks suffered an unexpected shock in Spring 2023. The Swiss government-brokered takeover of banking giant Credit Suisse by UBS led to its Additional Tier 1 (AT1) bonds getting written down to zero. At the time, it was unclear how far-reaching the consequences would be, and the knock-on effect was that bid prices on AT1s fell across the board and started to underperform the high yield market.

But this also presented a buying opportunity for any active investors which took the view that the risk was likely short-term in nature and that the broader AT1 market would recover.

Structured credit

The economic environment proved favourable for structured credit. Lenders faced increased funding needs which drove volumes higher, and this was supported by tighter pricing.

The allocation to structured credit provided a material contribution to performance in 2024, namely the allocation to high-quality asset backed securities and collateralised loan obligations.

Short France vs. Germany

At the start of the year, the Strategy took a short position on French government debt versus German bunds, which was a prudent move.

France’s borrowing costs have crept higher over the course of the year, due to growing concerns over the nation’s finances, as well as the political turmoil in the summer.

France’s public debt – which hit 110.6% of GDP in 20231 – continues to rise. President Emmanuel Macron’s unexpected decision to call snap elections in June added to the pressure on yields. In the following days, the 10-year OAT2/Bund spread widened to 65bps3, taking the spread to a level not seen since 2017.

Curve Steepener

At the start of the year, we decided to implement a curve steepener strategy – using derivatives to benefit from escalating yield differences between two US treasury bonds of different maturities – in order to anticipate the range of scenarios that could arise from the Fed’s tightening cycle, and the anticipated end to the inverted yield curve.

The Strategy went long on five-year US treasuries and short on 30-year US government debt.

In the event that the Fed reached the end of its hiking cycle and opted to cut rates to boost growth – albeit at the risk of a resurgence in inflation – then this approach was expected to produce positive results.

However, in the event that the US entered a recession or suffered a hard landing, the curve steepener also accounted the possibility that the Fed might cut rates faster than anticipated. All possible scenarios were weighed against the backdrop of growing deficits, which will likely require financing.

US election response

The victory of Donald Trump in November’s presidential election had a noticeable impact on credit markets. Trump has pledged to introduce tariffs on all foreign goods as part of a more aggressive trade policy towards global manufacturing centres such as Europe and Asia. From a credit perspective, this is most likely to impact more significantly cyclical and consumer-oriented sectors, with consumer goods and autos already starting to show signs of weakening.

As interest-rate volatility is expected to remain elevated for some time, we anticipate that more rates-sensitive sectors such as financials to experience headwinds.

With this in mind, we have been rotating our exposure within the automotive space over the past few months, favouring auto manufacturers in the US comparted to autopart companies in Europe. We’ve also shifted our exposure within the chemicals space in recent weeks, favouring the specialty chemicals industry, which we believe will fare better if global demand slows down further.