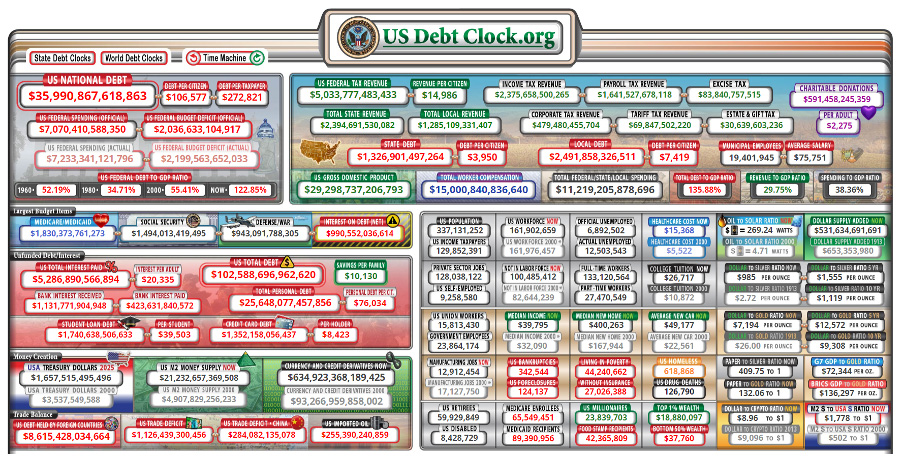

There’s plenty of speculation about what a new Trump presidency will bring to financial markets. Will inflation rise? Will the Fed continue cutting rates? One thing is for sure, US debt is set to keep growing. Have a look at the US Debt Clock below.

If you look it up online, you’ll see debt growing constantly. The effect is much like poker machines, where the numbers keep turning over. The US government, along with other developed nations, has borrowed more than 100% of GDP. The Debt Clock shows debt to GDP at 122.85%.

Borrowing is fine, as long as there is enough appetite from investors. There comes a point though that the market demands higher interest rates, which makes raising more and more debt increasingly expensive. Then there’s a point likely much further down the road where it reaches saturation. We are not there yet, but there’s potential for ‘bond vigilantes’ to sell out of US government bonds, to send a protest to the new government about its policies. The US 10-year Treasury rate has been increasing and sits at around 4.33%, but Janu Chan from Bite-Sized Economics thinks it needs to be above 4.5% before it’s worth considering. Will it move higher still? There’s potential, watch this space!

Both the US Fed and the Bank of England cut interest rates this week, but both central bank rates are below Australia’s 4.35% cash rate and respectively 4.5-4.75% and 4.75%. I’m still of the view that a domestic rate cut is months away.

I know I’m reaching saturation point with articles on the US, but that market drives ours, so here are four of the best this week:

- The Fed’s Drive towards Neutral: Slowed but not Stopped, by Robert Tipp and Tom Porcelli of PGIM Fixed Income

- ESG and EM under a New President, will the new President repeal all of the Inflation Reduction Act? By Nazmeera Moola, Thys Louw and Archie Hart from Ninety One

- Trump and the US Govt 10-year, a bit of a history lesson from Chris Iggo of AXA Investment Managers

- US Election: The Path Forward for Investors by Seema Shah from Principal Asset Management.

I’m pleased to share also that Betashares has launched a new ethical fixed income ETF.

Finally, we have this terrific article from the Mawer Credit Team about Boeing, its massive debt pile and its potential credit rating downgrade into high yield and the consequences.

Have a good week!