Authors: Andre Chinnery, William Maher, Diego May and Josh Spiller* – Reserve Bank of Australia

Abstract

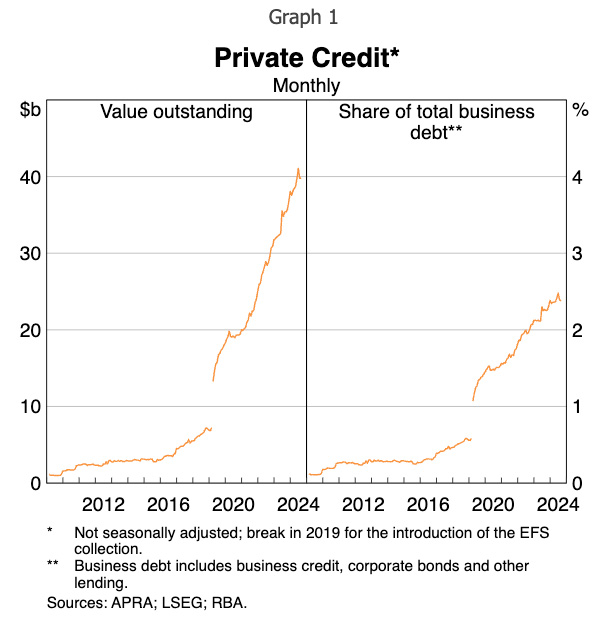

Global private credit has grown rapidly over the past two decades, providing an alternative source of financing for businesses. This article introduces a new estimate of the size of private credit outstanding in Australia, based on data collected by the Australian Prudential Regulation Authority and London Stock Exchange Group. It is estimated that there is around $40 billion in private credit outstanding in Australia, which is around 2½ per cent of total business debt. Globally, the growth in private credit has raised concerns related to a lack of visibility over leverage and interlinkages, with regulators taking steps to strengthen oversight of the market. For Australia, the risks to financial stability appear contained for now, though regulators continue to monitor the sector closely.

Introduction

Private credit is bilaterally negotiated lending to businesses arranged by non-banks. The lenders in the private credit market are typically asset managers that intermediate between end investors and borrowers.[1] End investors – like pension funds and insurance firms – provide funds to these intermediaries or, in some cases, lend directly to borrowers. Private credit provides an alternative source of finance for businesses to borrowing from banks or issuing bonds, particularly for firms with unique financing needs or irregular cash flows that are too risky for banks or too small for public markets.

Understanding the use of private credit is important for assessing the nature and availability of business funding and potential risks to financial stability. As private credit is sourced from non-banks, it can be difficult to measure. This article introduces a new estimate of the size of private credit outstanding in Australia based on data collected by the Australian Prudential Regulation Authority (APRA) and London Stock Exchange Group (LSEG) on lending to Australian businesses facilitated by asset management firms. This measure indicates that the Australian private credit sector has grown strongly over recent years, though it accounts for a small share of total business debt.

The global private credit market

Global private credit assets under management have quadrupled over the past decade to US$2.1 trillion in 2023 (IMF 2024). In the United States, the stock of private credit is now around the same size as either of the high-yield bond and leveraged loan markets (IMF 2024). North America accounts for around 70 per cent of global private credit raised since 2008, while Europe represents about one-quarter (PitchBook 2024).

Also read: How Not Shopping Around is Costing Australian Institutions Staff and Money

Private credit has an attractive risk-return trade-off for some investors. It pays a relatively high interest rate – generating higher returns than other similar assets such as leveraged loans – and to date has exhibited low volatility relative to publicly traded assets, like corporate bonds (Cai and Haque 2024).[2] Non-bank lenders have played an increasingly large role in lending to risky companies, in part because some business lending has become more expensive for banks; regulatory reforms after the global financial crisis raised banks’ capital requirements and made them more sensitive to risk (IMF 2024).

The structure of private credit lending

Private credit loans are in many ways similar to syndicated loans by banks. That is, they are generally senior secured, variable rate, larger than standard bank loans, and may comprise multiple credit facilities.[3] Unlike syndicated lending, however, most private credit lending involves a private credit fund that intermediates between the ultimate lender and borrower. Private credit loans are typically not traded in secondary markets or publicly rated, and lenders tend to hold private credit deals to maturity. The key roles in the private credit market are:

- End investors, which provide funds to intermediaries. These include pension funds, insurance companies, family offices, sovereign wealth funds and high net worth individuals. Some investors also lend directly to borrowers without a fund intermediating. In Australia, superannuation funds primarily invest in private credit via funds, though they also lend directly.

- Intermediaries, which take funds from end investors and lend to borrowers. The most common lenders in the global market are unlisted private credit funds, but lenders also include business development companies (BDCs) and off-balance sheet securitised loan pools, known as collateralised loan obligations.[4] The most common private credit investment vehicle outside Australia is a closed-end fund, with a limited life cycle that prevents redemptions during its life span. Notably, in Australia, open-ended funds are more common (Preqin and AIC 2024).

- Borrowers, which are typically highly leveraged medium-sized businesses. Globally, most of these businesses have been acquired by private equity firms, which tend to increase debt levels to enhance investor returns (Haque 2023). Borrowers’ earnings are typically between US$10 million and $100 million, and they often have irregular cashflows or limited collateral, thus necessitating bilateral loan negotiations. Some borrowers access both private credit and other markets, with recent instances of banks and private credit funds jointly providing finance to borrowers (ACC undated; Tan and Seligson 2023).

The Australian private credit market

The scope of lending varies across estimates of Australian private credit:

- RBA (A$40 billion) (Graph 1): This estimate captures lending to Australian businesses facilitated by asset management firms from investor money pooled into managed funds. It also includes direct lending from superannuation funds as part of a syndicated loan. The estimate does not capture non-syndicated direct lending by superannuation funds. The data are sourced from data reported by registered financial corporations (RFCs) to APRA and from LSEG syndicated lending data. APRA and LSEG data are timely and consistent with other aggregates, but coverage is not universal (see Appendix A).

- EY (A$188 billion): This estimate captures privately disclosed or publicly reported assets under management of private debt funds and other non-bank investors (Paphitis and Lowe 2022; Paphitis and Gaede 2024). Assets under management may differ from lending reported to APRA; for example, RFCs only report the portion of their business lending that is to Australian residents, and some types of fund structures may not be in scope to report to APRA.

- Preqin and Australian Investment Council (AIC) (A$1.8 billion): This estimate captures assets under management of closed-ended private credit funds using Preqin data.

The RBA estimate focuses on business lenders with a managed fund structure to distinguish from other types of non-bank lenders in Australia (see Hudson, Kurian and Lewis 2023). Private credit is typically funded with equity, whereas many Australian non-banks operate similarly to banks, raising funds from debt and securitisation markets but without access to deposit funding. These non-banks tend to provide standardised loans for specialised purposes like finance for vehicles or other equipment.

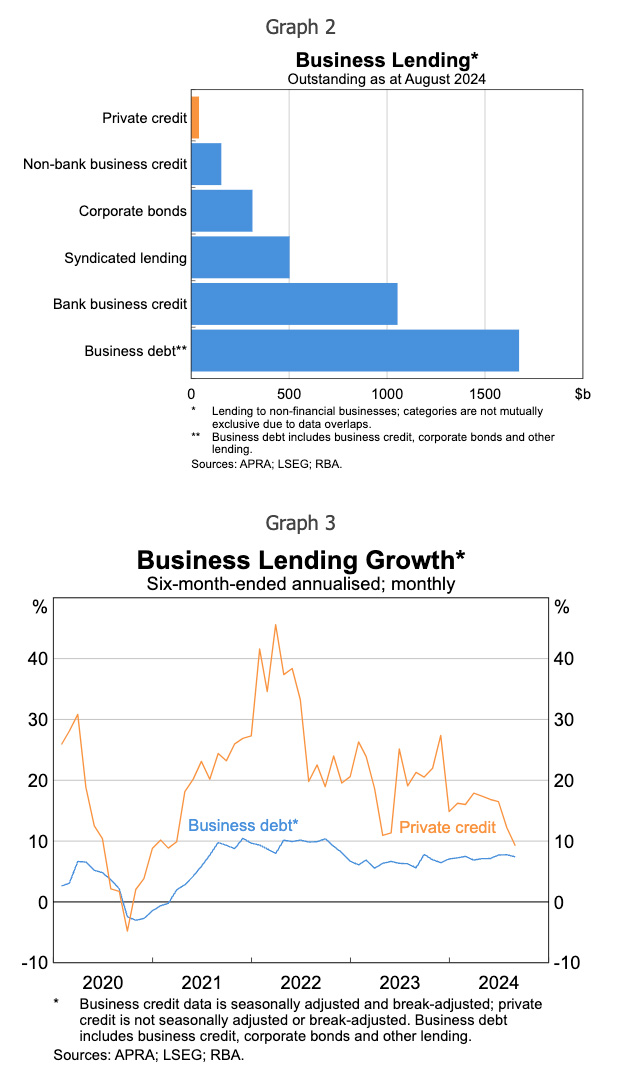

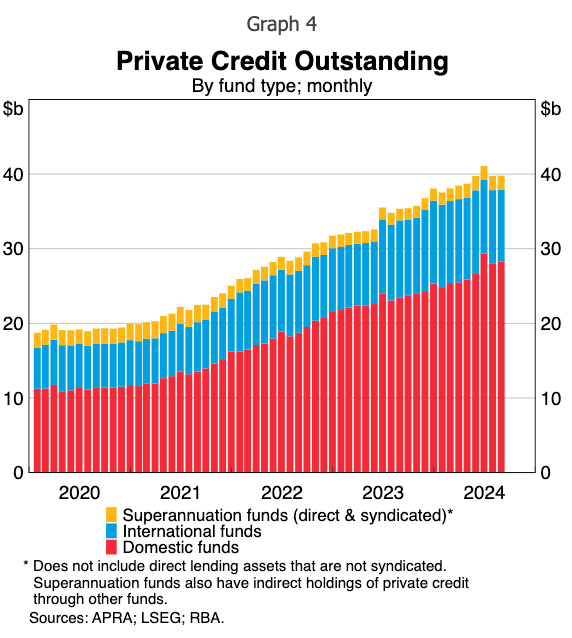

The Australian private credit market is small relative to other lending to businesses but it is growing rapidly (Graph 2). Private credit accounts for around 2½ per cent of total business debt (which includes both intermediated lending and corporate bond issuance outstanding). Private credit grew faster than business debt over the past few years; growth has slowed in 2024 but is still around 2 percentage points higher than growth of business debt (Graph 3).

Domestic private credit funds account for around 70 per cent of private credit outstanding and have contributed the most to growth in lending (Graph 4). Superannuation funds’ direct holdings of private credit via syndicated deals are relatively small, though our estimate does not capture their non-syndicated direct lending. Australian superannuation funds primarily invest indirectly in the private credit sector via investment in private credit funds; this investment is captured in our estimate.[5]

Risks to financial stability from private credit markets

Leverage

Private credit can involve leverage at three different levels: investors, intermediaries and end borrowers. Each of these parties can use leverage to achieve a higher return on equity. Information on leverage in the Australian private credit market is limited. However, on average, North American private credit funds’ debt-to-asset ratios are around 35 per cent, lower than those of issuers of leveraged loans and high-yield corporate bonds that are closer to 50 per cent (IMF 2024). Although private credit funds’ leverage appears low compared with other lenders, end borrowers tend to be more highly leveraged than those in public markets, increasing the risks to financial stability (IOSCO 2023).[6]

Liquidity risks

Private credit funds invest in illiquid assets like corporate loans, but typically manage cash flow risks by adopting a closed-end structure. This structure allows funds to restrict end investors’ withdrawals in a given period, mitigating liquidity risks.

However, liquidity pressures could arise for end investors and spill over to financial markets. For example, in the event of a large economic shock, intermediaries may request large amounts of capital from existing investors’ committed but uninvested capital via capital calls.[7] End investors have little control over the timing of these calls and may be required to provide capital within days (IMF 2024). There is a significant and growing amount of committed but uninvested capital, suggesting potentially large cash flow pressures if capital calls were widespread and synchronised. In such an event, end investors – such as pension funds or insurance companies – may struggle to meet the required payments and may therefore need to quickly sell other assets, potentially causing tension in financial markets.

Interconnectedness

While bank lending to private credit funds appears moderate and well-collateralised globally, there are some links that could pose risks to financial stability. Banks are among the primary providers of leverage to private credit funds, and in the United States, invest in private credit via collateralised loan obligations and are reportedly selling complex debt instruments to private fund managers in synthetic risk transfers (Carpenter 2024).[8] These instruments can make links between financial institutions more complex and less transparent. It is challenging to determine the size of these vulnerabilities due to data limitations.

There are strong links between private credit and private equity markets. Most private credit borrowers are partly controlled by a private equity firm following the acquisition of a major equity stake. Furthermore, around three-quarters of private credit assets are managed by funds whose umbrella firm is also active in private equity (IMF 2024). Private equity firms are often involved in strategic decisions about the borrowing firm’s management, operations and capital structure. This can help reduce the frequency of defaults, but can also introduce conflicts of interest, given that managers may have multiple connections through portfolio firms and investors (IMF 2024).

Transparency of asset quality

The value of private credit assets appears more stable than for some comparable asset classes, partly because valuations are typically less frequent and subjective. While private credit funds must generally adhere to accepted accounting principles, these principles do not mandate specific techniques for asset valuation. Stale valuations may pose a risk to financial stability whereby a macroeconomic shock leads to a broad reassessment of asset valuations across the sector. In Australia, APRA has recently revised prudential standards in an effort to strengthen the investment governance of superannuation trustees, including in the valuation of unlisted assets (APRA 2023).

Default rates in private credit have been relatively low and less frequent in recent times relative to comparatively risky investments, such as in the syndicated loan or high-yield bond markets (Cai and Haque 2024). The sector has greater capacity than other forms of lending to postpone losses and defaults due to the bilateral nature of lending agreements. This has made it more resilient thus far in the cycle, but could increase the sector’s vulnerability to large shocks.

The sector has also not endured a recession so there is little precedent to understand its resilience to a large downturn (IMF 2024). Where there have been defaults, private credit typically has a higher loss given default. This may reflect a higher incidence of lower or poorer quality collateral or subordinated lending (IMF 2024; Cai and Haque 2024). Lending in the sector is typically medium term, and refinancing risk appears to be evenly distributed across the next five years (Cai and Haque 2024).

Regulatory response

The International Monetary Fund (IMF) has highlighted vulnerabilities in private credit that could become systemic if left unchecked (IMF 2024). Since private credit lacks the oversight of banks (which are subject to strong prudential regulation) and the disclosure requirements of leveraged loans, the IMF recommends that authorities consider a more proactive regulatory approach.

International regulators have taken steps to strengthen oversight of the sector. The US Securities and Exchange Commission (2023) has implemented measures to enhance transparency and competition within the sector, including stronger reporting requirements. The European Union (2024) has enhanced disclosure requirements, implemented limits on funds’ use of leverage and placed restrictions on fund structure. Regulators in other countries, including the United Kingdom, India and China, have also increased oversight of private credit funds (IMF 2024).

In Australia, the Australian Securities and Investments Commission (ASIC) is examining the growth of private markets as part of its drive for consistency and transparency across markets and products (ASIC 2024a). ASIC is undertaking a number of surveillances and industry engagement to identify conduct issues and consider the implications for the integrity and efficiency of markets (ASIC 2024b). APRA is heightening supervision of superannuation funds’ investments in unlisted assets and stress-testing potential sources of contagion (APRA 2024; Wootton 2024). The Australian Treasury is also reviewing the regulatory framework for managed investment schemes, which are one form that private credit funds can take, with an aim to reduce risk to investors (Jones 2023).

Conclusion

The Australian private credit market is growing rapidly. Due to its small size, direct risks to financial stability from the private credit market in Australia appear low. Risks stemming from overseas private credit markets also appear contained. Although the migration of credit from regulated banks and public markets raises some vulnerabilities for the financial system, liquidity risks are low, and so far in the most recent tightening phase, default rates have been lower than leveraged loan or high-yield bond markets. However, private credit markets remain opaque and are expected to continue to grow rapidly. Work by regulators to improve transparency will assist in monitoring growth in private credit and the potential risks to financial stability.

Appendix A: Data used to estimate the size of the Australian private credit market

The RBA’s estimate of private credit outstanding in Australia captures lending to Australian businesses from lenders with a fund structure. It combines data from the Economic and Financial Statistics (EFS) Collection and the LSEG syndicated lending data. The EFS Collection includes balance sheet data from RFCs with total assets of A$50 million or more. The syndicated lending database collects loan-level data of syndicated loans to Australian borrowers, including firms that do not report in the EFS Collection (see Liu 2023). We identify more than 200 lenders with a managed fund structure across the two sources. Two-thirds of private credit outstanding comes from lenders in the EFS Collection.

The estimate captures much of the private credit lending in Australia, but there are some gaps. The estimate of direct lending from superannuation funds only includes superannuation funds’ participation in syndicated loans. Direct lending from a superannuation fund to a borrower with no syndication is not captured. Non-syndicated lending from overseas institutions that do not report to APRA is also not captured. The estimate also does not include lending by RFCs with assets of less than A$50 million. Smaller lenders below the reporting threshold – such as some family offices – are therefore excluded unless they participate in a syndicated loan captured by the LSEG database. Certain trust structures used by some managed investment schemes are not covered by the definition of an RFC, so do not report in the EFS Collection. It is also likely that some syndicated loans are not captured by the LSEG database, if they are arranged by financial institutions that are not surveyed by LSEG.

Endnotes

[*] The authors are from Financial Stability and Domestic Markets departments. They would like to thank Jenny Hancock, Michael Thornley, Duke Cole, Peter Wallis, Jon Cheshire, Claude Lopez, Gideon Holland and Andrea Brischetto for their valuable comments. They would also like to thank APRA, ASIC and others for participating in helpful discussions.

- Intermediaries in the sector are often referred to as ‘general partners’ or GPs, while the end investors who provide funds to these intermediaries are referred to as ‘limited partners’ or LPs.

2. The most common form of private credit is ‘direct lending’. Like bank lending, direct lending is typically senior secured (claiming priority over a company’s assets in the event of insolvency).

3. Syndicated lending is extended by a group of lenders to a single borrower. The borrower typically organises this by agreeing to terms with a small group of banks, called ‘mandated lead arrangers’. In most cases, the mandated lead arrangers seek other lenders to join the syndicated loan as participating lenders. See Liu (2023) for further details of syndicated lending in the Australian market.

4. BDCs are closed-end managed funds that invest in small and medium-sized businesses. They are often listed and open to retail investors. Collateralised loan obligations are structured finance vehicles that pool a portfolio of privately originated loans and securitise them into debt securities (IMF 2024).

5. Indirect investment is captured to the extent that those funds lend to Australian businesses; however, Australian superannuation funds’ indirect investment in private credit funds that lend overseas is not captured.

6. Leverage can be provided directly, by making cash loans, or synthetically using swaps (Aramonte and Avalos 2019). Intermediaries like private credit funds can gain leverage via subscription credit lines (bank loans collateralised with committed but uninvested capital) and net asset valuation credit facilities (lending facilities secured against assets placed in special purpose vehicles). Listed BDCs also issue secured and unsecured corporate bonds. End investors borrow to achieve higher returns on their assets (IMF 2024). While most pension funds typically employ low leverage, entities like hedge funds, insurance companies, family offices and high net worth individuals often have more variable and opaque leverage structures.

7. The portion of end investors’ capital that is committed but uninvested is often referred to as ‘dry powder’.

8. Synthetic risk transfers are securities that allow banks to buy insurance against credit risk, reducing their risk weights and capital charges. They have reportedly been used to reduce regulatory capital charges and become popular in recent years (Wirz and Rudegeair 2023). They are structured much like credit default swaps, except that they are used to insure a broader loan portfolio rather than a specific counterparty exposure. A typical synthetic risk transfer pays a floating coupon in exchange for the buyer bearing the first 10 to 15 per cent of losses on the specified pool of assets (often consumer loans, trade finance and commercial real estate loans), while retaining the remainder of the risk.

This article was first published here.