By Mitch Reznick, head of sustainable fixed income at Federated Hermes

Vice President Kamala Harris and former President Donald Trump remain neck and neck in the polls. How will the result impact credit markets?

Expected outcomes of the US elections are all within margins of error. Across the White House, the Senate and the House of Representatives, it is tough to have confidence in predicting whether the results will be blue, red, or purple. That said, the most likely outcome is that there will be no clear outcome. Perhaps the recent rate and credit volatility is prescient.

It is hard to see a material rally in credit, given that credit spreads are in the sub-five percentile in the US and top quintile in Europe versus a decade-plus history. This would limit a prolonged effect of a corporate-friendly ‘red sweep’. Although a Republican White House introduces uncertainties with trade (and other) policies, such an outcome could be positive for corporate fundamentals in the near term.

What does it mean for fixed income?

However, a big concern is what that would do for the rate outlook. Both Democrats and Republicans are likely to add to the deficit. However, the Republican platform seems more overtly deficit-agnostic, which could trigger a selloff in rates. This, in turn, could slow the flow into the credit space and weaken the strong technicals of the market that have served as a remarkable backstop to spread-widening for months. A Democratic White House would create less policy uncertainty, but could lead to some modest spread leakage.

Also read: Rebates Slow Inflation But Don’t Expect Rate Cuts

When positioning our investment strategies ahead of the elections there was also a myriad of other underlying factors to consider. The tailwinds for credit have been: attractive all-in yields; a surprisingly constructive macro environment in the US; a global trend in declining interest rates; very strong technicals and sound fundamentals (i.e. earnings, default rates).

Headwinds include a fair amount of complacency toward risks; a softer macro environment in Europe and China; rising geopolitical risks; reflation in the US that would slow or – gasp – reverse rate reductions; shakiness in levered private credit markets; and, of course, relatively tight volatility-adjusted credit spreads.

Portfolio update

In taking all of this into consideration, we are positioned somewhat defensively ahead of next week. In high yield (HY), we have moved up in credit quality following the unbridled run in triple-Cs, largely driven by a handful of event-driven names out of the US. Predicated on strong credit fundamentals, we still see value in triple-Bs. In our flexible credit range, we reinforced the credit options book to mitigate the risk of any substantial spread decoupling and heightened spread volatility. Our US rates book pivoted recently to a steepener in deference to both central bank biases toward rate reductions and in anticipation of widening budget deficits. In structured, asset-backed securities (ABS) structures remain robust and are buttressed by the trajectory of lower rates. Well-structured collateralised loan obligations (CLOs) continue to protect investors from being overly vulnerable to the downgrades seen in loans.

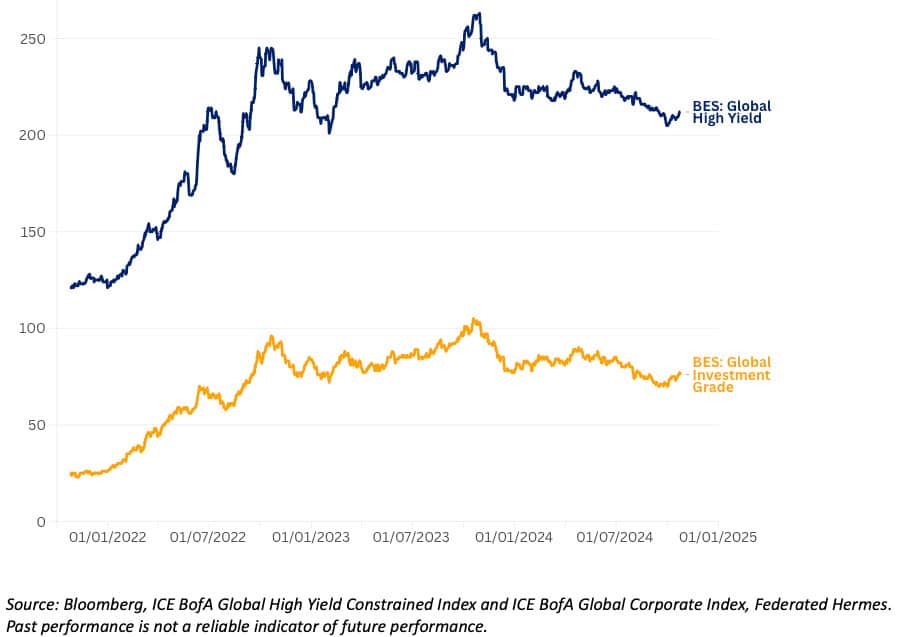

We do believe there is a decent cushion to total returns this year. With credit making such a remarkable run, a lot would have to go wrong for it to deliver negative returns. Based on Figure 1, the HY and investment grade markets would have to give up more than 210bps and almost 80bps, respectively, in yields to reach breakeven returns. Given the rate outlook and generally supportive fundamentals, we view this as unlikely, going into the elections. At the same time, we are looking for any signs of reflation in the US, which would slow or reverse the expected rate trajectory.

Figure 1: Spread-widening required to reduce returns to zero

We know we don’t know what the results will be. We anticipate there will be a certain measure of uncertainty in the context of an otherwise healthy fixed income market. There is range of results, with each likely to trigger some kind of short-term move in spreads. We think it is better to look through that knee-jerk response. Predicated on whatever the outcome, we will re-position risk for an updated longer-term view following the elections… once we know what we don’t know.