Quarterly inflation is heading in the right direction, albeit, still above the RBA board 2-3% target band. The trimmed mean for the September quarter was up 0.8% to take the annual change to 3.5%. The trimmed mean excludes irregular or temporary price changes, such as electricity bill rebates and is the preferred measure.

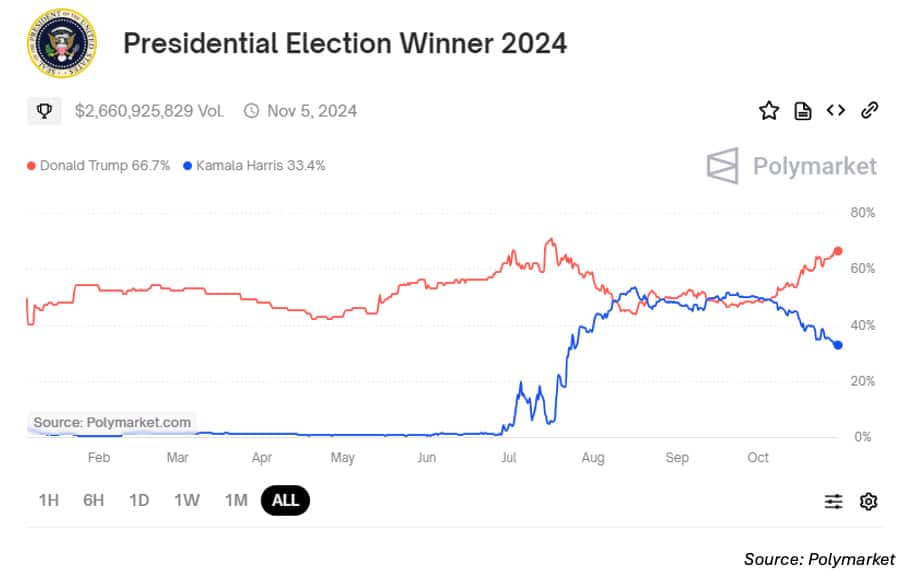

Have you been following the US presidential candidates’ progress? The polls show Trump is ahead. Polymarket, the world’s largest prediction market gives Trump a 66.7% chance of taking the top job. If Trump wins there’ll be some well-flagged changes to markets and I expect his protectionist policies will keep inflation high – the battle isn’t over yet. Further, because of significant promises on both sides of the political spectrum, US Treasury yields should also remain higher for longer.

The lead article this week is from Sébastien Page, from T. Rowe Price and shows what happened during the last 12 US rate cutting cycles. He argues we should learn to love bonds again and that it’s not about bonds versus shares. It’s about bonds versus cash.

Some investors consistently hold high levels of cash. Charities and not for profits come to mind. Curve Securities argues that by not shopping around these investors are not making the most of opportunities and that extra income could be used to expand services or hire an extra staff member.

For avid investors we publish a technical article from Ninety One that delves into last quarter’s sector and credit rating performance. Surprisingly there’s been strong demand for CCC-rated loans amongst other securities.

New research from S&P Global shows only active bond managers are performing. They’re doing far better than active equity fund managers.

Have a good week!