S&P Dow Jones Indices (S&P DJI) has published the SPIVA Australia Focus Mid-Year 2024 Highlights, which tracks the performance of actively managed funds in Australia versus their respective benchmarks across various time horizons.

According to the report’s findings, over the six-month period ending June 2024:

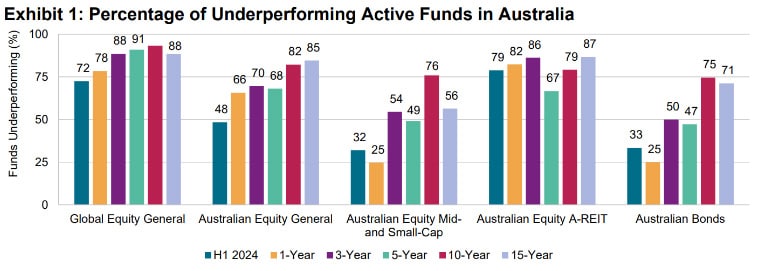

- A majority (54%) of funds across all Australian fund categories underperformed their assigned benchmarks.

- 72% of Global Equity funds domiciled in Australia underperformed the S&P World Index, in line with the underperformance rates (70-85%) of those domiciled in U.S., Europe and Canada.

- Australian domestic equity funds had relatively better results. A slim minority (48%) of Australian Equity General funds underperformed the S&P/ASX 200, while less than one-third (32%) of Australian Equity Mid- and Small-Cap funds underperformed the S&P/ASX Mid-Small.

- Australian Equity A-REIT funds were an exception, with 79% of funds underperforming, partially driven by a high portion (15.4%) of funds failing to survive.

- Australian Bonds managers continued to add value. Following a record low underperformance rate (26%) in 2023, only one-third of funds underperformed in 1H 2024 on the back of tightening credit spreads.

Also read: Cutting Cycles and Learning To Love Bonds Again

In line with the U.S. dollar and euro-denominated fixed income market, the Australian fixed income market provided favorable grounds for active managers in H1 2024. The excess return obtained by moving from Australian government bonds to investment grade corporate bonds, as measured by return spreads between the S&P/ASX Corporate Bond Index and the S&P/ASX Australian Government Bond Index series, was positive across maturities. This suggests that bond managers would have been rewarded for their conventional strategy of taking more credit risk than the benchmark. With credit spreads tightening further as of the end of Q3 2024, active bond managers appear to be on track for another strong year.

Sue Lee, APAC Head of Index Investment Strategy at S&P Dow Jones Indices, says: “Australian equities had a slower start to the year than other developed markets, but they picked up steam in the third quarter. With the large-cap segment’s outperformance reversing and 56% of the S&P/ASX 200 constituents underperforming the index as of the end of the third quarter, market conditions remain fairly neutral for active managers in the Australian Equity General category.”