If you had been watching Chinese media for economic news over the past few months you might have noticed something odd.

There’s been virtually nothing. No comments on data, no policy developments – basically radio silence when it came to the economy.

Skepticism grew among investors and outside observers of China with regards to the willingness of authorities to tackle some of the economic challenges facing China’s economy.

So, when Chinese authorities kicked off wide ranging stimulus measures last week, it makes sense to see an outsized reaction in financial markets. Last week, Hong Kong’s Hang Seng rose a whopping 13% and China’s CSI300 index surged over a 15%, with further gains beginning this week.

The stimulus has been called a “bazooka”, although there are no doubt some critics with regards to whether the measures can solve some of China’s deep-seeded economic challenges.

Here are some of my takeaways on the measures:

- The economic growth target is still of utmost importance to authorities. It was inevitable that meeting China’s growth target of around 5% was going to require some additional stimulus. This stimulus comes just three months before the end of the year.

- The wide-ranging and sizeable easing in lending is a major shift in attitude towards borrowings and looks markedly different from the caution of previous policy steps. The move included reductions to various interest rates in the economy, including mortgage rates, and the reverse repo rate. The reserve requirement ratio was also lowered by 50 basis points, and other lending facilities were bolstered to support stock market purchases and property purchases.

- Some of the long-standing reluctance to provide direct stimulus to households has also shifted. On top of the other easing measures, consumption vouchers worth 500 million yuan will be distributed by Shanghai’s local government.

- The big difference with the stimulus this past week is that it focused on providing lending support to the broader economy rather than on local governments to spend on infrastructure – although we don’t know if that’s in the pipeline as well.

Is this the silver bullet for China’s economy?

Also read: Life After The First Cut

Not quite, but it’s a start and the policy shifts has sent some important signals.

Firstly, it reinforces the notion that pragmatism did win out… eventually. The inertia that prevented easing monetary policy more significantly, facilitating borrowing “too much” or providing handouts to consumers seems to have given way.

Secondly, it signals that there will be more to come. If Shanghai is ready to dish out consumption vouchers, other top tier cities will be likely to as well.

The measures do go some way into addressing some of the long-standing challenges. Although it wasn’t the headline act, direct support to consumers is some recognition that production-led stimulus and support wasn’t going to have enough of an impact in driving demand.

That being said, it doesn’t shift the dial significantly on transferring income gains towards households away from other special interests in China’s economy. Household consumption continues to comprise a very low proportion of China’s GDP.

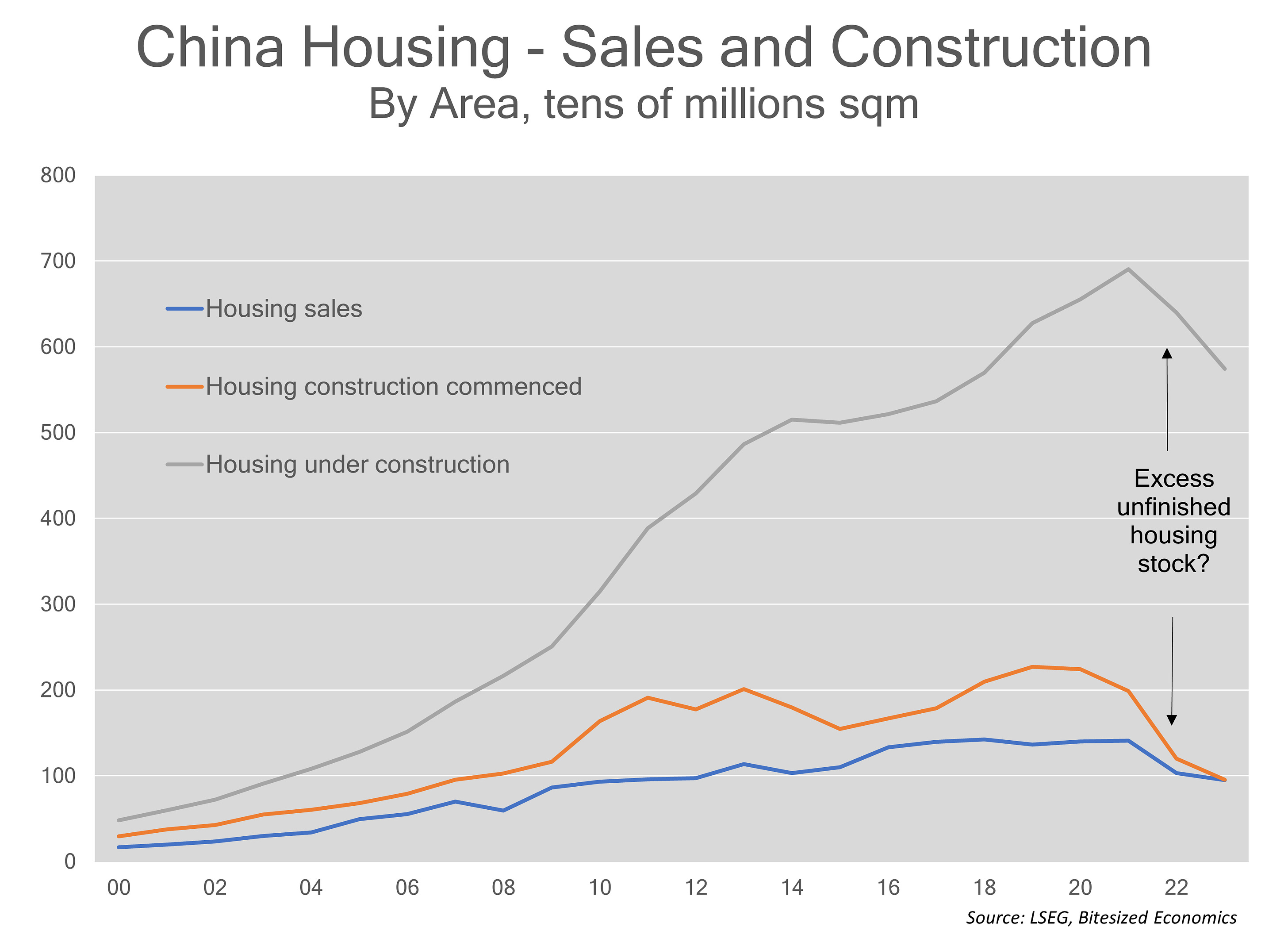

And of course, given the scale of China’s unsold housing inventory a meaningful turnaround in the housing market isn’t on the near-term time horizon, even though the measures to support the housing market do seem substantial.

But just remember the lack of any form of new policies just prior to last week. Market participants were deeply concerned that economic challenges were not being addressed, at all.

Bazooka or not, this is still a big positive step.