With the Federal Reserve now on an easing cycle, investors are turning their attention to the performance of US long duration Treasury bonds. The key question on the minds of many investors is: When is the optimal time to position in long term bonds, specifically those with 20 year and 30 year maturities?

Paul Mielczarski, Head of Global Macro Strategy at Brandywine Global, has analysed the historical context and potential implications for the bond market.

“Long duration bonds have historically struggled at the onset of Federal Reserve easing cycles, with notable exceptions like the 1984-1986 period when the Treasury yield curve was upward sloping with exceptionally high real rates,” said Mielczarski. “However, unless a significant financial shock occurs, these bonds may continue to underperform in the early stages of the upcoming easing cycle, especially given how flat the yield curve is now.”

Also read: When Might RBA Join The Cuts?

Mielczarski’s analysis revealed that long term bonds tend to perform particularly well under specific conditions: substantial Fed rate cuts, a steep yield curve, and a sluggish economic response to monetary stimulus. Historical examples of such favorable environments include 1992-1993, 2002-2003, and 2010-2013.

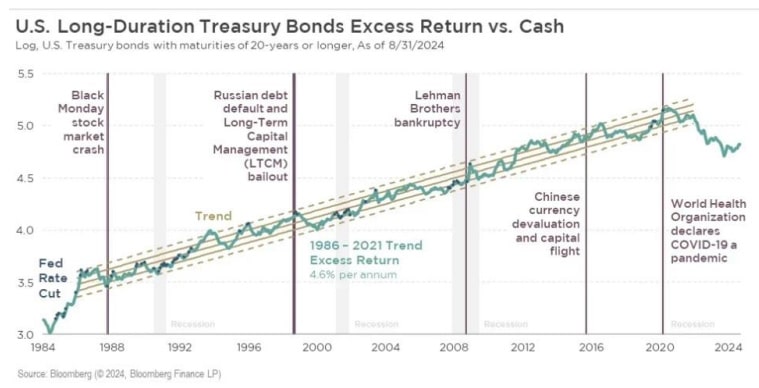

This chart below shows the excess return on long term US Treasuries versus cash. The dots on the chart indicate federal funds rate cuts, while gray shading denotes recessions. The period between 1986 and 2021 was unusually favorable for fixed income, and the trend of 4.6% annualized excess return seen during that time likely will not be repeated in the future. Instead, the focus should be on when bonds have performed well—or poorly—compared to the overall trend.

“Long bonds also react positively to large exogenous shocks, such as the 1987 Black Monday crash, the 1998 Russian debt default and the 2020 COVID-19 pandemic,” Mielczarski added. “Moreover, they have often performed well in anticipation of Fed easing cycles, as seen in 1989, 1995, and 2019.”

Despite these historical trends, Mielczarski advises caution. “The current economic environment is unique, and while long-duration bonds may perform well under certain conditions, they are likely to struggle against shorter-duration bonds in the early phases of the Fed’s easing cycle.”