From Flavio Carpenzano, Haran Karunakaran, and Manusha Samaraweera, Investment Directors at Capital Group.

Key takeaways

• Fixed income markets could offer compelling investment opportunities alongside continued lower inflation and central banks entering the easing cycle.

• The role of fixed income in portfolios is back. Bonds now offer attractive levels of income thanks to their high starting yields and are once again providing diversification from equities, as highlighted by recent market volatility.

• We favour higher-quality credit bonds, which we think could deliver high single — to low double — digit total returns over the next few years, driven by a combination of income and price appreciation from yields dropping.

“Bonds are back” has been a common refrain for financial markets for the last year or so. The sentiment has been validated by fixed income market results. Global core bonds have returned 7.5% over the last 12 months while global credit has been even higher, delivering 9.5% for investment grade and 15% for high yield1.

These strong results may cause some investors to wonder whether they have missed the boat. Has the opportunity in fixed income passed?

To that, our answer is an emphatic no. In fact, we believe the opportunity is just getting started. The combination of high starting yields and a supportive macro backdrop means the stars could finally be aligning for fixed income markets.

The power of yield

The post-financial crisis period was marked by near zero rates, quantitative easing and other forms of liquidity provision by central banks. This was a challenging environment for fixed income, which was reflected in relatively low bond returns.

The environment today is very different. The hiking of policy rates by central banks in 2022/3, while painful at the time, had a silver lining: fixed income investors are now well compensated for holding this defensive ballast in the form of historically high bond yields.

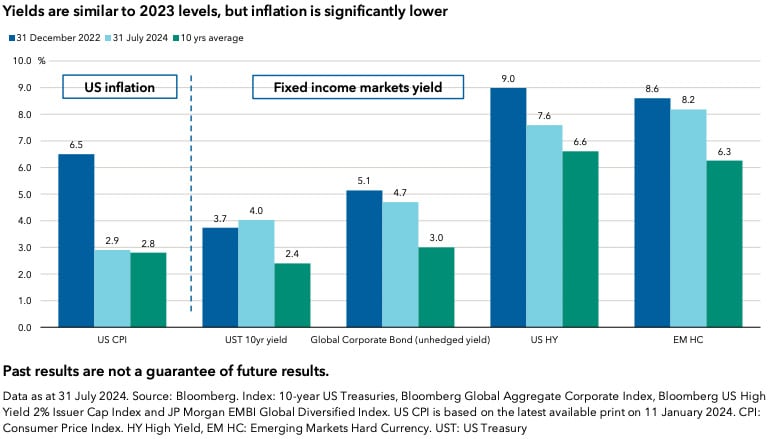

And even with the strong returns of bond markets over the last 12 months, yields remain well above historical averages. In addition, inflation has come down, meaning real yields are well into positive territory.

Download a PDF of this article: Fixed income markets: When the stars align

This is important because the starting yield of a bond is highly correlated to its future total returns. For example, high-quality global corporate bonds today offer starting yields of more than 5%; history suggests this correlates to mid-to high single-digit total returns over the coming five years.

Potential benefits from rate cuts

In addition to the high starting yield, fixed income results could also benefit from the capital gains that typically come with rate cuts. The macroeconomic backdrop has been marked by a shift in focus from concerns about inflation to a potential slowdown in growth. This means duration changes from being a possible drag on portfolio results to potentially being a positive contributor.

A continuation of the disinflation trend in the US should allow the Federal Reserve (Fed) to cut rates by 50-75 basis points (bps) this year and then by more in 2025. If this rate cutting scenario plays out, fixed income markets and asset classes such as global corporate bonds should benefit from price appreciation as a result of their duration.

Analysing past rate cycles confirms the strong return boost fixed income assets can be expected to have in this environment. Looking back at every period of sustained rate cuts of the last 40 years, we found that, on average, investment grade credit returned 10%pa in the three years after the last hike in a cycle.2

The last Fed hike was in July 2023. Since then, global corporate bonds have returned 9.5%. If historical patterns hold, the next few years should provide similarly strong returns – an opportunity that investors will need to move quickly to take advantage of.

The defensive role of fixed income is more important than ever

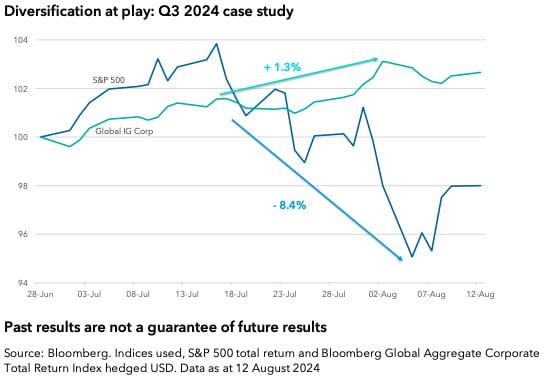

A key role of bonds in a broader portfolio is to provide defensive ballast – to protect investors’ capital and diversify against equity market volatility. While this diversification role has been less reliable in recent years, there is reason to believe it is returning. In the recent mini correction in equity markets, bonds delivered positive results (see chart below). That fabled negative bond-equity correlation reasserted itself.

As the market narrative on risk has shifted from worries about a potential reacceleration of inflation toward recession concerns, we believe the negative bond-equity correlation could persist.

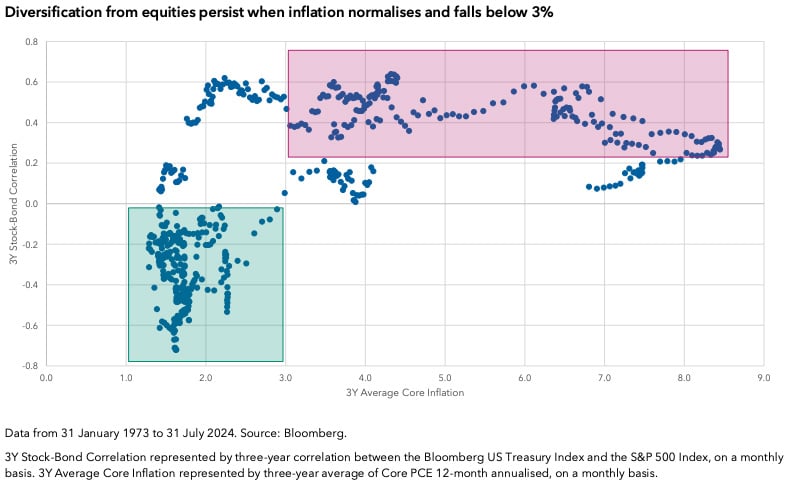

Historical analysis shows this correlation varies over time. Typically, in periods of greater inflation uncertainty, it is positive, while in periods of growth uncertainty, it is often negative.

Furthermore, as shown in the chart below, historically, when inflation has fallen below 3%, the correlation between bonds and equity normalises and turns negative, with bonds offering their traditional role of diversification versus equity.

The current environment of moderating inflation, and a Fed that is primarily concerned about growth risks, points to a higher likelihood of bonds continuing to provide that diversifying role.

Actionable ideas

- We believe it could now be time to deploy cash and invest in fixed income, gradually increasing duration to potentially benefit from the expected price appreciation that results from lower yields. Inflationary concerns are much lower and Fed rates cuts are now more certain; the question is how much, rather than if, they are going to cut. In this early phase of the easing cycle, investing in fixed income and particularly high-quality corporate bonds provides the opportunity to lock in yield and benefit from the potential duration tailwind.

- We remain positive on credit, particularly higher-quality parts of the market. Even if today’s spreads are relatively tight at around 100bps, we need to remember that tight spreads do not necessarily immediately widen. History shows us that spreads typically stay tight for a long time until a significant external factor pushes them wider (macro/sector specific factors). High-quality credit offers many of the benefits of sovereign bonds – similar defensiveness in all but the most severe recessions and potential to benefit from rate cuts – with an additional yield pick-up that compounds attractively over time.

- We believe a multi-sector, flexible and diversified approach in credit is also sensible. It provides the ability to move nimbly across different segments to find value as market conditions change. Fundamental, bottom-up research can unearth attractive credit opportunities in today’s market. For example, we currently find the banking, pharmaceutical and utilities sector in IG quite attractive. We are also finding some select opportunities in energy and healthcare companies in the high yield market where our emphasis is on higher-quality BB-rated bonds.

- Today, an active multi-sector portfolio investing in high-quality bonds across the broad spectrum of credit markets, can offer a diversified yield of more than 6% and a duration of below five years.

1 As of 30/8/2004. Based on Bloomberg Global Aggregate Total Return USD Hedged, Bloomberg Global Aggregate Corporate Total Return USD Hedged and Bloomberg Global High Yield Total Return USD Hedged indices respectively.

2 Source: Bloomberg. Based on Bloomberg US Corporate Bond Index. Rate cycles captured 1988-89, 1994-95, 1999-2000, 2004-06, 2015-18.