From Moody’s Ratings

Australian US-dollar issuance is dominated by investment-grade issuers that benefit from Australia’s (Aaa stable) diversified economy, supported by strong immigration-led population growth and deep pools of capital stemming from its large superannuation (pension fund) sector. Australia’s well-capitalised banks, the largest issuers of Australian US-dollar bonds, are aptly positioned to tackle a weakening in asset quality as borrowers remain under pressure from elevated interest rates and high, although declining, inflation. Corporate issuers benefit from the economy’s robust consumption and natural resource exports, while at the same time, the stretched household budgets may pose some challenges to corporates that are leveraged to the consumer. Against this backdrop, the transition to net zero should provide investment opportunities if the execution risks are managed well.

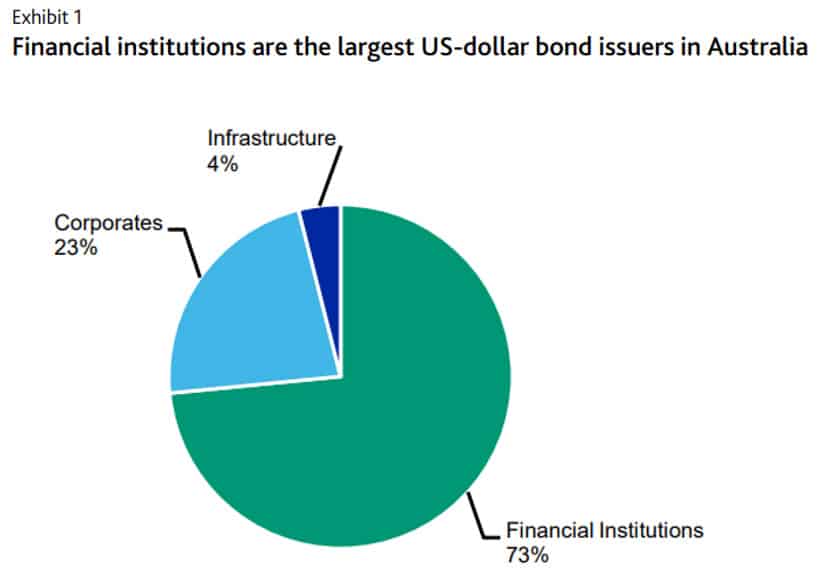

» Australian US-dollar issuance is dominated by investment grade-rated entities. Financial institutions, corporate and infrastructure segments collectively had $223 billion in US dollar-denominated bonds outstanding, 95% of which has been issued by investment-grade issuers. Financial institutions make up around three-quarters of the total, with corporates making up 23% and infrastructure the rest. We rate around 97% of the issuers with US-dollar bonds outstanding.

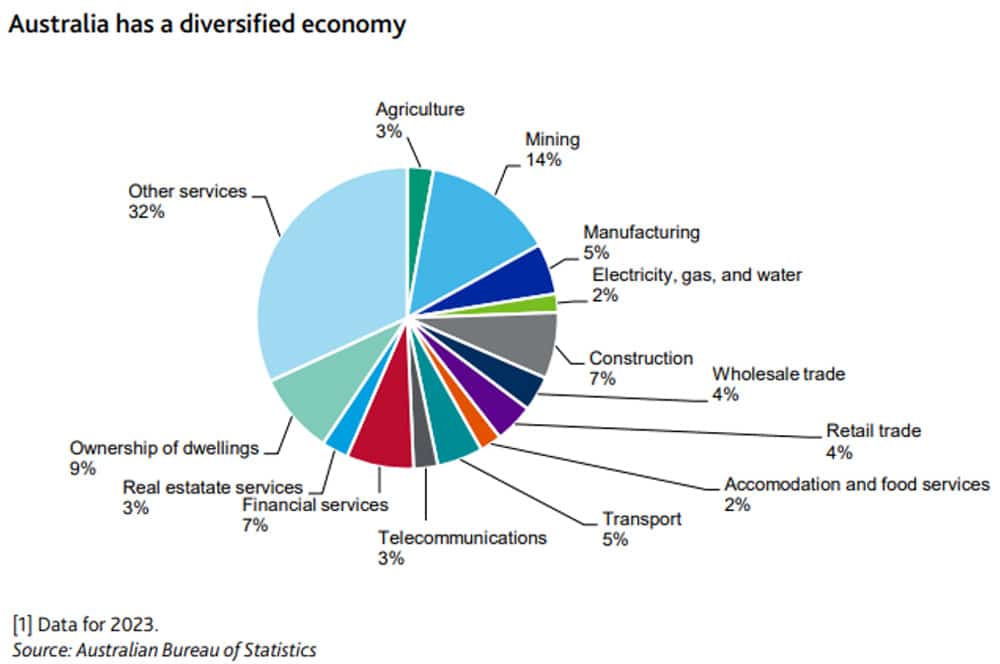

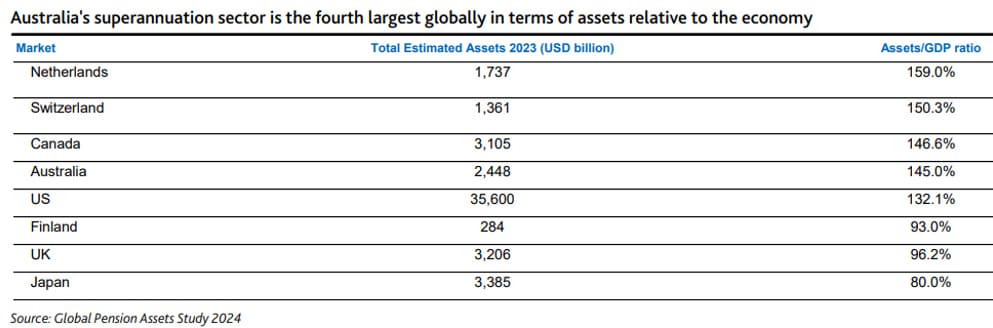

» Issuers benefit from diverse macro growth drivers and deep pools of capital. Australia benefits from a diversified economy and population growth that is supporting long term expansion in domestic consumption and infrastructure investment. Australia’s superannuation sector is the fifth largest in the world in terms of value1 , providing a significant source of capital for issuers.

» Domestic banks are well-positioned to weather cyclical changes to asset quality — driven by the effects of elevated interest rates — reflecting their strong balance sheets that are underpinned by high capital levels and solid liquidity.

» Consumption and rising exports support corporate issuers amid stretched household budgets. Overall consumption continues to support corporates’ earnings and credit strength. At the same time, stretched households may constrain further growth and pose social risks. Strong exports, particularly from the natural resources sector that comprises two-thirds of the corporate US dollar-denominated debt, are benefiting from rising export volumes, while universities are benefiting from strong international student enrollments.

» The transition is fuelling infrastructure investment opportunities. Australia’s transition to net zero is creating strong investment pipelines for energy, transportation and the digital economy — opening the door for US-dollar issuance in attractive assets. However, such strong investment pipelines also raise execution risks.

Australian US-dollar issuance is dominated by investment-grade-rated issuers

Australian issuers collectively had around $223 billion in US dollar-denominated bonds outstanding as of 30 June 2024. This includes around 270 US-dollar bond securities issued by around 49 Australia-based entities. We rate around 97% of the issuers with US-dollar bonds outstanding. Financial institutions are the largest US-dollar bond issuers, with around 73% of such bonds outstanding. Australian corporates make up around 23% of the US-dollar bonds outstanding, while issuers in the infrastructure segment make up the rest.

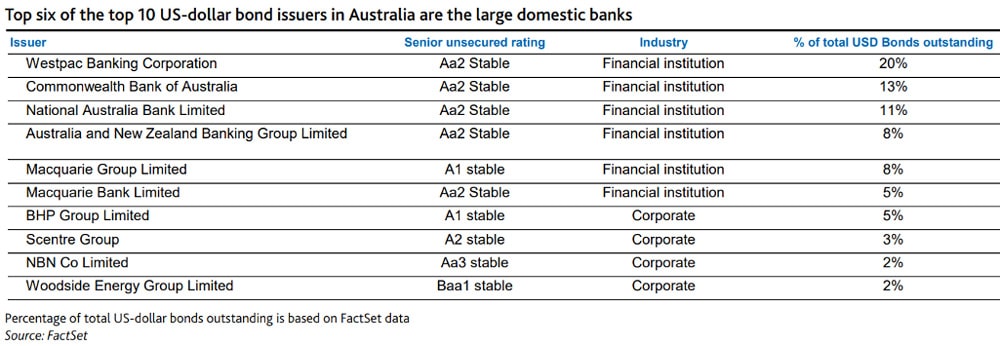

Of the total US-dollar bonds outstanding, around 94% have been issued by investment-grade entities. Around 52% of the US-dollar bonds outstanding have been issued by the big four domestic banks, Commonwealth Bank of Australia (Aa1/Aa2 stable, a1), Australia and New Zealand Banking Group Limited (Aa1/Aa2 stable, a2), Westpac Banking Corporation (Aa1/Aa2 stable, a2), and National Australia Bank Limited (Aa1/Aa2 stable, a2).

Domestic banks make up the top six of the top 10 issuers and have collectively issued around 65% of the US-dollar bonds outstanding.

Issuers benefit from diversified macro growth drivers and deep pools of capital

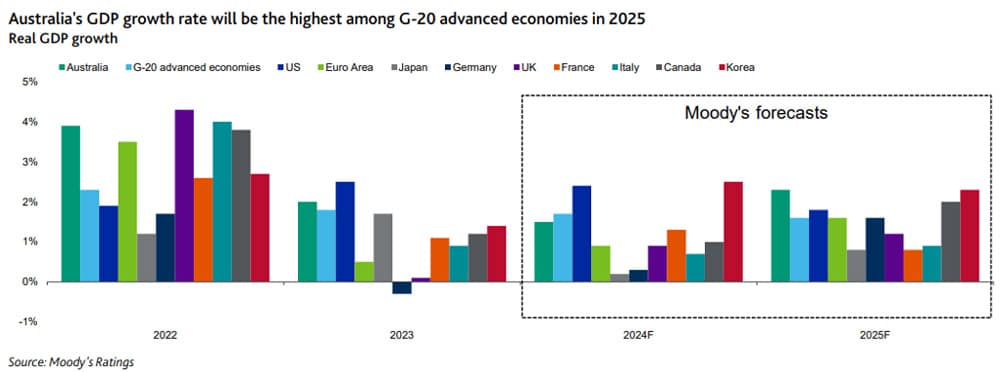

Australia benefits from multiple drivers of growth, and we expect its growth rate in 2025 to be the highest among G-20 advanced economies, despite our expectation of 1.5% GDP growth in 2024, lower than the 2.1% in 2023.

Australia entered the COVID-19 crisis from a position of strength. Up to the onset of the pandemic, Australia had recorded 28 consecutive years of annual economic growth3 . Despite being home to only 0.3% of the global population, Australia was the world’s 13th largest economy in 2023.

Australia’s diversified economy benefits from multiple growth drivers, including but not limited to the following:

- Domestic consumption, supported by immigration-led population growth, rising income and wealth;

- Services, including tourism and education, which also boost economic activity;

- Exports, particularly from natural resources and a post-pandemic recovery in international university enrollments;

- Investment from governments and utilities investing in energy infrastructure to facilitate Australia’s transition to net zero carbon emissions.

Australia’s superannuation sector is the fifth largest in the world in terms of value despite the country’s small population size, and provides a significant source of capital for issuers. Australia’s overall pension assets lag only those of the US (Aaa negative), Japan (A1 stable) UK (Aa3 stable), and Canada (Aaa stable). Australia’s assets per capita are high, fourth largest globally.

The sector continues to grow strongly with the superannuation guarantee rate paid by employers set to rise to 12% by 2025, from the current 11.5%.

This is a strong credit positive because it:

» provides a diversified funding source for companies, particularly to support their growth;

» imparts a degree of confidence that pension funds would generally be willing and able to support these companies in downside financial situations.

This deep pool of stable and growing capital — overseen by sophisticated investment managers — is being driven by the superannuation guarantee rate paid by the employers to a super fund that is generally locked up until the employee reaches retirement age. Superannuation funds support liquidity in Australia’s financial markets as they invest cash contributions to generate returns for their members. Public companies listed on the Australian Securities Exchange (ASX) and private companies with stable cash earnings benefit from the access to equity and debt capital from these funds. Superannuation funds also invest directly in infrastructure and property assets, and continue to participate in the state governments’ asset-recycling schemes.

Annual population growth of 1%-2% over the last 20 years and projected growth of 1.2%-1.4% annually over the next decade reflect a growing workforce that further supports an increase in cash contributions to the superannuation sector. Australia saw record levels of immigration following the pandemic. However, these levels will normalise over time. In the absence of productivity gains, lower population growth could translate into lower economic growth projections with a flow-through effect to corporate earnings growth — a potential credit negative.

Note: This is part of a paper published 2 September 2024, see Moody’s for more information