From Brian Carney and Kevin Minas, Mawer

Executive Summary

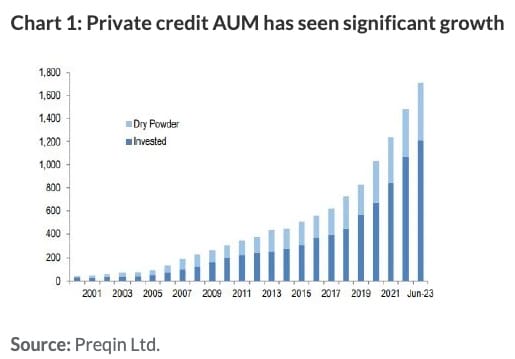

- Private credit assets under management have boomed over the past decade with various estimates putting the size of the market between $2-3 trillion USD.

- Despite public credit and private credit often being sharply delineated in investors’ minds and strategic asset allocations, they have many common features.

- While we see room for making long-term allocations to both categories, in our view, the pendulum of investor interest has swung too far in favour of private credit. Investors may be well served to consider adding more public credit to their portfolios.

- Diversified public credit, especially if implemented through an unconstrained strategy that can tactically exploit public market inefficiencies, offers investors attractive return potential, transparency, liquidity and can be an anchor allocation in a well-diversified portfolio.

Historical growth of the private credit market

While private credit as an investable asset class has existed for the past twenty years, the last five years has seen explosive growth. A primary catalyst for this growth was the implementation of more stringent bank capital regimes following the Great Financial Crisis. These required more bank capital to be set aside against corporate loans. Increased capital requirements caused direct lending activity to decline, most notably to smaller corporates, with a corresponding increase in underwriting, distribution, and trading of corporate bonds and loans to and with other market participants. These other market participants include non-bank lenders such as asset management firms and pension plans who have stepped in to fill the lending void left by the banks.

Private market data provider Preqin estimates invested capital and capital waiting on the sidelines but yet to be invested (dry powder) tops nearly $2 trillion USD (Chart 1 below), however a recent report by J. P. Morgan1 estimates the true market size might to be closer to $3 trillion USD.

In either event, the sheer scale and pace of growth in the asset class has caught the attention of many investors and when private credit is considered alongside public credit securities, “credit” more generally offers a huge opportunity set.

How are public credit and private credit related?

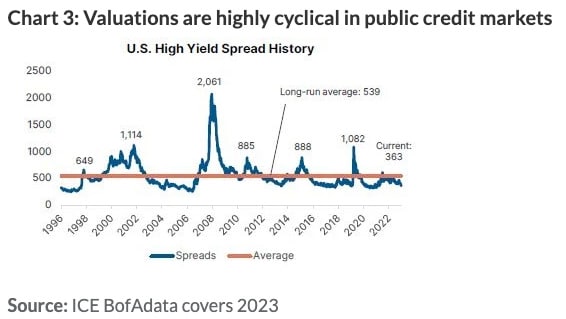

“Credit investments” are a broad and varied category. They span both public and private markets, investment grade and non-investment grade, and in general offer investors enhanced return potential, substantial income, and diversified exposure.

Also read: Regulation Will Be The Primary Driver of Change

Public credit includes financing arrangements facilitated through investment banks and other financial institutions. An issuer’s creditworthiness is typically rated by one or several agencies and lending capacity is typically tied to a company’s cashflow generating ability or secured by recourse to cashflowing physical or financial assets. Financial institutions may underwrite the debt but typically broadly syndicate or distribute the debt to retail and institutional buyers. As a result of both the investment banks involvement in syndicating the transaction and the broad ownership base, there is often an active secondary market for trading public credit securities and readily observable prices are available.

Private credit, sometimes referred to as private debt, entails privately negotiated financing arrangements. The terms and conditions of the financing are privately negotiated between the lender and the borrower (“bilateral agreement”) or a small group of lenders and the borrower (“club deal”). Borrowers are typically private companies or small to medium sized public companies and like public credit, lending is done on either a cashflow or asset basis. Lastly, due to their private nature, there is no active secondary trading market, transactions are often executed without credit ratings, and there are typically no readily observable secondary prices available.

Both public and private credit include of a wide range of transaction types with some of the primary categories listed below.

Why we think public credit can be a great allocation for many investor’s portfolios

Public credit is more liquid

Liquidity has value in an investor’s portfolio. It gives an investor the flexibility to dynamically change their asset mix, fund unexpected outlays, and take advantage of market dislocations that present themselves from time to time.

Dislocations in public credit can be effectively exploited to improve total returns over an economic cycle

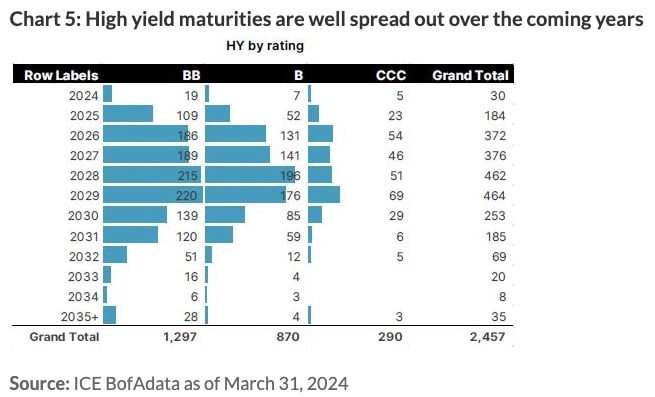

Since public credit is more liquid than the private alternative, the asset class may exhibit short-term price volatility. This volatility provides investors the ability to exploit these market moves if the manager has been given the leeway to do so.

Sentiment can shift quickly in public markets (the periodic spike in credit spreads as illustrated in Chart 3) and as this happens, so too does pricing, sometimes quite drastically. An opportunistic, absolute return focused public credit strategy, can shift into higher rated securities when valuations are tight (low spreads), and aggressively shift to lower rated, higher yielding securities after a dislocation (high spreads). In this way, one can create a private credit-like return stream over the long-term with greater liquidity and transparency.

For example, investors today can earn 5-6% yields in short-dated investment grade corporate bonds, while patiently waiting for the next big market dislocation. When that dislocation comes, and history has proven it always does, it has been common historically to earn substantial, double digit annual returns in the years following the dislocation (see Chart 4).

By making a strategic allocation to an unconstrained credit strategy, investors ensure they are consistently in the public credit asset class and positioned to take advantage when credit spreads sharply increase.

When considering all of this over a market cycle, a liquid, bottom-up focused public credit portfolio can target mid to high single digit returns. This compares well to private credit which returned 8% over the past decade2.

More capital in private credit could lower underwriting standards and credit spreads

The surge of capital into private credit means more dollars are chasing each deal. All else equal, if capital keeps pouring into the asset class, the risk is that private credit lenders lower their credit adjudication standards and/or the compensation they demand for taking on risk. In addition, if poorer quality borrowers are finding it easier to get financing, the risk of future defaults during the next economic downturn increases.

Since we haven’t seen the same amounts of capital come into the public credit markets, this is less of a risk for public credit.

Floating rate loans can stress businesses in a higher interest rate world

Private credit is typically issued on a floating rate basis meaning the coupon payments a company pays are reset frequently with reference to an overnight interest rate. As central banks increased interest rates in 2022 and 2023, companies that took on private credit loans have seen their cost of capital soar, lowering interest coverage ratios and reducing cashflow available to reinvest in their businesses. This is another source of potential future default risk.

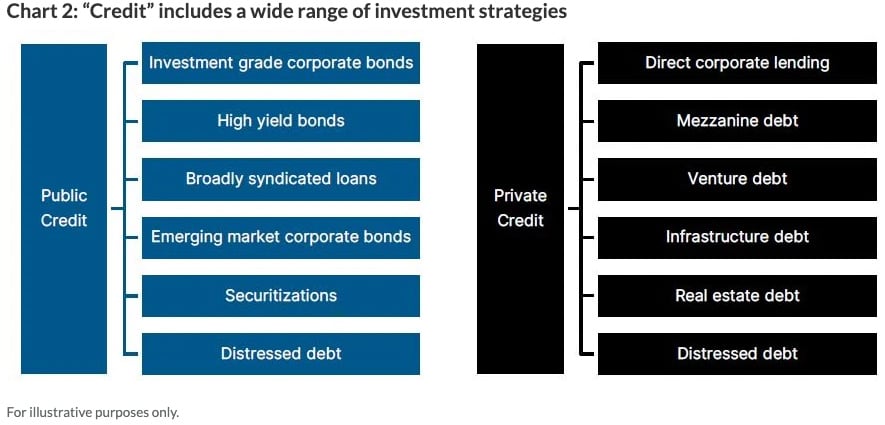

This compares to the high yield market where it is more common for bonds to be issued with fixed coupons. When interest rates were quickly cut in 2020 and stayed low through 2021, many high yield borrowers took advantage of the ultra-cheap financing to term out their debt, reducing interest costs and securing their long-term funding needs which adds resiliency to their businesses.

Conclusion

As banks continue to recede from their traditional role as providers of capital to private corporations, the private credit markets are likely to keep growing alongside their public peers. We don’t see the asset allocation decision between public and private credit as an either/or tradeoff—they both have value and can be attractive parts of an investor’s strategic asset allocation.

Although private credit has received the lion’s share of headlines of late as its high return, low volatility marketing pitch has led to a surge in AUM growth, we believe investors shouldn’t lose sight of the rationale for a meaningful allocation to public credit. This is particularly true for strategies that can allow for wide dynamic shifts in credit quality, geography, and term exposure. Diversified public credit offers one of the best risk-return profiles of any asset class and can be a great way for investors to make their portfolio work harder.

1J.P. Morgan Credit Watch April 5, 2024

2J.P. Morgan Credit Watch April 5, 2024