From Pete Robinson, Head of Investment Strategy, Fixed Income, Challenger Investment Management

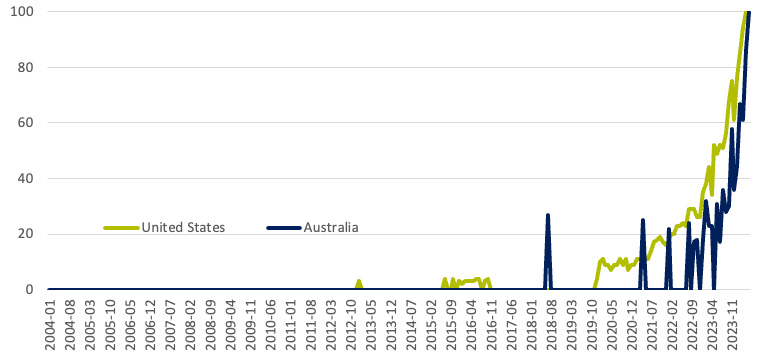

The Oxford Word of the Year 2023 was “rizz” – a term used for an individual who has a lot of style and is attractive to others, albeit not just in their appearance. If you aren’t a Gen Z-er but are a keen observer of financial markets, it would not be a surprise if your word of the year was “private credit”. A quick Google Trends search shows the dramatic increase in interest in private credit, starting in 2020 and ramping up considerably in 2022 and 2023.

Figure 1. Private Credit is Trending

Source: Google Trends

Note the y-axis represents a normalisation of search popularity. An upward sloping line shows increasing interest in a search term with 100 representing peak interest in a term.

The sky-high level of interest in private credit inevitably raises the question of whether it has peaked. While, notably, Australia lagged the United States with interest only peaking in late 2023, many are asking whether private credit still has the “rizz” factor or if the opportunity, particularly in US markets, may not be what it once was.

Three points to watch in private credit

Firstly, funds raised by private credit funds slowed in the first quarter of 2024. According to Preqin, private debt managers raised US$30.6 billion in Q1 taking total funds under management to US$1.7 trillion. This is the lowest Q1 figure since 2018. Interest rates and inflation were the top two concerns for investors. The fourth quarter of 2023 was also slow with only US$42 billion raised, the slowest end to the year since 2018. The terms of the funds are typically 6-8 years and dry powder (capital raised but not yet invested) was estimated at US$400 billion in September 2023 implying there is still plenty of capital available even if fund raising continues to slow.

Also read: From Volatility to Victory: Building Resilient Fixed Income Portfolios

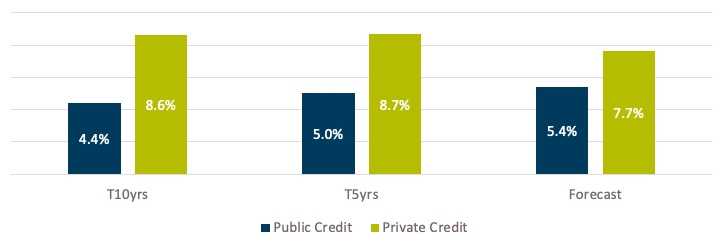

Secondly, returns in private credit are moderating. With so much capital flowing into the sector it was inevitable that returns would slow. Cliffwater now expects a long term illiquidity premium (measured as the difference between the expected return on the CDLI index unleveraged after fees and losses to the return on the Morningstar LSTA Lev Loan index after losses) of 2.25% per annum. This compares to an excess return of 4.2% p.a. in the ten years prior.

The chart below shows yield to maturity on a forecast basis and total returns on a trailing 10 year and 5 year basis. Public Credit is proxied by the Morningstar LSTA Lev Loans index. Private Credit is proxied by the Cliffwater Direct Lending Index. Forecast yields are net of fees and assumed losses.

Figure 2. Shrinking Illiquidity Premiums in Private Credit

Source: Cliffwater, Bloomberg.

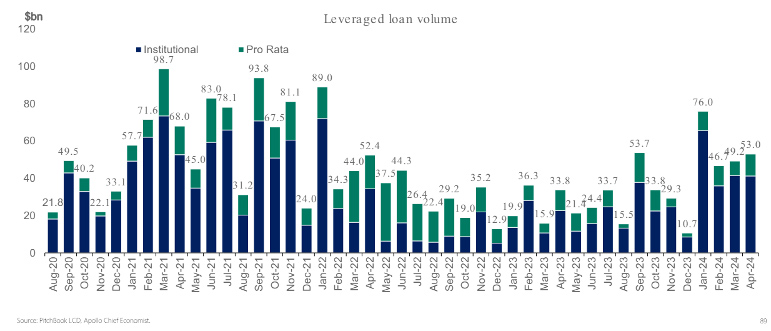

Thirdly, the growth of the private lending market might have outpaced the supply of private lending opportunities. In other words, we may have reached a point whereby private lenders are competing with public markets and banks for new deals. In 2023 private credit lenders provided a US$5.3 billion loan package to Finastra Group, refinancing existing syndicated debt raising the question of what the private lenders were providing that public markets couldn’t.

The sharp contraction in credit spreads seems to have reversed this trend in 2024. As shown below, public leveraged loan issuance levels have picked up from 2022/23 levels. According to Pitchbook, in 2023 around US$20 billion in publicly syndicated loans was taken out by private direct loans. In 2024 through April, over US$13 billion of private direct loans have been refinanced by publicly syndicated loans.

Figure 3. Public leveraged loans volumes rebounding

Source: Apollo

And in another important data point, Bloomberg reported in May that a large US private lender, HPS Investment Partners actually capped inflows into one of it funds to manage the imbalance between demand for private credit and the supply of opportunities.

Of course, there are two interpretations of the supply argument. One is that public markets are lacking discipline and pricing risk too low. The other is that private lenders have become too large and are now competing directly with public markets rather than filling the gaps around them. Both are probably true to some extent.

Does private credit still have the “rizz” factor?

At Challenger Investment Management, our conclusion is that we have probably hit the peak in private credit in the United States. That’s not to say that it is a poor investment now but perhaps not the slam dunk it was 5-10 years ago. An illiquidity premium of greater than 2% per annum is good, but maybe doesn’t have the “rizz” it had a few years back.

But how about Australia? Are we past the peak in Australian private credit? In assessing this question, the first thing to note is that until recently Australian private credit definitely didn’t have the same amount of “rizz” as US private markets. This is consistent with the Google Trends data and the level of understanding from investors and advisors who had barely scratched the surface of these markets before COVID.

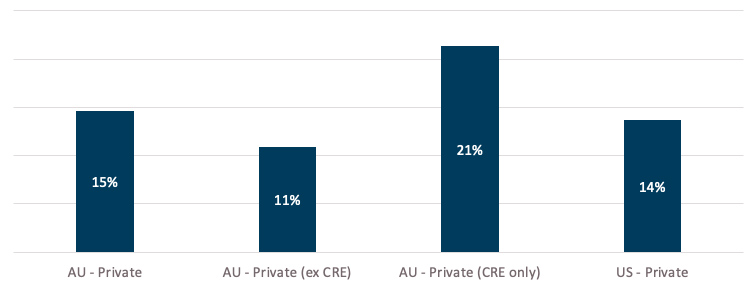

Data on funds raised in Australian private credit markets is hard to come by but anecdotally there has been exponential growth of the number of private credit managers claiming to be active in Australia. According to E&Y’s annual survey the growth in Australian private credit has outpaced the growth of US private credit markets but only if you include CRE debt as we show below.

Figure 4. Growth in Australian Private Credit (4 Year CAGR through end of 2023)

Source: E&Y, Preqin

So, growth in Australian private credit is really about growth in commercial real estate lending. Non-CRE lending has grown at a more moderate place which aligns with our lived experience.

Australian markets are also less transparent than the United States when it comes to returns. Our anecdotal view is that illiquidity premiums were never as large in Australia as they were in the United States and haven’t compressed nearly as much and we continue to guide investors to expect an excess return of around 2% per annum.

Supply-wise the Australian market has never competed with public high yield markets for the simple reason that Australia has never had much of a public high yield bond market. In Australia, the main competition for private lenders is banks for whom non-financial corporate loan exposure growth slowed to around 6% in the 12 months to March 2024. Looking at major bank Pillar 3 disclosures it seems as though loan growth for sub-investment grade corporate credit exposure was around 8% over the past 12 months. This implies that banks were actively but not aggressively competing in corporate direct lending markets in Australia, consistent with our experience.

So, while there may not be as much “rizz” in the US private lending opportunity, we think there is probably still some left in Australia. Indeed, if there is a credit cycle down under, the opportunity for alternative lenders to fill the gaps left by the banks could be significant, especially in non-CRE lending which has experienced less growth. Watch this space!