In its latest Central Bank Watch report, Franklin Templeton notes that the RBA turned less hawkish at its March 19 meeting but maintained that it is “not ruling anything in or out,” which they view as not dropping its tightening bias altogether.

The Franklin Templeton Fixed Income team notes: “RBA’s meeting minutes indicated the same. Growth has slowed, as evidenced in gross domestic product (GDP) reports with the RBA confirming that private consumption remains particularly weak.

“But additional fiscal easing in the May 14 federal budget on cost-of-living pressures as well as the Stage III tax cuts, which will be implemented from July 1, should lift spending in the second half of 2024, in our view.

“Labour data continues to show signs of tightness, with the unemployment rate crawling back to 3.7% from 4.1% previously, despite stable participation rates. This will give credence to the RBA’s view that labour-market trends lend support to the goal of reaching the inflation target by the end of 2024 (we expect the unemployment rate to stabilize close to 4% levels).

“Inflation has consistently moderated, but as is the case elsewhere, goods disinflation has led to this decline, whereas non-tradeable inflation remains sticky. So, the battle is not entirely won, which is what the RBA will continue to reiterate through the coming months.

Also read: BetaShares CRED ETF in the Spotlight

“We expect a move only in the fourth quarter once the impact of fiscal easing on growth is ascertained, and inflation and labour trends are more stabilised.

“A quicker loosening of the labour market could bring forward cuts, but that is not our baseline view,” notes Franklin Templeton.

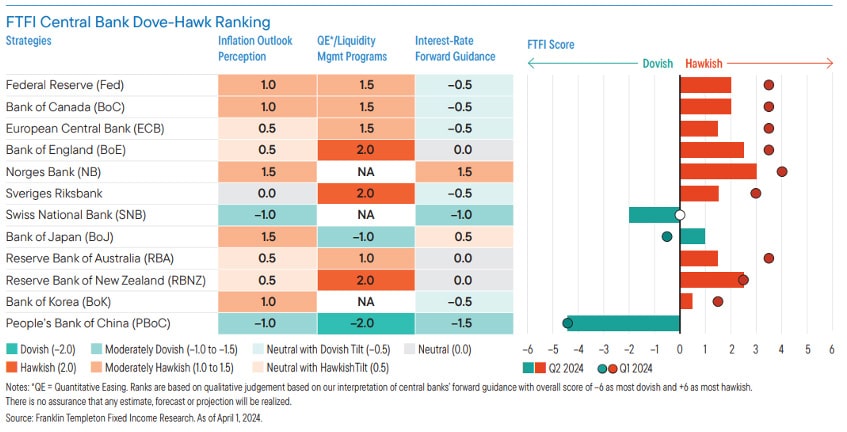

The Franklin Templeton Fixed Income Central Bank Watch is a qualitative assessment of the central banks for the Group of Ten (G10) nations plus two additional countries (China and South Korea).

Each central bank is scored on three parameters: Inflation Outlook Perception, Quantitative Easing/Liquidity Management Programs, and Interest Rate Forward Guidance. Each parameter can be scored from a range with a minimum of -2 (dovish) and a maximum of +2 (hawkish).