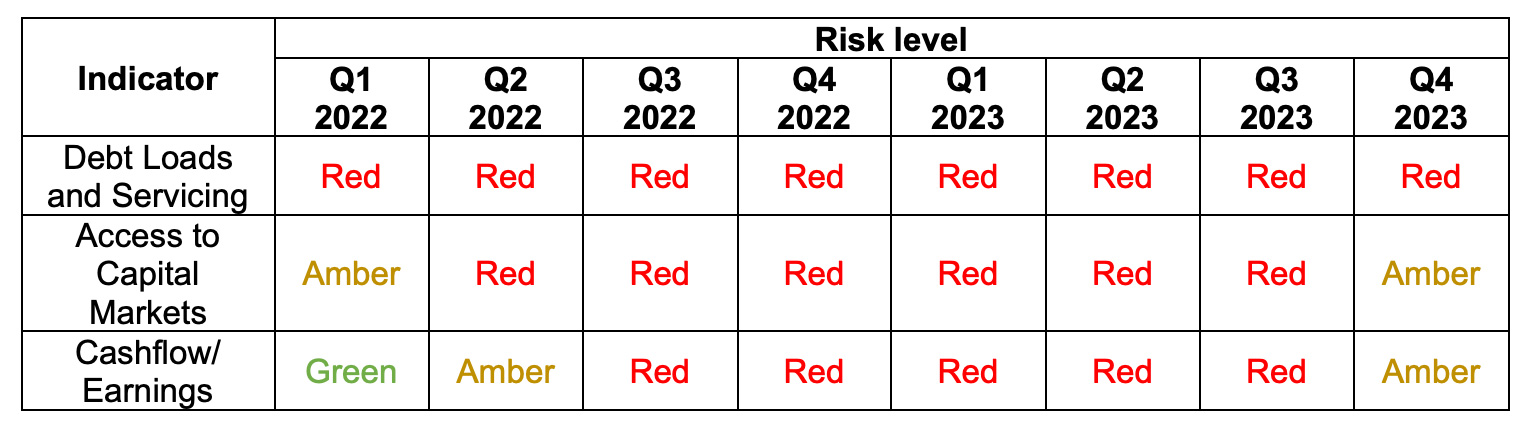

Janus Henderson Investors’ Credit Risk Monitor tracks key indicators which impact credit portfolios.

• “Cashflow and Earnings” and “Access to Capital Markets” indicators have moved to amber from red over the last quarter, but concerns remain over “Debt Loads and Servicing”.

• The widespread decline in inflation, accompanied by resilient consumer and labour markets is allowing the elusive soft landing to heave into view. This should be supportive for credit markets and leads us to be cautiously optimistic towards the asset class.

• Expectations for rate cuts could provide a tailwind to duration-sensitive assets. Credit spreads can tighten further if the ‘soft landing’ narrative holds but investment grade corporates in our view offer the most attractive blend of credit and duration risk.

‘Soft landings’ are hard to achieve but evidence is building that the US Federal Reserve might be able to pull off this feat. While risks remain, credit markets are offering an attractive proposition, according to the latest analysis from Janus Henderson Investors.

Declining inflation and expectations of rate cuts is allowing yields to come down and companies are finding it easier to refinance in capital markets. This is despite bank lending standards remaining tight historically.

Rather than being catalysed by a major macroeconomic or geopolitical event, there have been rolling earnings recessions across a number of different industries, but earnings forecasts suggest companies may be through the worst phase.

Against this macroeconomic backdrop, the “Access to Capital Markets” and “Cashflow and Earnings” indicators have moved from red to amber over the last quarter.

Janus Henderson Investors’ latest Credit Risk Monitor tracks corporate fundamental and macroeconomic indicators on a traffic light system to indicate where we are in the credit cycle and how to position portfolios accordingly.

Jim Cielinski, Global Head of Fixed Income at Janus Henderson Investors, said: “People often ask us what signposts we are looking at. For us, the key one remains inflation. Rate cuts are predicated on a fall in inflation. If that persists, it will allow central banks to ease aggressively, which will stand us in good stead”.

“We think that spreads will tighten in the coming months. The soft landing, the friendlier central banks stance – all this tends to be supportive of that. We don’t expect heroics from the corporate bond segment, but we think they can do better than just the coupon or carry that they provide.”

Debt Loads and Servicing

Mild weakening in credit fundamentals.

Most companies are able to service their debt, but some clearly cannot which is why we are seeing the default rate tick up across both European and US High Yield. The deterioration in credit ratios is mild, however, and default rates are likely to peak at relatively low levels, with a slightly higher default rate in the US given it has a lower quality High Yield market than Europe. Distress is concentrated in the real estate, telecoms, media, and pharma sectors. Shifting work habits, debt loads, and higher financing costs explain the problems in real estate, whereas the media sector has been struggling from weakness in cable operators and a general softening in advertising, although a busy election year in 2024 could prove supportive for advertising spend.

Access to Capital Markets

Credit conditions have eased even as bank lending standards remain tight.

The decline in yields late in 2023 saw a lot of issuance, both by sovereigns and corporates, which was easily absorbed by markets eager to lock in yields. In the corporate sector this enthusiasm has continued into 2024 and has contributed to the spread tightening we have seen in recent weeks. We expect central banks to start cutting rates this year, which will help reduce financing costs, but it pays to be discriminatory. Any evidence of economic downturn in the US could see spreads widen. Bank lending standards remain tight but during this credit cycle the impact seems to have been diluted by the ready availability of financing via private credit.

Cashflow and Earnings

Economic data suggests a rare ‘soft landing’ might be achievable.

Disinflation globally, better-than-expected US economic data and the bottoming of PMIs in Europe have lent credence to the thesis that central bankers can rein in inflation without excessive damage to the economy. The earnings growth outlook appears to have stabilised overall, with the exceptions of the UK and China. We retain some concerns that the lagged impact of earlier rate rises could still weigh on the economy, but resilient consumer and labour markets should provide support to corporate earnings.

Asset Allocation Implications

Lower inflation has historically been associated with uncorrelated assets, whereby when risk assets struggle, bonds outperform. This important diversifying dynamic has been missing in recent years which led to a poor outcome for many diversified investors. As inflation reverts to normal, that diversification should return, making bonds a more attractive proposition.

Both Investment Grade and High Yield are attractive. Investment Grade credit is more sensitive to duration and has a higher credit quality. It should benefit from falling rates while offering more protection in different economic scenarios. In a ‘soft landing’ scenario High Yield should perform well. Individual security / sector selection will continue to play an important part in delivering attractive risk adjusted returns in credit portfolios.

Jim Cielinski, Global Head of Fixed Income, added: “With US consumption holding up strongly, and the US labour market remaining tight, there is no urgency for the Fed to cut rates. That said, US policy rates are above inflation, meaning that rates do not need to be as restrictive, and the Fed has already signalled a pivot in policy rates.

“We are slightly overweight credit and see further spread tightening as likely if the consensus ‘soft landing’ narrative holds. However, the jury is still out on whether we have turned the corner in terms of credit fundamentals. Given that the ‘soft landing’ narrative could shift to a hard bump down to earth, we believe it prudent to maintain a focus on quality companies with resilient cash flows.”