Franklin Templeton provides some key macro and investment themes as well an outlook dashboard on their views of sub sectors.

Our growth projections for the United States continue to improve as a “soft landing” becomes the most likely outcome, while other economies may face harsher conditions. US and European central banks appear to have reached the peaks of their hiking cycles, but we believe it is still too soon to declare victory against inflation. A core tenet of our macro view is central banks will need to maintain rates at higher levels than the market anticipates, which will keep pressure on yields across the curves.

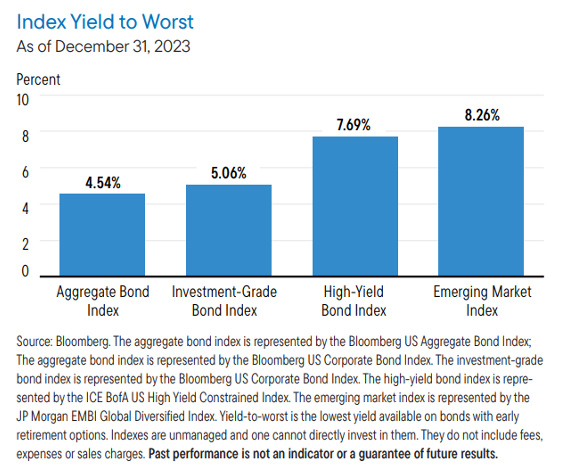

We are still cautious about taking broad-based risks as spreads are currently not pricing in any potential downside; however, all-in yields remain at historically high levels making them appear attractive to us. We are finding pockets of value across several sectors and are focusing on security selection.

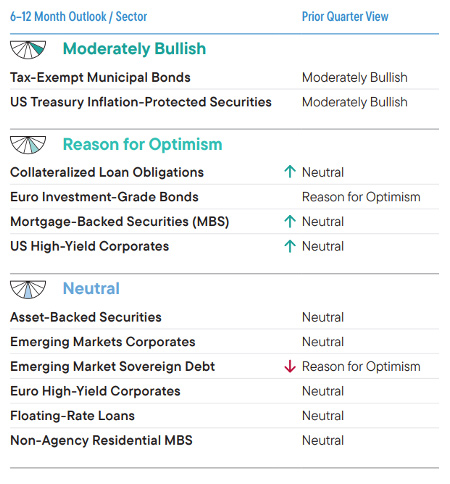

Fixed income outlook dashboard

Outlooks for fixed income sectors are based on our analysis of macroeconomic themes and the technical conditions for each asset class. We rate each sector from bearish to bullish to express our outlook over the next six to 12 months.

Also read: The Tide Turns – The Outlook For Fixed Income in 2024

Three US macroeconomic themes

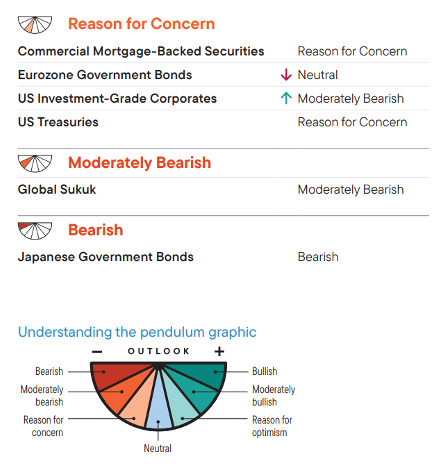

1. Fed narrative changes, but inflation battle not won

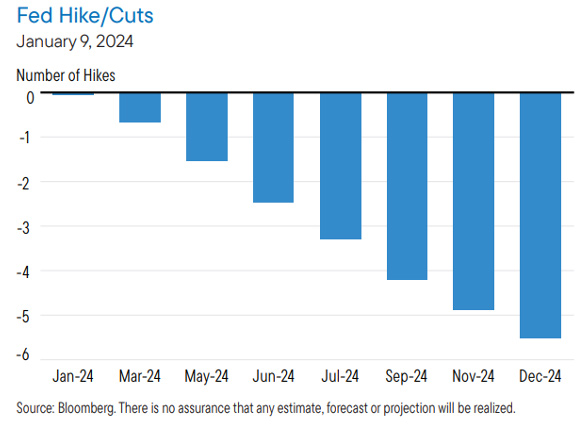

After reaching the 5% level in late October, yields on 10-year US Treasuries (USTs) dropped more than a full percentage point (pp) on slightly cooler economic data and a surprisingly dovish pivot from the Fed, leading markets to price in nearly 150 basis points (bps1 ) of rate cuts in 2024. The UST market rally has loosened financial conditions to mid-2022 levels, nullifying almost 375 bps of tightening. Whether the Fed was right to pivot so soon will depend entirely on the trajectory of inflation and employment. Very little in the incoming economic data over the last few months has warranted such an expansive change in the Fed’s narrative. The last mile of disinflation could still prove to be difficult. Continued economic strength would suggest that monetary policy is not too restrictive, giving the Fed room to hold the current policy stance longer.

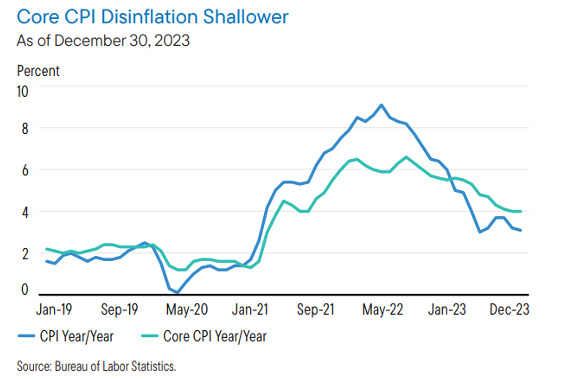

2. Still healthy private sector surplus

The private sector financial balance is the difference between the current account balance and the fiscal balance. A deficit would indicate that households and firms are unable to finance their spending out of their incomes, having to instead rely on credit/borrowing or asset sales to bridge the funding gap. The US private sector balance is, however, at a significantly healthy 4.6% of gross domestic product (GDP), compared to –4.4% in the third quarter of 2000 and –2.7% in 2006. This implies that in the event of a banking sector crisis or asset market decline, should the supply of credit dry up, households and firms should still be more than able to meet their current expenses from their incomes.

3. Uncertainty around the US economy continues

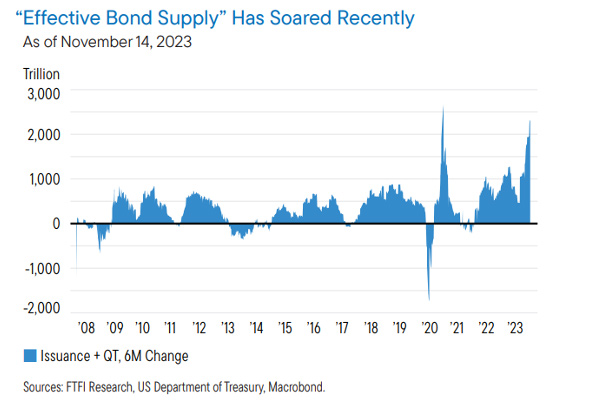

The impact of rising fiscal deficits, growing UST issuance, quantitative tightening, the changing buyer base of USTs, a resilient US economy (given that consumers have continued to spend), and temperamental energy markets are suggestive of structurally higher inflation and interest rates. Consequently, we believe it has become tougher to define the kind of “landing” the economy is likely to see. In the United States, a still-tight labor market, persistently solid household spending, and robust balance sheets amid record homeowners’ equity for their real estate holdings bolster the case for a soft landing. Conversely, the rise in longer-term rates makes the soft-landing scenario in United States more challenging.

We are still cautious about taking broad-based risks as spreads are currently not pricing in any potential downside; however, all-in yields remain at historically high levels making them appear attractive to us. We are finding pockets of value across several sectors and are focusing on security selection.

Three Portfolio themes

1. Yield investors provide a technical tailwind to credit

In our analysis, nominal yields across broad fixed income sectors are attractive on a historical basis, providing significant income opportunities. The fear of missing out (FOMO) on these high yields has some investors looking at outright yield levels and not spreads. This has allowed spreads to migrate tighter than longer-run averages despite weakening US economic prospects. Higher income levels reduce the potential for negative absolute returns even in a modest spread widening scenario. We maintain our valuation discipline to ensure we are appropriately compensated for risk.

2. Market discounting downside risk

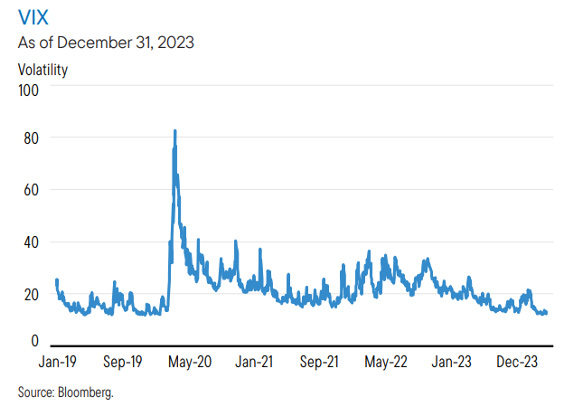

Implied volatility measures in fixed income spread sectors remain too low, in our view, given the still uncertain path of the global economy. The equity volatility index VIX, a good proxy for market risk appetite, is on the lower end of recent history. Also, fewer fixed income investors have employed derivatives to protect against market volatility. We remain vigilant in evaluating the impact of a slowing economy and higher interest rates. By tiering risk parameters across fixed income sectors, we can more efficiently construct portfolios with an eye toward limiting the downside risk without sacrificing current market returns.

3. Follow the Fed speak

The market is pricing in an aggressive path of Federal Reserve (Fed) rate cuts by the end of next year. This is too much, too soon as the Fed will need to remain in restrictive territory for as long as necessary to bring inflation down, in our view. Market expectations of Fed cuts have kept intermediate yields low, making the Fed’s efforts to restrict lending to consumers and businesses more difficult. The Fed will have limited ability to cut rates as fast as the market is forecasting as long as disinflation remains a challenge. Even with moderating inflation, the Fed should proceed cautiously, as any resurgence would be damaging to the market. We have positioned our portfolios to benefit as the market adjusts to a more realistic Fed path.