There were huge inflows into fixed income funds last year with Vanguard reporting that Australian bond ETFs received A$3.81 billion in cash inflows in 2023, a 37% improvement year on year.

It is always interesting to know where investors are allocating their funds. We’re in the process of updating our ETF Fund Finder and I thought it’d be interesting to share the biggest domestic fixed income funds with you.

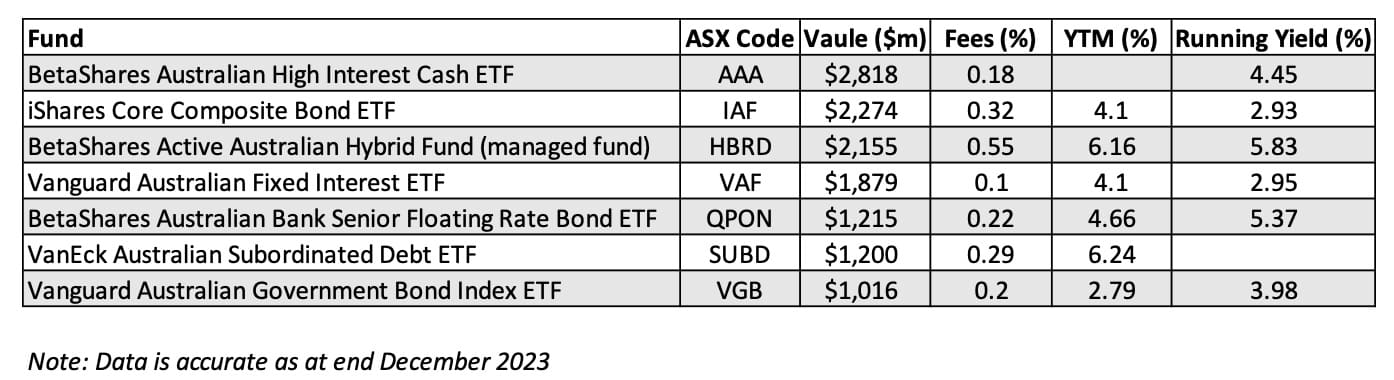

There is a very diverse range of funds from all-cash to all hybrids at the riskier end of the spectrum. Yields also differ significantly even though there would be very little high yield allocation in any of the funds. Five of the funds invest in specific sectors, enabling investors to target specific segments, while just two are multi-sector funds.

Sitting in first place, with the most funds under management (FUM) is the BetaShares Australian High Interest Cash ETF, managing $2.818 billion as at 29 December 2023. This fund would have likely included some institutional investors that can access better returns than if they went to the market direct.

The iShares Core Composite Bond ETF (ASX:IAF) and the Vanguard Australian Fixed Interest ETF (ASX:VAF) are the most alike, with significant allocations to Australian government bonds and government-related entities with a small allocation to corporate bonds. This is also reflected in the same running yield and only a very slight difference in yield to maturity (YTM).

One of the most interesting points to note is the YTM of the BetaShares Active Australian Hybrid ETF (ASX:HBRD) and the lower risk VanEck Australian Subordinated Debt ETF (ASX:SUBD) where the sub debt fund has a higher yield. I think this reflects strong retail involvement in the ASX-listed hybrid market compared to the over-the-counter subordinated debt market that can only be accessed by institutional investors and bond brokers.

Keep a look out for more articles about the ETF market and we’ll let you know when our ETF finder is updated in the next few weeks.

Just because these are the biggest fixed income ETFs by value, doesn’t mean they are right for your portfolio. Do your own research and be sure the qualities of the ETF meet your requirements before you invest.