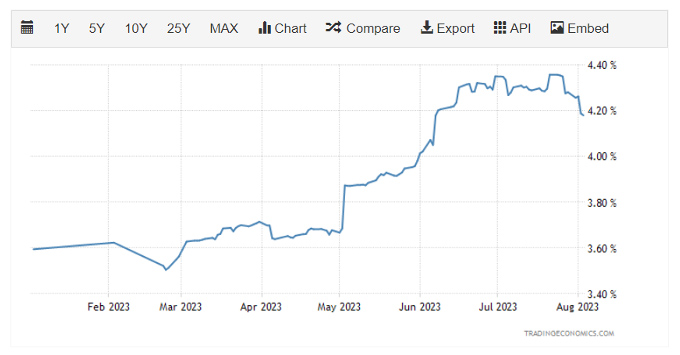

The three-month Bank Bill Swap Rate (BBSW) is a benchmark for Australian floating rate securities. Not that long ago, the rate was close to zero, which meant those securities earned very little.

Today, it’s a different story. Three month BBSW came close to 4.4% in recent weeks when the market expected two more cash rate hikes by the RBA board.

Historic 3m BBSW

Recent data including lower inflation and lower-than-expected retail sales, amongst others and consecutive RBA pauses in monthly cash rate meetings has reduced consensus market expectations for peak interest rates to just one further hike to 4.35%. Some commentators think the rate hikes are finished and the current 4.1% cash rate is the peak.

One of the other measures I watch closely to gauge interest rates is government bond yields.

The 10-year government bond yield as of 9 August 2023, is 4.004%, very close to the cash rate. If it’s accurate, the current cash rate is unlikely to move higher and stay higher than where it is now in the next 10 years. It should also be noted that at these levels, 10-year government bonds are close to decade highs and represent a good hedge if you do expect interest rates to decline quickly.

Australian government 10-year bond yields

While I’m not an economist, I’m inclined to agree with one further hike at least. Inflation is declining but it’s still double the top of RBA’s target 2-3% range. I expect interest rates to be higher for longer. And if you are in retirement, you’ll be rejoicing and if you’re a homeowner with a mortgage it’s deeply concerning. But, the average very long-term mortgage rate is around 7%, which is close to where it is now and that’s the rate I think mortgage holders should use when calculating affordability.

Consequently, 3-month BBSW may well increase again, but it is likely near the top of the cycle. If you concur with my thinking, it’s a good time to invest in fixed rate bonds and floating rate notes will stay attractive as interest rates remain relatively high.