IAM Capital Markets has been mandated by ZEN Energy Pty Ltd in a joint lead manager capacity to raise up to AUD $150M across two pari passu ranking loan tranches in Q1 FY24. The fixed rate notes have a three-year maturity and pay quarterly fixed rate interest in the range of 13.5% – 14%.

About ZEN Energy

ZEN Energy is a Melbourne-based, integrated energy retailing and wholesale trading business with a specific focus on delivering solutions to customers participating in the energy transition. ZEN Retail sells electricity to Government and business customers, while ZEN Wholesale sources power and Large-Scale (Renewable) Generation Certificates (LGCs) to supply the retail book via derivative contracts and Power Purchase Agreements (PPA).

The largest shareholder of ZEN, Professor Ross Garnaut, was previously the economic advisor to Australian Prime Minister Bob Hawke, and a leading voice in the national conversation on energy transition and economic reform. ZEN is now led by CEO Anthony Garnaut, who has been instrumental in ZEN’s growth to secure key government customers (including the South Australian Government) and contracted supply from 17 solar and wind farms.

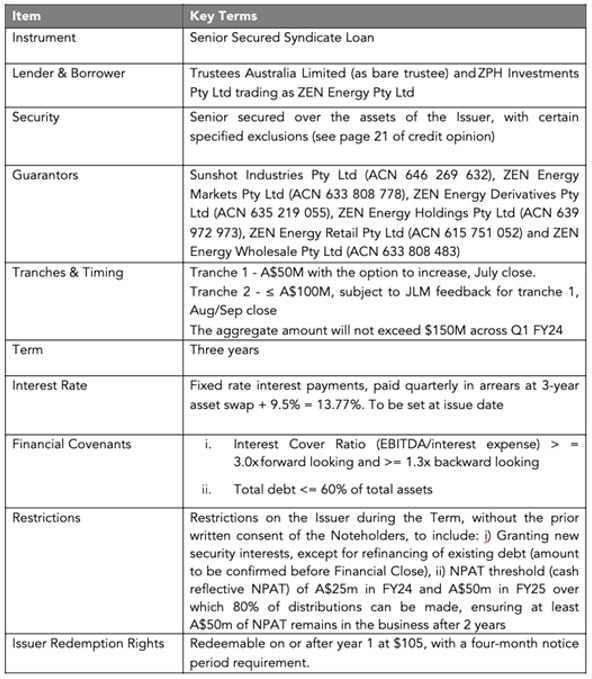

Below is an overview of the transaction’s key terms.

Credit Highlights

- Highly credible board and equity backers, led by Professor Ross Garnaut who was previously economic adviser to Australian Prime Minister Bob Hawke and leading voice in the national conversation on energy transition and economic reform.

- A scalable business model producing high gross margin backed by a sophisticated risk management policy, which will deliver circa $65M EBITDA in FY23.

Also read: Australian Corporate Debt Levels Fall

- Revenue streams underpinned by predominately fully hedged long term offtake agreements with blue chip government and corporate customers e.g. South Australian Government, CSIRO, CBUS, Bunnings and The University of Adelaide. Who have a volume weighted average contract tenor of 9 years and an average customer credit rating of AA.

- The business is entering an exciting transition into storage and generation, which will enhance its capacity to manage risk and optimise gross margin outcomes.

- Existing capital support from institutional lenders and project level senior financing secured with Natixis to develop Templers Battery and Solar River.

- ZEN has established itself as a clear leader in what is a niche segment of the renewables market. Exemplified by the calibre of its board/management team, AA rated client base and its capacity to deliver on its financial performance objectives.

Important Information

- Tranche one is now open, targeting minimum $50M and will settle on the 31st of July.

- ZEN has received commitments of $40M in firm interest, leaving up to $30M of available stock for IAM investors. ZEN will reserve the right to increase the size of tranche one, subject to JLM interest.

- Tranche two has been established to cater for institutional investors who are working through a 4 to 8-week due diligence process. Tranche two is expected to be up to $100M and will close in mid to late August. One large investor has received preliminary approval from its investment committee for up to $50M and is expected to finalise its position by the end of July. Several other discussions are under way with green energy focussed fund managers. The total amount of funding across both tranches will not exceed $150M and will coincide with a maximum indebtedness covenant.

- You will note a reference to “convertible notes” in the draft term sheet, this instrument has been proposed with a lower cash coupon in exchange for the addition of warrants/equity risk. IAM will make this offering available to interested investors on the basis that IAM focuses on delivering debt (rather than equity) capital market solutions to its clients and investors must assess for themselves any interest in the convertible notes.

- The notes will price at three-year asset swap + 9.5% (currently 13.77%, as at 9am 13th July). The interest rate will be confirmed with allocations between 4PM and 5PM on Thursday the 20th of July

- Wholesale investors only, minimum $50,000 investment. All investors will be required to sign a firm bid letter (via Docusign) to secure their interest in this transaction.

- Draft loan facility agreement to be provided prior to close.

A complete set of independent legal and financial due diligence has been completed by Gilbert and Tobin, PWC and BDO, in addition to a three-month process run by the IAM Capital Markets team and an institutional investor.

To learn more, please contact IAM.