Inflation continues to be a key theme and despite its recent peak, may stick around for longer than expected. In the second installment of a two-part series, Elizabeth Moran looks at high yield managed funds to beat inflation.

Given persistent inflation and increasing commentary for inflation to be higher for longer, last week we considered Five ETFs to beat inflation – that is a trimmed mean 6.6% inflation rate.

This week I’ll look at managed funds.

At the high 6.6% hurdle rate, you would expect the managed funds to be sub investment grade, but surprisingly, three of the funds have average investment grade credit ratings. More on those funds later in the note.

You’ll need to do some additional research to determine if the funds suit your objectives and risk and return profiles, but hopefully the list below will get you started.

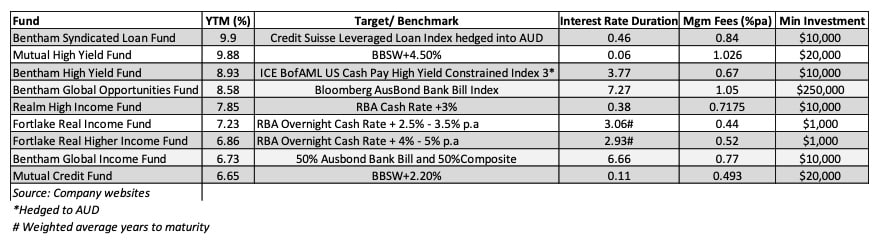

While inflation is based on historic prices, I’m going to focus on future yields. That is one of the beauties of debt securities, they have maturity or call dates and funds can predict future yields. The table below shows mixed data to 31 March and 30 April 2023.

Top of the table with a yield to maturity (YTM) of 9.9% is the Bentham Syndicated Loan Fund. More than 90% of the fund is invested in sub investment grade syndicated loans with 75% rated single ‘B’ or below, indicating a high risk portfolio. This fund has a long history with an August 2004 inception date. The Mutual High Yield Fund has a YTM of 9.88%. This fund mainly invests in asset backed securities with a 50% Residential Mortgage Backed Securities (RMBS) allocation and around 25% to Asset Backed Securities (ABS).

Also read: Back to Bond Market Fundamentals

The list is followed by a further two Bentham funds, the Bentham High Yield Fund and the Bentham Global Opportunities Fund. Both funds have a yield to maturity of more than 8.5%.

It’s worth noting that Credit Suisse is one of Bentham’s partners for two of its funds. The relationship is explained in this note from the website:

The Bentham Wholesale High Yield Fund and the Bentham Wholesale Syndicated Loan Fund are currently sub-advised by the Credit Investments Group (CIG) of Credit Suisse Asset Management, LLC, an SEC Registered Investment Advisor. CIG invests in diversified portfolios of non-investment grade credit strategies, including senior secured loans, high yield bonds and rated tranches of CLOs and seeks capital appreciation with strong focus on principal preservation.

CIG is a business unit of Credit Suisse Asset Management, LLC, an indirect wholly owned subsidiary of Credit Suisse Group AG. In connection with its sub-advisory mandate, CIG is an independent third party provider acting in accordance with such mandate and is unaffiliated with Bentham Asset Management.

Unsurprisingly, the lower risk funds are at the bottom of the table. The three investment grade portfolios are:

- Realm High Income Fund

- Fortlake Real Income Fund

- Fortlake Real Higher Income Fund

Realm has a diverse portfolio with circa 36% invested in public and private RMBS and ABS as well as 23% in hybrids and 17.5% in corporate bonds. Both Fortlake Funds had high allocations to non-US commercial banks at the end of April, taking advantage of attractive rates after the Credit Suisse bailout by UBS.

Fortlake has the lowest fee funds, also with a low $1,000 minimum investment amount. The Fortlake Real Income Fund charges just 0.44%, while the most expensive is the Bentham Global Opportunities Fund at 1.05%. The Bentham fund also has a high minimum $250,000 investment.

Investing in high yield securities means you take additional risk whether it’s credit risk (the risk the borrower will default), liquidity, interest rate, currency risk or other risks. Fixed income markets are fairly intelligent and if you are being shown high yields, please make sure you understand what you are being paid for.

None of the funds mentioned above are recommendations, the note is for educational purposes only.

Yield definitions

There are four main yields quoted for fixed income securities:

- Yield to maturity (YTM) includes the capital gain or loss on the bond price, as few bonds trade at the par value of $100 except at first issue, plus the interest until maturity.

- Yield to call (YTC) used for bonds with a call date.

- Yield to worst (YTW) is commonly used for bonds with a call date, or multiple call dates where the bond can be repaid prior to final maturity and is the worst yield an investor can expect over the life of a bond.

- Running yield is the expected income if you buy the bond and hold it for a year and is dependent on the price you pay for the bond in the market. Running yield is similar to dividend yield.

This article is for educational purposes only and none of the funds mentioned are recommendations. Past returns are no indication of future performance. Please do your own research and if you are uncertain speak to a financial adviser before you invest.