Interest rates rises are starting to slow and many economists are suggesting we are nearing peak rates. If you agree, then it’s time to start thinking about adding interest rate risk, also known as duration.

Once interest rate expectations start to reverse, fixed-rate bonds will outperform.

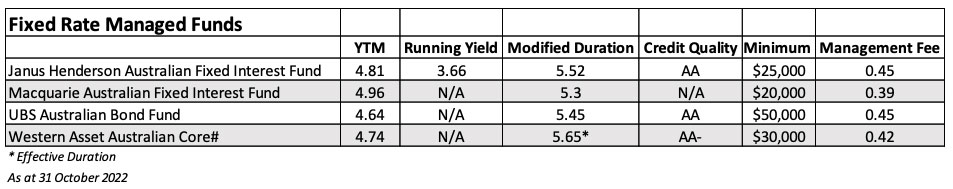

Last week I looked at Three Fixed Rate ETFs with yields over 5%p.a. All the portfolios were investment grade. This week, I wanted to see what was similarly available in managed funds.

To summarise, I was wanting predominantly fixed-rate, investment grade exposure, with a yield over 5% p.a.

While I was able to find a couple of managed funds that also had similarly high yields, they didn’t have the duration that I was seeking, specifically to lock in for when interest rates peak. That said, there were four managed funds that had yields to maturity of over 4.5% and had duration of more than five years.

1. Janus Henderson Australian Fixed Interest Fund

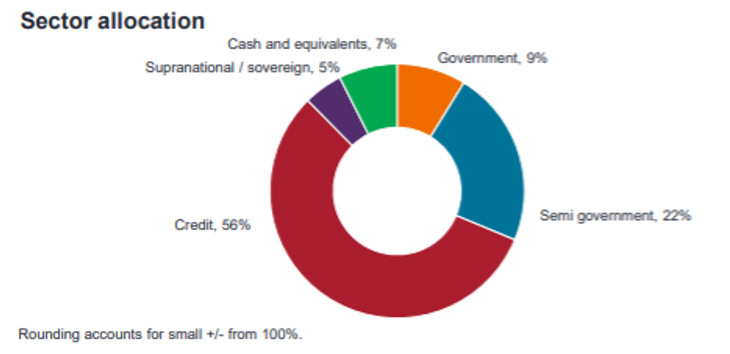

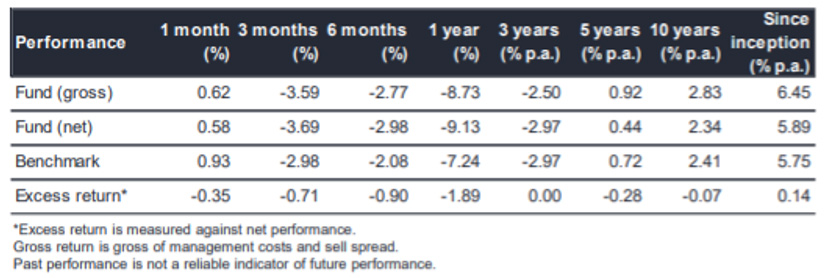

This fund has been going for 28 years and has a return since inception of 6.45%. Investment grade companies (credit) account for 56% of the portfolio, government, semi-government bonds and supranational bonds 36%, and the remainder in cash. Distributions are quarterly and the fund has $728m under management as at 31 October 2022.

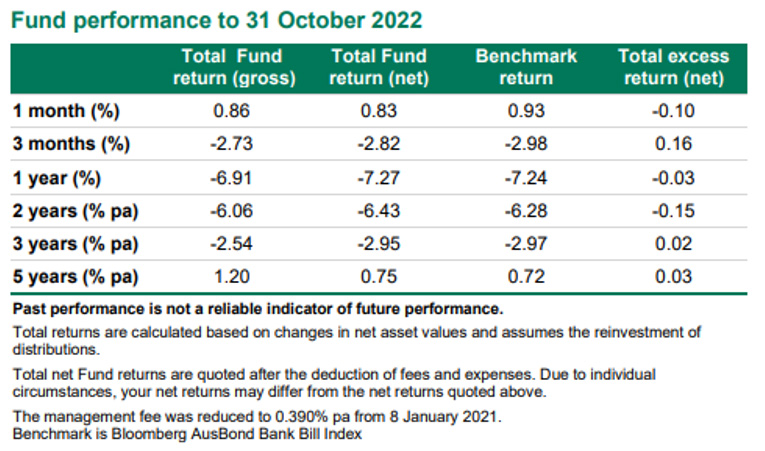

Like other funds exposed to interest rate risk, the fund made a significant loss over the last year but in October rebounded. Since inception, the fund has made a small excess return of 0.14% over its Bloomberg AusBond Composite 0+ Year Index.

2. Macquarie Australian Fixed Interest Fund

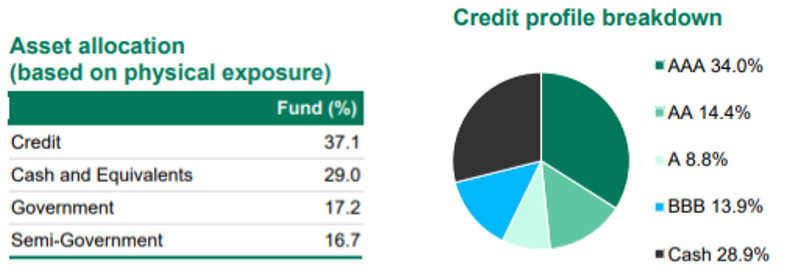

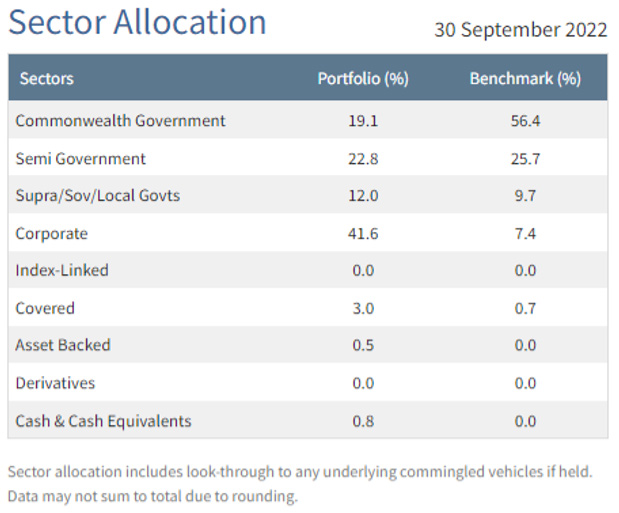

The Macquarie Australian Fixed Interest Fund has the highest yield to maturity of the four funds being considered and also the lowest fees of 0.39%p.a. Interestingly, it has the highest allocation to cash of 29%. The fund is overweight derivatives versus physical securities both in swap and futures, held in the 10-year part of the yield curve. Asset allocation based on physical exposure is shown below.

Like the Janus Henderson fund, this fund began in 1995 and has a long history. Return since inception is not provided in the latest monthly report but its one-year loss is 6.91% and 1 month gain 0.86%, both beating its Janus rival. The Macquarie fund also tracks the same AusBond Index.

Distributions are quarterly with $253m FUM.

Macquarie’s strategic commentary gives great insight into the way it approaches investment and is well worth reading if you are interested in the fund.

3. UBS Australian Bond Fund

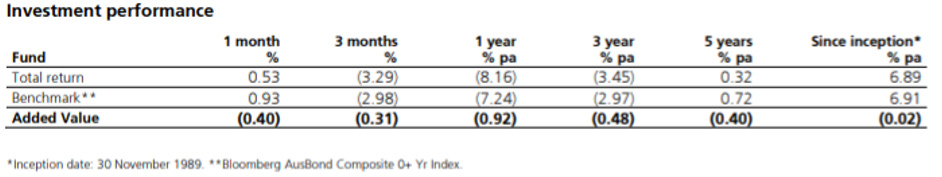

Like the other two funds above, the UBS fund has a long history with inception in 1989. Its return since then was 6.89%, which is very marginally below the benchmark performance.

However, it has the lowest yield to maturity of the cohort and the highest minimum investment of $50,000.

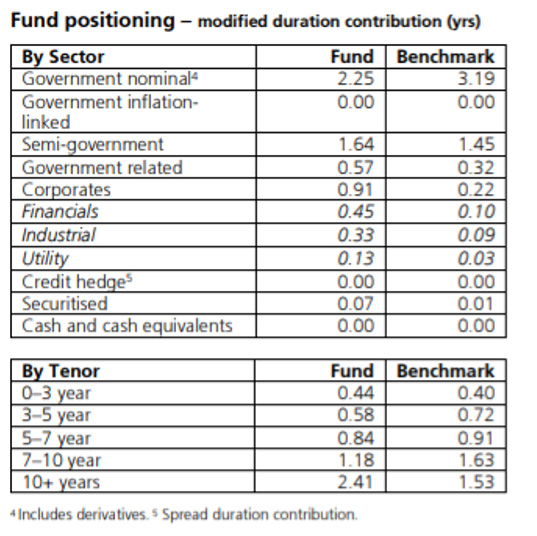

Positively, the fund sets out which sectors and maturity buckets are taking modified duration, providing valuable insight for potential investors.

The index is the same as the other two funds, distributions are quarterly and it has $965m in FUM.

4. Western Asset Australian Core

Like the other three funds, The Western Asset Australian Core Fund has a long history, with inception in 1994. This fund reports on a quarterly basis, so I reached out to the company for figures to 31 October 2022.

Net returns since inception were 5.36%p.a. beating the benchmark AusBond rate at 4.70%.

Credit quality is slightly below the Janus and UBS funds and would be below Macquarie as well although that fund doesn’t provide an average weighting. The fund had a solid one-month gain of 0.81% and -7.59% over the last 12 months.

A significant advantage for income-seeking investors are monthly distributions.

Summary

All four funds have long histories. Past performance during tough markets can give some insight into active management, but please don’t rely on it for future investment.

All four funds benchmark performance against the same Index but have a wide range of allocations. Fees are similar but Macquarie has the lowest fee of the four. Some of the funds have additional buy/sell spreads, although they are usually small. Western Asset is the only fund to pay monthly distributions.

If you are interested in investing in any of the funds, please download their recent reports to understand their methodology and future strategies. Transparency is important, does the fund explain where it made and lost money in its performance reviews?

Finally, the Janus Henderson fund is available as an mFund on the ASX, a positive if you don’t want to fill out the paperwork.

This article is for educational purposes and none of the funds mentioned are recommendations. Please do your own research and if you are uncertain speak to a financial adviser before you invest.