From Mark Dove, Junior Credit Portfolio Manager, Federated Hermes Limited

With a global recession looking more and more likely to materialise in the near future, investors will be looking for the best place to allocate their portfolios over the coming months. In our view, investment grade credit looks attractive on a risk-adjusted returns basis.

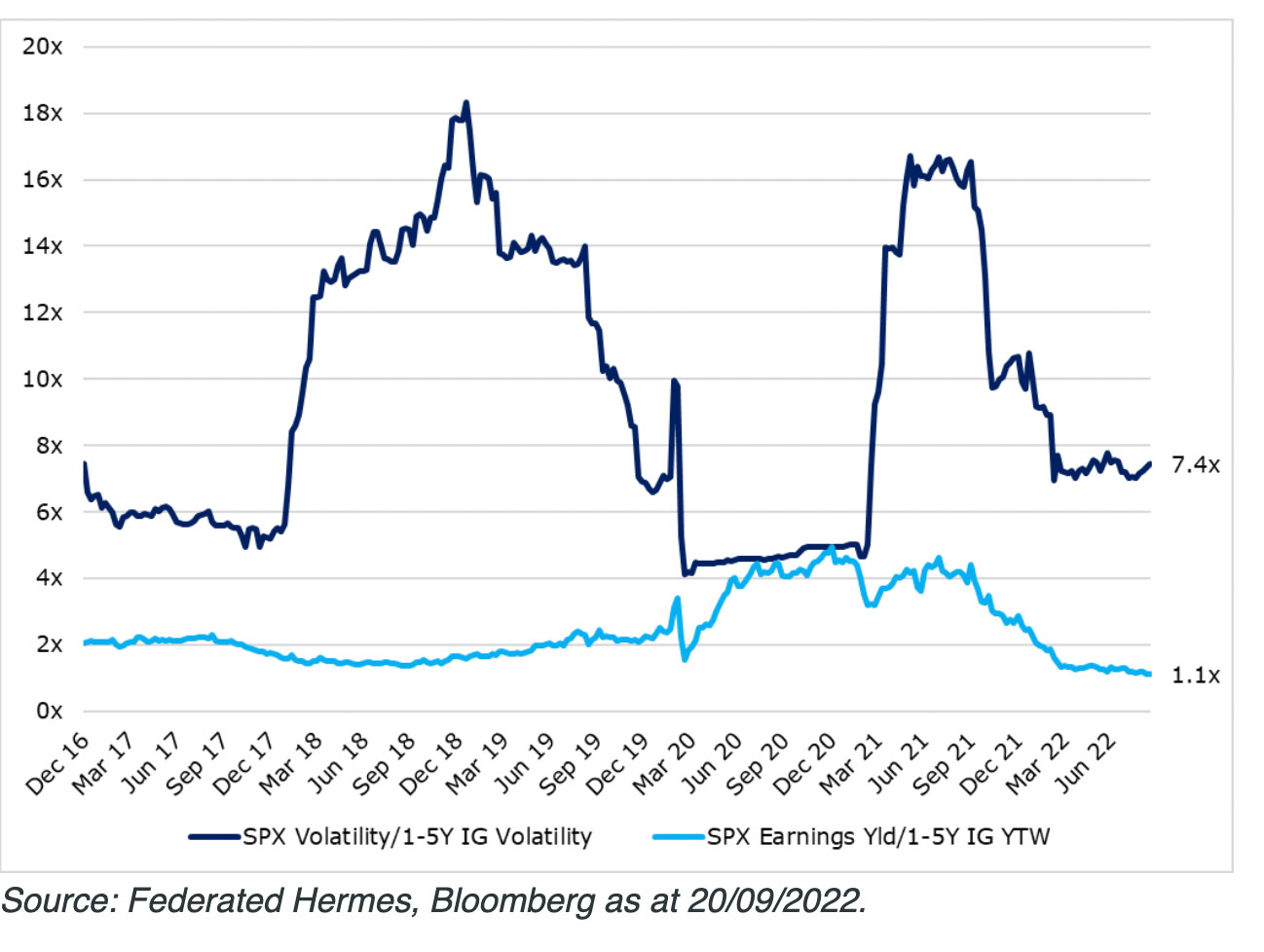

Expectations around the path of interest rate hikes and their effect on fixed income markets have driven yields on 1-5yr US investment grade bonds to 4.80% (as measured by Bloomberg US Corporate 1-5 Years TR Index), compared to average earnings yield on the S&P 500 of 5.29%, a ratio of just 1.1x – the lowest it has been over the last five years.

In Europe, 1-5Y Corporate IG yields are even higher at 5.99% when hedged back to USD using 3 month forwards.

Also read: The Worrying Signs Of Secular Stagnation

Looking at risk on the other hand, 12m rolling volatility of the S&P is 7.4x that of short dated IG corporates, despite the record levels of volatility seen in fixed income markets this year. Similar levels of return for considerably less risk makes investment grade credit attractive from a relative value perspective.