Amundi’s Global Investment Committee recently published an excellent paper on investing in second half 2022. Here we republish its Top Convictions, as well as its central and possible alternative economic scenarios. While covering multiple asset classes, we focus on the fixed income elements, including their Fixed Income suggestions.

Top Convictions

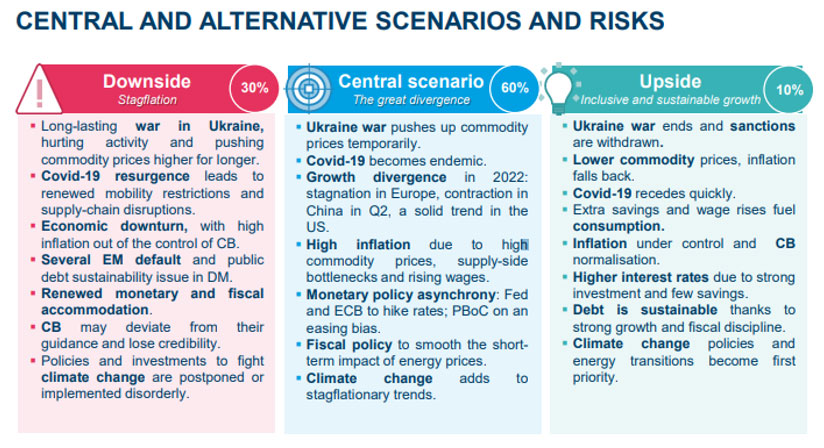

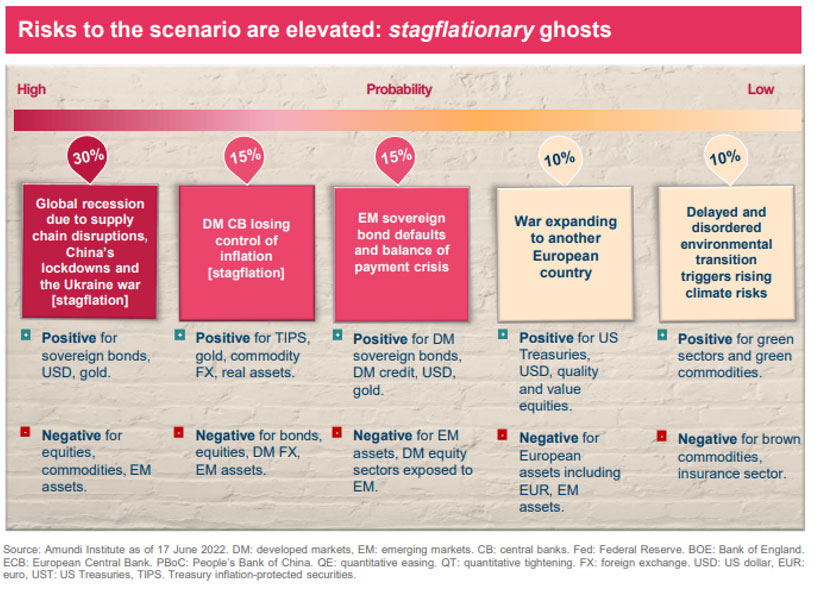

- The 2H economic outlook will feature divergences in growth, inflation and policy mix across regions. Stagflation risk will be a common feature across Developed Markets (DM). In addition, since there will no longer be a synchronous global cycle, country risk is back.

- The US economy is heading for a soft landing, while the Eurozone is fragile, hit by rising energy prices. China growth should rebound in H2, thanks to policy support.

- Inflation may be close to a peak, but will stay high due to deglobalisation, supply bottlenecks, high commodity prices and upbeat US wage growth. A psychological dimension is also kicking in.

- Central Banks will act to curb inflation at a time of slowing growth, high debt and fragmentation risk in financial markets. They will not go too far, and markets have already priced in most of their new hawkish stance.

- Fiscal stimulus is mostly behind us, with some country-specific room available, particularly in Europe and China. In the United States, fiscal space is non-existent ahead of mid-term elections.

- The depth of the equity sell-off has helped absorb overvaluations but it has not incorporated a deterioration in corporate fundamentals. Risks remain in the growth space. The buying signal for risky assets will depend on bond yield’s capacity to stabilise. Although the global repricing is still underway, this prospect does not appear so distant.

- We are cautious on DM equities, as the earnings outlook remains too optimistic. Tactically, we favour US over EU equity and China should benefit from an economic rebound in H2. Quality, value and dividend stocks should outperform.

- In fixed income, some value is back in government bonds. It is time to move to a neutral duration stance and play monetary policy divergences. Chinese bonds remain good diversifiers.

- The search for yield at all costs is over. In credit, we favour US IG credit, as Fed action should not significantly affect demand-supply dynamics.

- Unstable cross-asset correlation dynamics will require investors to seek additional diversification in commodities, currency and alternative strategies that exhibit low correlation with equities and bonds.

Also read: Australian Economic View – August 2022: Janus Henderson

Building stagflation-proof portfolios

In a fragmented world featuring high inflation, a growth slowdown and falling global liquidity, investors need to look for sources of positive real return and gain exposure to assets that can protect against high inflation and low growth. Investors should look for opportunities that may arise from a de-synchronised cycle and different paths in fiscal and monetary policy. At the same time, they should increase portfolio diversification, including strategies on currency markets and strategies targeting absolute real returns, while carefully monitoring liquidity conditions.

Following the great asset repricing of H1, the strong relative appeal of equities versus bonds has eroded and bond investing is becoming more attractive. For H2, we think investors should opt for a balanced / cautious allocation to risk assets, while focusing on increasing the diversification axis.

In fixed income it is time to move tactically to a neutral duration stance and play divergences in monetary policy. However, we believe it is not yet time to go overweight duration. We may reach such a position if growth disappoints and central banks become more accommodative. On peripheral bonds, we maintain a neutral stance and remain watchful on the ECB’s action. Inflation-linked securities and floating rates are part of the toolbox for building portfolios that are resilient to inflation.

In credit, investors should focus on quality and low-leverage companies, and areas resilient to a slowdown, such as US IG. Our preference is for hard-currency debt and selective high yield.

Regarding real assets, we favour real estate and infrastructure as an inflation hedge and private debt with floating rates, while we are more cautious on private equity markets, amid some areas of excess valuations. Given currently high geopolitical tensions, commodities – especially oil and gold – could be a good short-term hedge against geopolitical risk.