There does seem to be some progress in moderating overall inflation in the U.S., but it is a bumpy and uneven process for sure, according to global specialist fixed income manager Western Asset.

Michael J. Bazdarich, Product Specialist and Economist at Western Asset says: “The Bureau of Labor Statistics in the US announced in May that headline Consumer Price Index (CPI) inflation eased to 0.3% per month in April, down from 1.2% in March, while so-called core inflation widened to 0.6% in April from 0.3% in March. For both measures, the 12-month inflation rate moderated a bit, with that for headline CPI moving from 8.6% to 8.3% and that for core CPI moving from 6.4% to 6.2%.

“The core reading was higher than consensus expectations, while the headline reading was in line with expectations. After soaring in March, gasoline prices moderated a bit in April, and that accounted for the much lower headline reading. The core index excludes food and energy prices, so it was not affected by the -2.7% move in energy prices nor the +0.9% move in food prices.

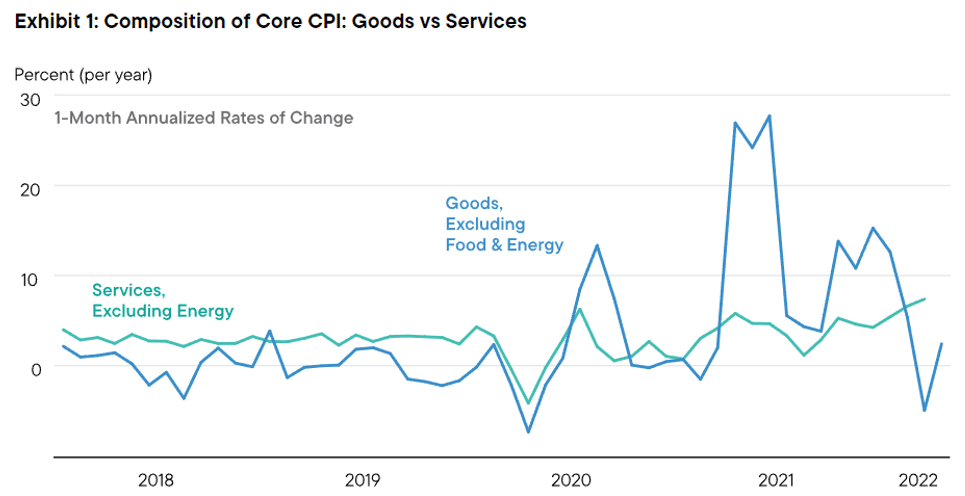

“We have been looking for inflation to moderate as easing supply pipeline problems (and burgeoning inventories of merchandise) worked to slow goods price inflation. This process has actually been in place. As you can see in the accompanying chart, core goods prices have moderated substantially over the last three months. However, in true whack-a-mole fashion, the subsidence in goods price inflation has been accompanied—and in April, offset—by faster increases in services prices.

“It has been widely reported that housing costs have been rising and contributing to the faster services inflation. Also at work in April were a number of more esoteric factors. Besides housing, shelter costs were raised by a 2.0% increase in hotel/motel prices. Health care costs rose 0.5% in April, mostly driven by a 2.0% increase in health insurance costs. A 3.1% increase in public transportation prices accrued largely from a whopping 18.6% increase in air fares. Aside from these attention-grabbing price surges, increases in other service prices actually remained modest.

Source: Bureau of Labor Statistics. As of 30 Apr 22.

“The especially concerning aspect of most of these specific gains is that they are occurring in sectors still substantially under-utilized due to the lingering effects of the COVID-19 pandemic. Consumer spending on both hotels/motels and airfares are still about 20% lower than where a continuation of pre-COVID-19 trends would place them now, but prices there are jumping anyway.

“Of course, staffing in these sectors is even further below pre-COVID-19 trends, so it would seem that the price increases there reflect growing pains related to restaffing amid ongoing COVID-19 concerns. The question is how much US Federal Reserve policy will have to tighten to slow demand there, especially as recovery from COVID-19 pushes consumers back to utilizing these services. A better solution would be stronger employment growth and capacity recovery in these industries, and perhaps the slower wage growth reported in last week’s post will help in that regard.

“Meanwhile, of course, aside from these “special” factors, housing costs are moving higher steadily, and the Ukraine crisis and other factors are holding up food and energy prices. All in all, there does seem to be some progress in moderating overall inflation, but it is a bumpy and uneven process for sure.”