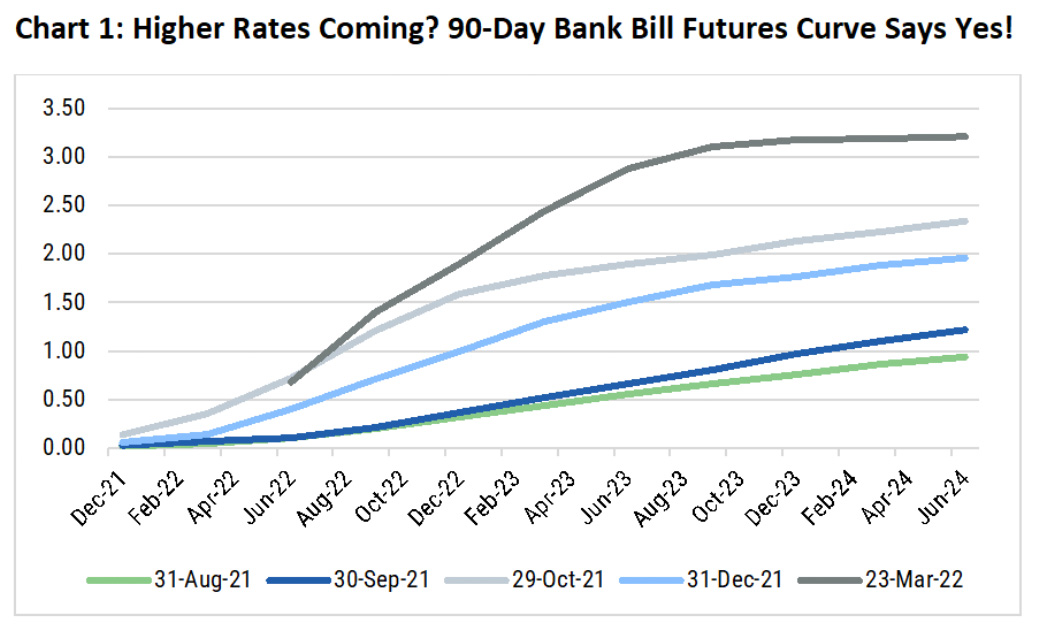

Following a sustained period of higher inflation, complicated more recently by the spike in commodity prices associated with the Russian invasion of Ukraine, central banks (CBs) are increasing interest rates. For instance, the Federal Reserve has ~7 rate hikes priced in between now and the end of 2022, with a similar amount also priced into Australian rate markets as indicated by shifts in the 90-day bank bill futures curve since August 2021 (refer Chart 1).

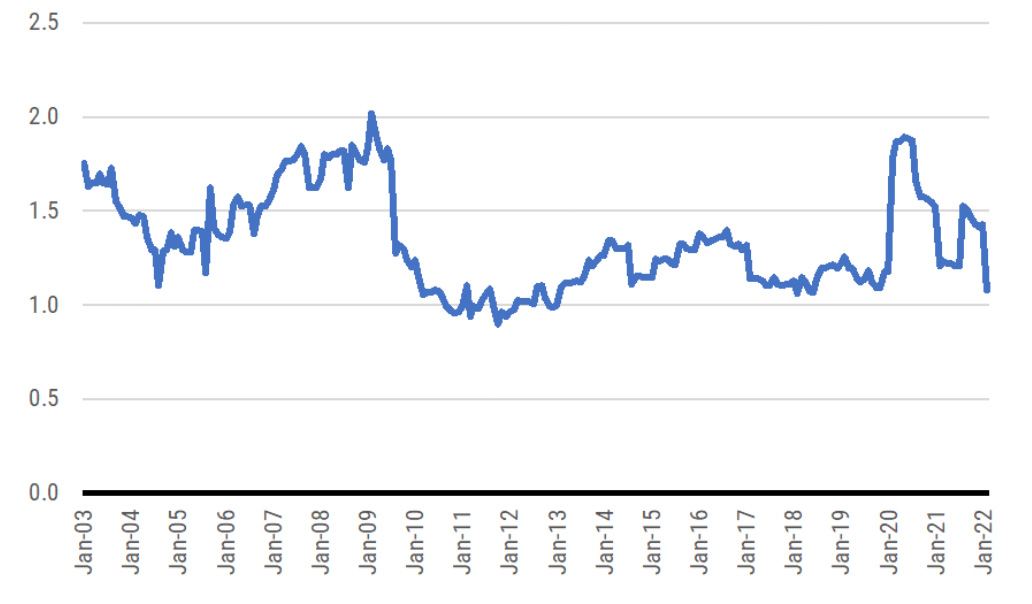

Given renewed uncertainty and tightening monetary policy, it’s no surprise we’ve witnessed the return of more volatile times in investment markets. That said, while higher rates are inevitable, we believe CBs will not follow through with all the rate hikes currently priced into forward curves but nonetheless; receding liquidity from increasing rates and quantitative tightening will expose some issuers/segments of the credit market. While some slowing of economic growth now looks inevitable, Australian credit is very well placed, with high household savings and government resources to further support demand enhanced by previous stimulus and soaring commodity prices respectively. Moreover, corporate Australia is also in a strong position to maintain its credit quality with balance sheets currently their strongest since 2010/11 (refer Chart 2).

Also read: Why Has The Price In iShares Inflation Linked Bond ETF (ASX:ILB) Dropped?

Chart 2: Corporate Australia’s Balance Sheets In Rude Health With Very Low Indebtedness

While we’d always prefer less tumultuous times, especially those without tragic wars, as an active fixed income manager, we are also attracted to the higher risk adjusted returns which invariably emerge in addition to applying our investment process; avoiding those issuers/segments more likely to suffer impairments and underperform.

Over the past six months, one area of the market we’ve consistently highlighted as representing higher risk adjusted returns is longer-dated investment grade corporates either on an outright yield or floating rate hedged basis; benefiting from every steeper yield curves, especially compared to the cash rate. This sector looks more appealing still going into 2Q22 following a moderate widening in credit margins and a further sell-off in government bonds.

Case in point, last week’s high-quality BBB+ rated 6-year bond issue from regulated utility Ausnet which priced at a very attractive yield of 4.3%, which in our estimation offers very attractive higher risk adjusted returns. Moreover, we’ve also more recently hedged out our BBSW exposure, locking in a bank bill rate of 1.91% out to the end of 2022 across all our portfolios, comfortable that what is priced into the curve will not be reciprocated by the RBA in actual interest rates hikes in 2022. While we do expect the RBA to increase rates in 2022, more than seven hikes seems unimaginable given current economic uncertainties and high household debt levels.

As the old saying goes, a high tide lifts all boats, but when the water recedes a little, active management in fixed income re-emerges in importance. Both of our credit funds – the Yarra Enhanced Income Fund and Yarra Higher Income Fund continue to offer high risk adjusted returns, yielding 4.4% and 4.8% respectively from average investment grade rated portfolios.