The ETF market continues to develop and it’s surprising the diversification you can add in a single trade.

Diversification can be through:

- The sheer number of invested securities

- Various types of bonds such as fixed rate, floating rate or specific sub sectors such as government, corporate, high yield or emerging markets

- Credit ratings

- Maturity profile

- Geographic location.

ETFs are particularly attractive if you are time-poor and want diversified exposure to many assets.

Here we review two diversified Australian ETFs – one with a passive strategy and the other with active management.

1. Vanguard Australian Corporate Fixed Interest Index ETF (ASX:VACF)

VACF is a passive, investment grade ETF that seeks to track the index of the Bloomberg AusBond Credit 0+ yr Index.

The ETF has 397 holdings from 161 issuers and is considered very well diversified given its investment grade target.

As at 30 September 2021, the fund holds roughly a 30% allocation to industrial corporate companies and slightly less to financial corporations. Almost 30% is allocated to government and agency bonds and there is also a small allocation to securitised investments.

Also read:

Three Key Fixed Income Risks You Need To Know About

Capital Notes – What Are They and Should You Invest?

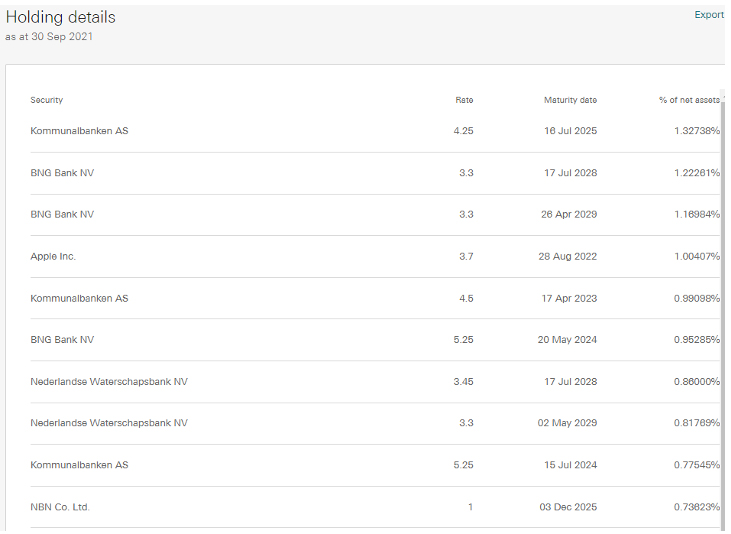

The ‘Top 10’ investments show three allocations to Kommunalbanken, worth circa 3% of the portfolio and three allocations to BNG Bank NV worth approximately 3.4% of the portfolio. The rate of return on the securities is high and the fund would have benefitted over time with high coupon payments and lower rates, increasing the value of the fixed rate securities.

The maturity dates of the bonds is spread over various maturity buckets. Approximately 9% of the portfolio matures in the next 12 months, and 60% in under five years. Only 2.5% matures after 10 years.

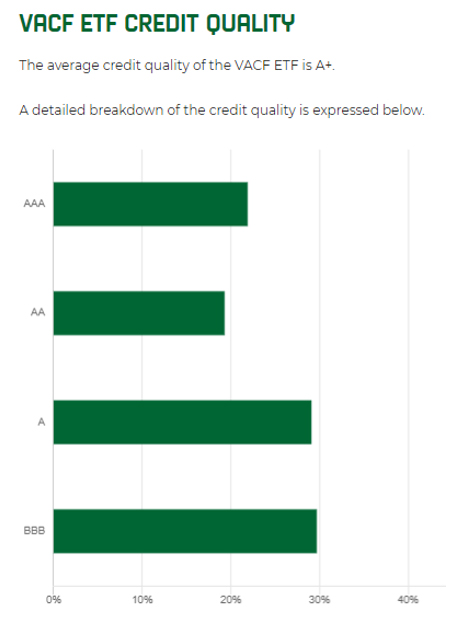

Equally, the credit rating distribution is healthy and fairly evenly spread between the broad investment grade credit bands.

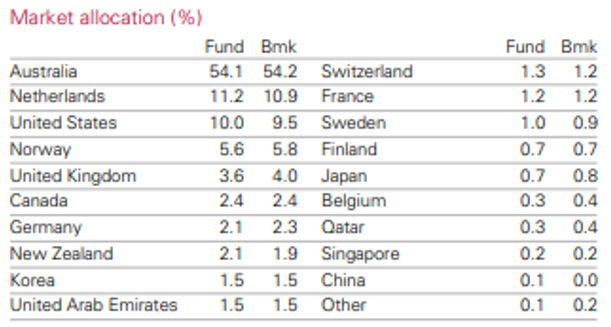

In terms of geographic location, while Australian entities dominates, there are seven other countries with allocations above 2% and allocations to at least 12 more countries.

It’s important to note the fund holds Australian dollar bonds issued by Australian and international companies.

VACF’s performance

The Bloomberg AusBond Credit 0+ Yr Index has been negative over the last year, as well as over the calendar year to date and last month. The fund holds an allocation to fixed rate government bonds, and as yields have started to increase, the bond prices have declined, impacting the fund’s returns. Effective duration is 3.9 years indicating the fund is exposed to interest rate risk.

Return since inception is 3.26%, lower than the benchmark 3.49%.

| Month | YTD | 1 year | 3 years | 5 years | 10 years | ^Inception1 | |

| VACF NAV | -2.75% | -3.01% | -2.26% | 3.11% | 3.23% | – | 3.26% |

| Benchmark | -2.76% | -2.84% | -2.07% | 3.41% | 3.47% | – | 3.49% |

2. Janus Henderson Tactical Income Active ETF (ASX:TACT)

The Janus Henderson Tactical Income Active ETF, unlike VACF, does not aim to track an index using a passive strategy, rather, actively manages its portfolio to outperform two indices – the Bloomberg AusBond Bank Bill Index and Bloomberg AusBond Composite 0+ Yr Index with the benchmark consisting of a 50% allocation to each index.

The portfolio manager can adjust the portfolio allocations to reflect where they see value in the market. The ETF invests in other funds and has exposure to 438 securities, considered a diversified strategy.

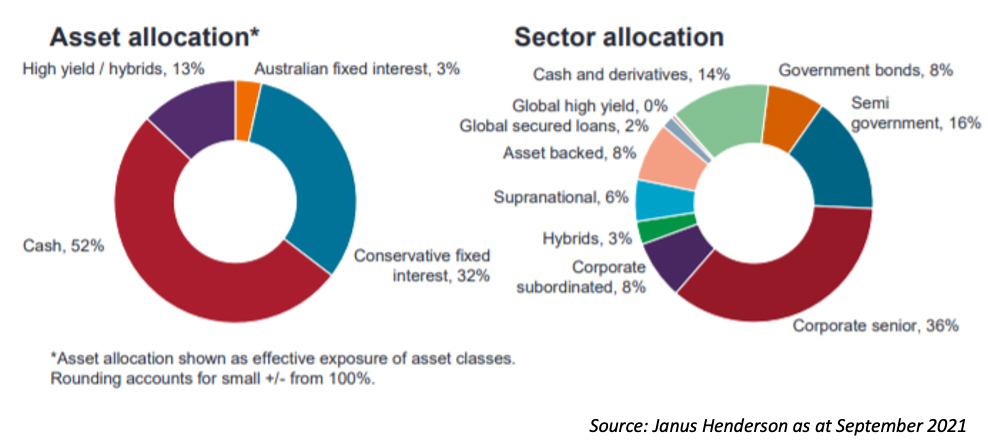

However, the current allocation is skewed to cash at 52%. The portfolio manager is likely expecting a rising interest rate environment and holding significant cash to take advantage of better yielding securities in the near future.

Other allocations include 32% to conservative fixed income, 13% to hybrids/ high yield, and a small 3% allocation to Australian fixed interest. Sector allocation is well diversified with senior corporate debt the largest, at 36% and then semi-government at 16%.

An important distinction between VACF and TACT, is the very low duration of TACT of just 0.16 years, meaning the fund takes minimal interest rate risk. This compares to its benchmark of 2.99 years and VACF at 3.9 years.

You can then start to appreciate the difference an active fund manager can make when investing in the fixed income ETFs. VACF as a passive strategy is bound to track its index. The TACT portfolio manager can assess the market and take positions to reflect thoughts on where the market is heading, strategically trying to outperform its benchmark.

TACT’s performance

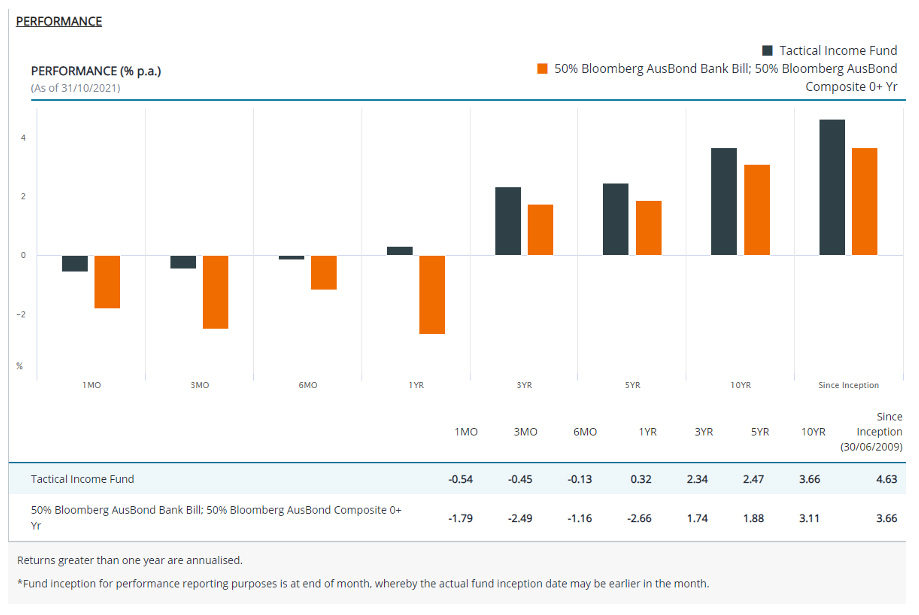

TACT’s performance over the last year is positive 0.32%, far above the benchmark -2.66%. Return since inception is 4.63% versus the benchmark 3.66%, clearly outperforming. Very recent returns are negative, but much smaller than the benchmark.

TACT’s active strategy is beating its benchmark, making it a more attractive proposition than the passive VACF, even though both offer diversified strategies.