Market Review & Outlook

Alternative fixed income manager CIP Asset Management (CIPAM) publish a quarterly market review and outlook across a range of sub sectors. It’s got some great insights, which we condense in this article.

1. Corporate (Credit) excluding Financials

Summary – Public investment grade markets remain expensive, high yield has cheapened up though not materially. Private markets look considerably better value with illiquidity premiums near the wides though fundamentals need to be closely tracked.

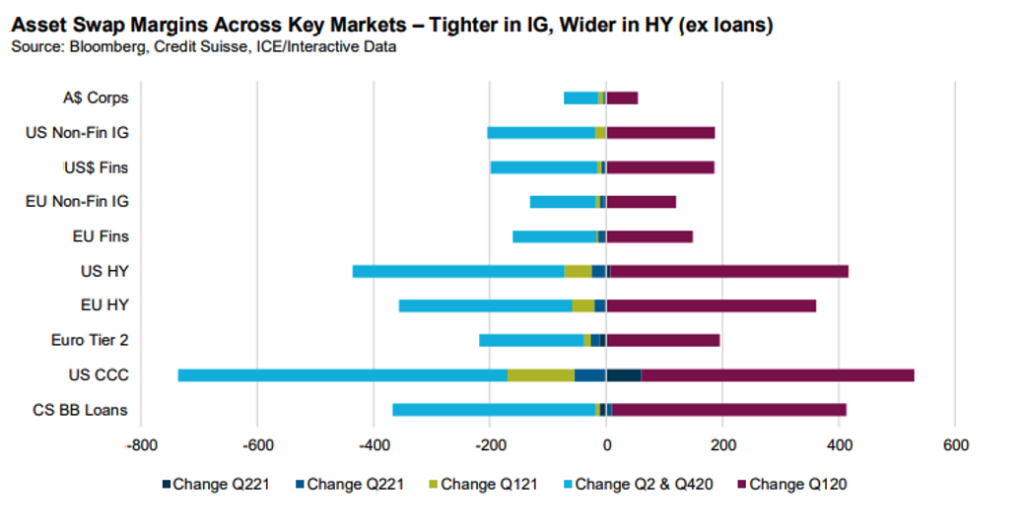

Since March 2020, quarterly moves in spreads have moved consistently tighter. With the exception of the leveraged loan market, these moves took spreads inside where they were pre-COVID and for much of the investment grade credit universe, close to post GFC tights.

The September quarter was the first where we saw hints that the tightening phase may be coming to an end. Higher beta markets (excluding loans) were wider with investment grade spreads moderately tighter.

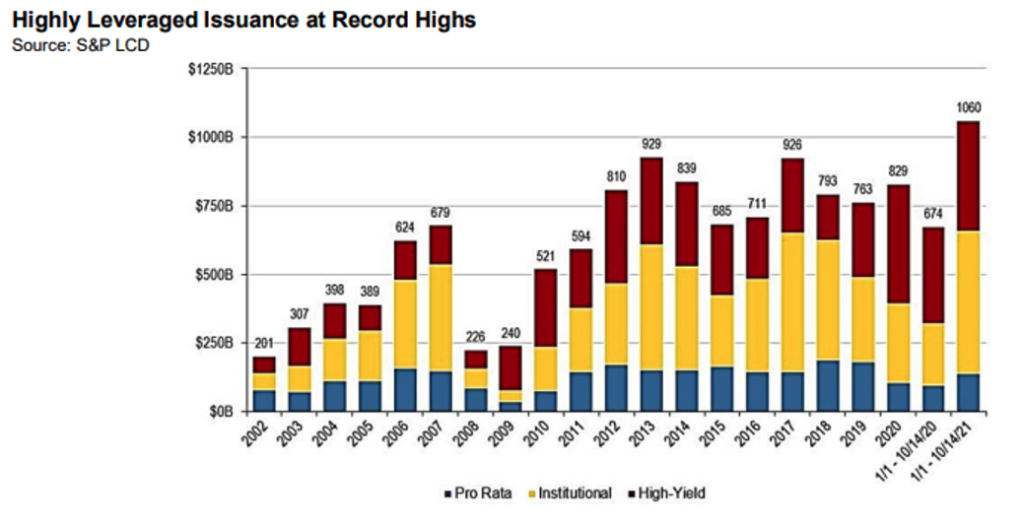

The wider spreads came on the heels of a significant level of issuance. As the below chart from S&P shows, total leveraged issuance (bonds and loans) from the United States has already hit a full year record exceeding US$1 trillion in 2021.

One explanation for the explosive high yield issuance is the equal opportunity impact of COVID-19 which hit investment grade balance sheets as much as high yield ones. In 2020, close to US$200 billion in credit was downgraded from investment grade to high yield. Year to a date in 2021 less than a quarter has returned to investment grade status.

An implication of this is that high yield bond markets in particular are better quality than pre-COVID.

ALSO READ: Three Key Fixed Income Risks You Need To Know About

According to Goldman Sachs the average rating on the high yield bond market is now between BB- and B+ having been consistently in the B+ to B range or worse for the entire 20-teens.

While fundamentals have been improving for both high yield and investment grade corporates there are several headwinds.

- Supply side pressures facing the global economy have the potential to weigh on margins. Wages, particularly those of lower paid workers are a key component as are energy prices (especially in Europe). With much of Australia in lockdown we think the scarcity theme won’t re-emerge until 2022

- M&A activity is re-emerging: take privates have hit record numbers in the United States and are not far behind in Europe. In Australia, the potential acquisition of Ausnet by APA or Brookfield is a warning sign to bond buyers given a significant part of the universe trades above par; and

- Higher yields driving capital outflows from credit: this could be a headwind or tailwind. Domestically liability driven investors are heavily invested in traditional fixed income have pretty limited exposure to credit. Higher longer term yields could allow them to remain uninvested in credit while retail investors could sell fixed income, fearing inflation and capital losses.

In private markets activity levels have accelerated with the third quarter one of the busiest on record

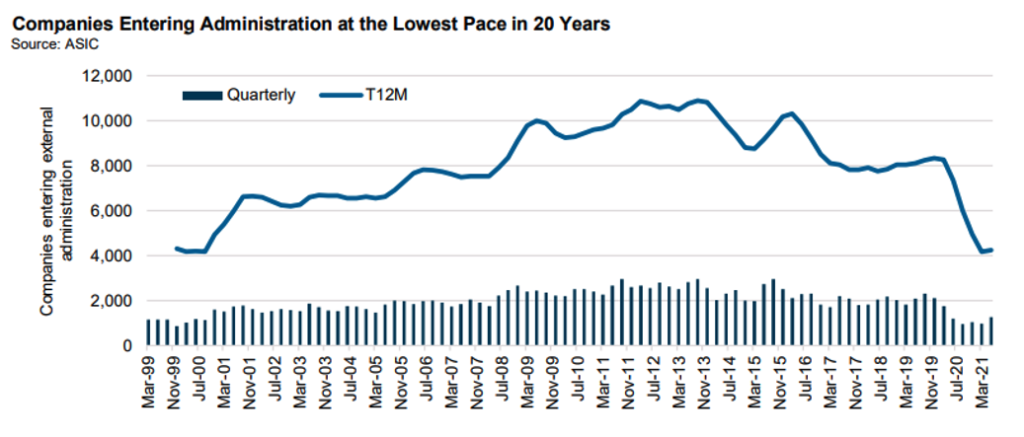

Lockdowns across the east coast of Australia has not slowed the private pipeline with the fourth quarter at a similar level to the third quarter. Anecdotally, fundamental performance remains sound although we feel it is inevitable that greater stress emerges. Government largesse continues to underpin corporate balance sheets evidenced by the lowest levels of insolvency in two decades. As this is wound back, we feel there is clearly risk of a catch up especially given some of the global headwinds.

2. Financial Credit

Summary – Financials are starting to reprice but have a lot more to go. Lockdowns create more (temporary) technical support across the capital structure but this will reverse upon re-opening. Offshore markets suggest that when issuance comes back, it will be significant.

Financial credit was in the eye of the hurricane for much of the September quarter. Domestically the major development was APRA announcing the end of the Committed Liquidity Facility (CLF) from 2022. Past low government bond issuance meant Australian banks could need meet High Quality Liquid Asset (HQLA) standards and APRA allowed the banks to take AAA tranches of mortgage securitisations or senior unsecured financial paper yielding around 0.5-1% and place them with the Reserve Bank for cash, improving their LCRs for the minimal cost of 0.2% per annum. This had two direct impacts:

- It created demand for CLF eligible securities because banks could pledge them via the repo facility to meet the LCR requirements and earn positive carry

- It reduced the amount of funding banks would need to do relative to offshore banks who needed to raise deposits or issue bonds, the proceeds of which would be used to purchase HQLA.

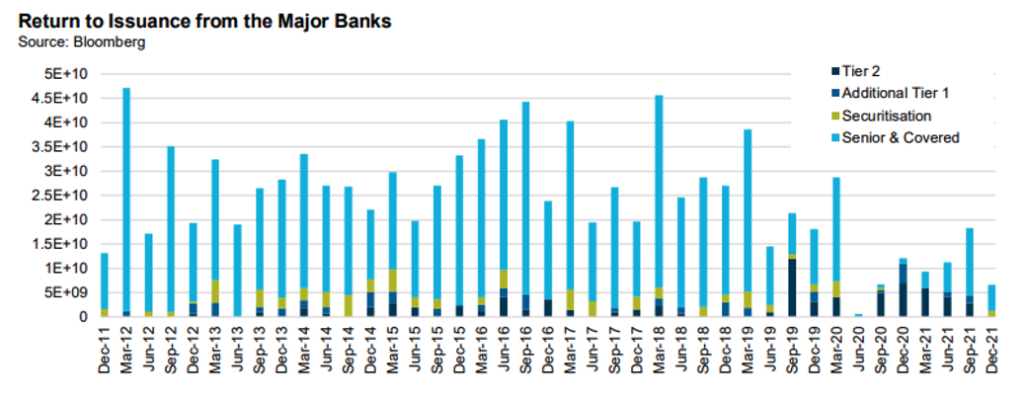

The end of the CLF and the Term Funding Facility (TFF) means the banks will need to issue more bonds.

It is hardly surprising that issuance of financial paper has materially increased from what was a very low base. The previous quarter saw the major banks issue $18 billion in funding across covered bonds, senior unsecured, Tier 2 and securitisations which was the most active quarter since Q1 2020. However, over the past two years the majors have issued around $135 billion less than the previous 5 year average.

We think it is reasonable to assume banks may need to be issuing around $140 billion in funding over the next couple of years, equivalent to around $35 billion per quarter. Currently banks are growing at around 3% per annum. If this continues, it would add around $5-8 billion in additional long term funding. So, call it $40+ billion per quarter.

We are less sanguine than our peers when it comes to the major bank task. In fact, our view is that the task is sufficiently large that there is a reasonable chance the Term Funding Facility will be extended to allow the banks more time to manage this transition. But for this to happen things need to get worse before they get better.

3. ABS & Whole Loans

Outside of selective secondary opportunities negative on public domestic investment grade mezzanine tranches, positive on private market opportunities. Prime RMBS mezzanine looks expensive relative to financial sub debt.

4. Real Estate Loans

Private real estate markets look attractive for stabilised assets but recent lockdowns create uncertainty. Caution regarding flow on impacts from issues in Chinese property sector is warranted.