Earlier this week, US-based cellphone carrier Verizon Communications issued a AU$1.25bn bond as part of a $25bn capital raising to help pay for 3,511 US 5G network licenses it won in a US government auction last month.

The total cost of the purchases was US$45.5bn plus approximately US$8bn in costs to help existing license users move to other bands.

According to an article in the Wall Street Journal, the company theoretically had enough funds to make the payment outright, but with other sizeable capital expenditure plans of around US$27.5bn in 2021 and further large expenditures in 2022 and 2023, it decided to approach the market.

Since 11 March, the company has raised more than US$30bn. The largest raise was in the US where it sought US$25bn and was met with more than US$100bn of demand. Other international issues included EUR2.75bn (US$3bn), a Canadian issue of C$1.5bn (US$1.2bn) and a Swiss franc issue of CHF750m (US$813m).

Verizon is one of the big US corporate bond issuers and like others that issue in size want a diversified funding base. The company debuted in the Australian market, known as kangaroo issuance, in August 2017 with a bumper AU$2.2bn issue and again accessed the market in November 2019 issuing AU$1.25bn.

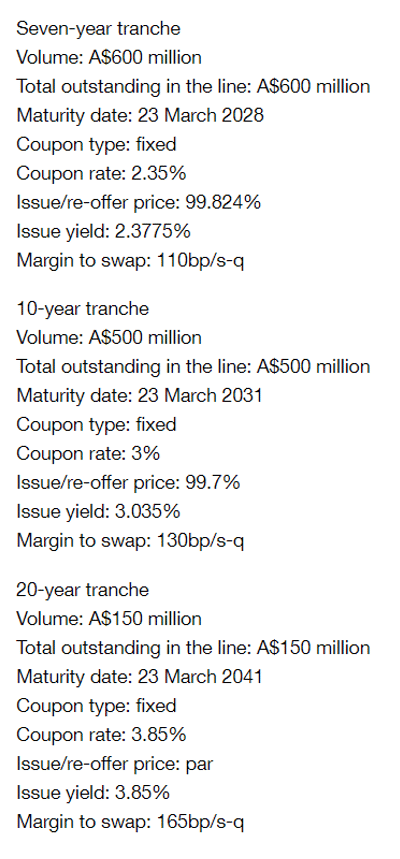

The new Australian dollar issue consisted of a seven, 10 and 20 year tranches. All three tranches are fixed rate, at 2.35%, 3.035% and 3.85% respectively. See the details, provided by KangaNews below.

Verizon Communication’s latest AUD bond issuance

Verizon’s net debt stood at US$129.06bn at the end on 2020 and the company is rated by S&P as BBB+, Moody’s as Baa1 and Fitch as A-.

Other large US based companies that have issued kangaroos includes: Apple, Anheauser-Busch and McDonalds.