At FINA, we track fixed income ETFs and managed funds with our ‘Finders’ to help you narrow your search for products that might suit your portfolio.

We don’t make any recommendations as such but try to help you work out what is important.

When assessing fixed income ETF performance, the first figure I check is the yield since inception. This will give you an idea of performance over time.

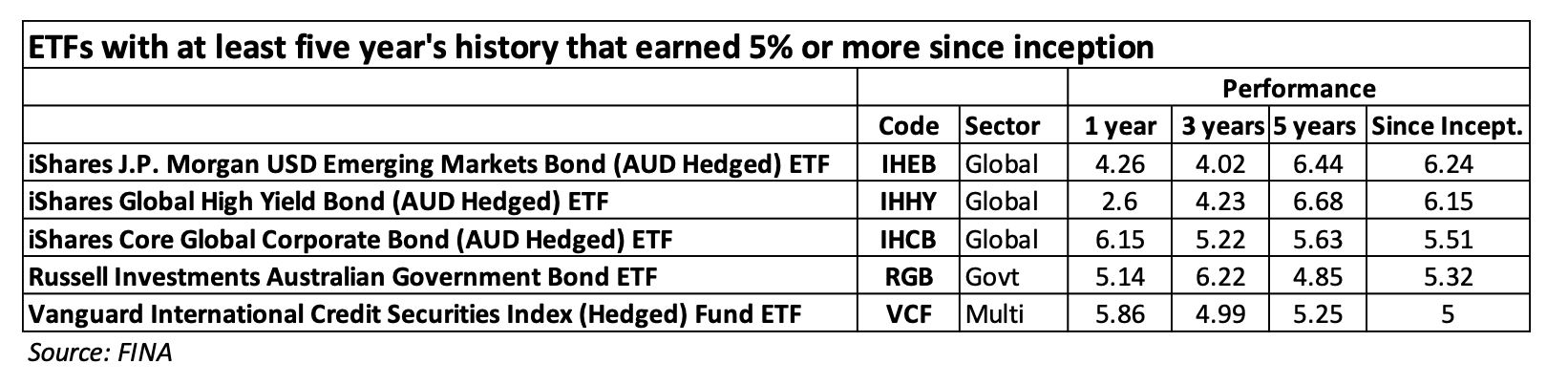

We recently updated our fixed income ETF tables to show data to 31 December 2020 and found there were nine funds that had earned 5% or more since inception. For the purpose of this article, I’m going to concentrate on those ETFs that have been operating for at least five years.

Three Blackrock, iShares funds make the cut and all of them invest globally. All three are hedged to the Australian dollar.

The iShares J.P. Morgan USD Emerging Markets Bond (AUD Hedged) ETF (IHEB), hedged back into AUD has returned 6.24%p.a. since inception. This is a fund based on an underlying emerging markets fund that has been operating since 2015.

Investing in emerging markets is a high risk, volatile strategy that can pay off but in any given year can result in significant negative declines. This was the case with this fund in 2018 when it was down by close to 6%, but rebounded in 2019 to be up by 14.75%, so the above table doesn’t tell the whole story.

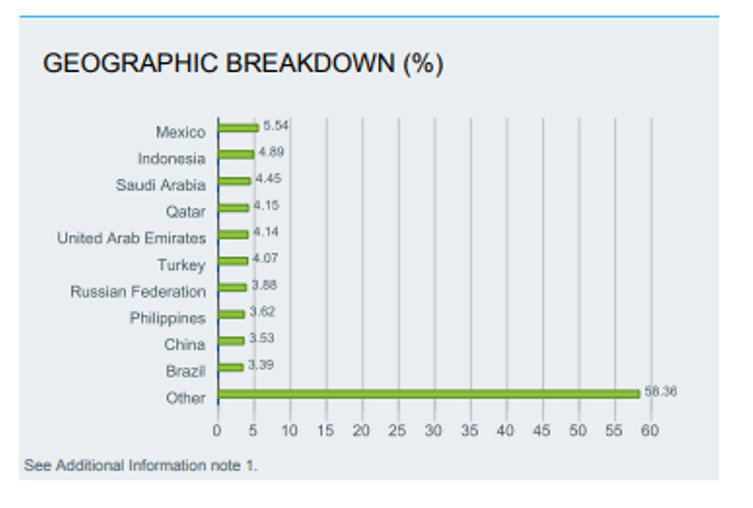

The underlying fund has a very broad strategy and diverse geographical diversity. Many of the bonds are foreign, fixed rate government bonds and the top single holding is a Russian Federation bond worth 0.86% of the total portfolio. Mexican bonds contribute 5.6% of the fund.

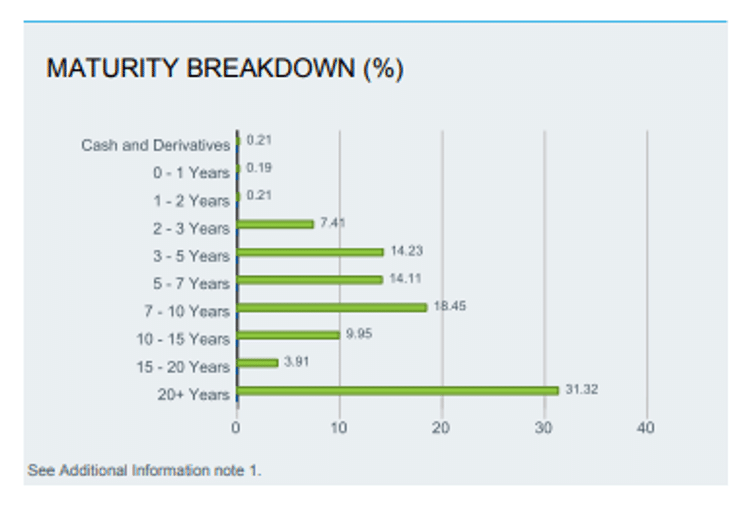

Importantly, this portfolio allocates to sub investment grade bonds constituting circa 43% of the portfolio. Around 5% of the bonds are rated CCC or below an considered very high risk. Investors interested in this fund need to consider it is a high risk, volatile investment and if the 3.99% yield to maturity is sufficient compensation for those risks and its exposure to long duration of more than eight years. More than 30% of the portfolio matures in more than 20 years.

Source: iShares website

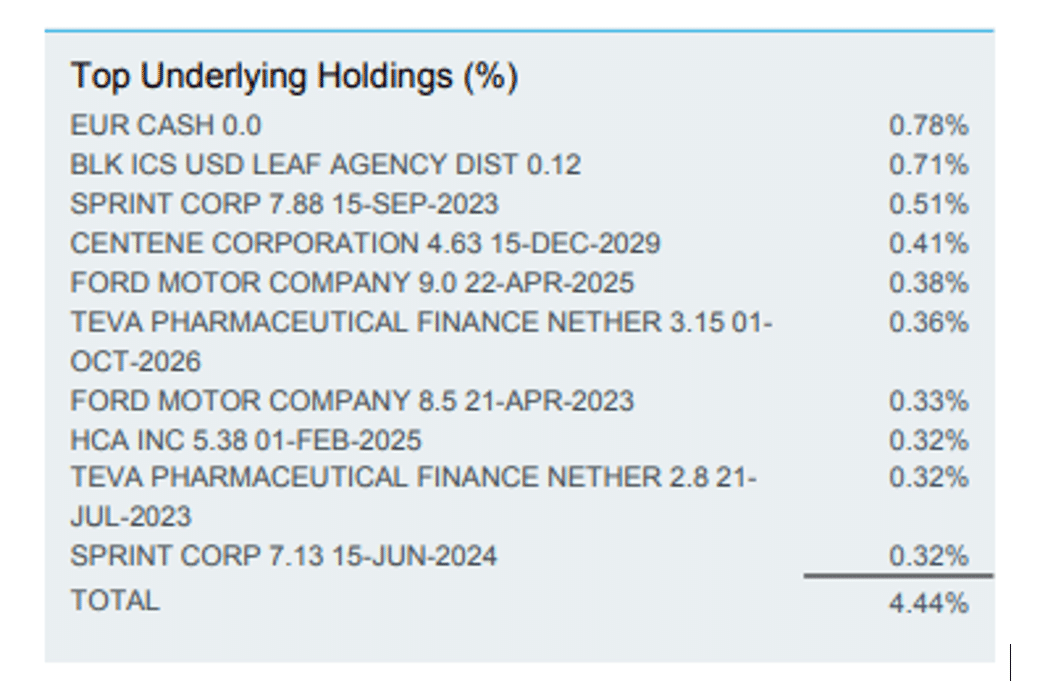

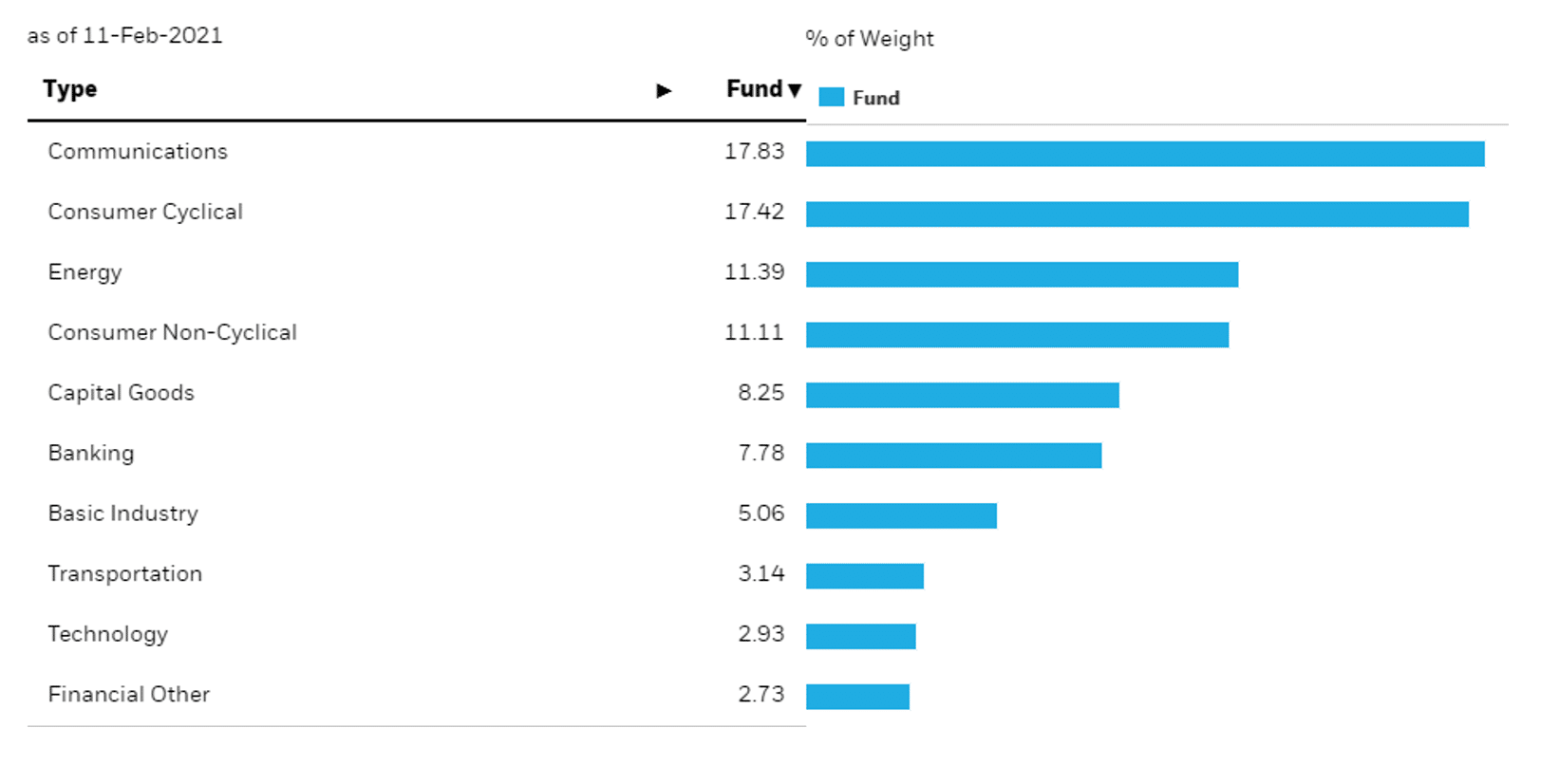

Like IHEB, the iShares Global High Yield Bond (AUD Hedged) ETF (IHHY) is a fund based on another fund. More than 50% of this fund is invested in the US high yield corporate bond market. If you consider credit ratings on the portfolio alone, this fund is higher risk than IHEB with just 2.5% of the bonds rated as investment grade. Close to 70% of the fund is rated in the ‘BB’ range. It has a shorter duration at 3.52 years with an average yield to maturity of 3.58%. It also has an allocation to CCC rated bonds and below of more than 7%.

Source: iShares website

IHHY net asset value declined by circa 35% in 2020 due to the COVID-19 pandemic but has since rebounded and the NAV is trading above its pre-pandemic high.

Again, investors should expect IHHY NAVs to be volatile and for there to be loss years. In its favor, the US government has been supporting the corporate bond market including buying sub investment grade bonds and in the short term, defaults should be lower than historic averages.

The third Blackrock fund, the iShares Core Global Corporate Bond (AUD Hedged) ETF (IHCB) contains a mix of government and corporate bonds that are 99% investment grade, so has a much lower risk profile compared to the two other iShares funds above. Circa 50% of bonds are rated in the ‘BBB’ range and about 55% of bond issuers are domiciled in the US. There is a range of maturities with a weighted average maturity of 9.62 years and duration of 7.22 years as at 31 January 2021.

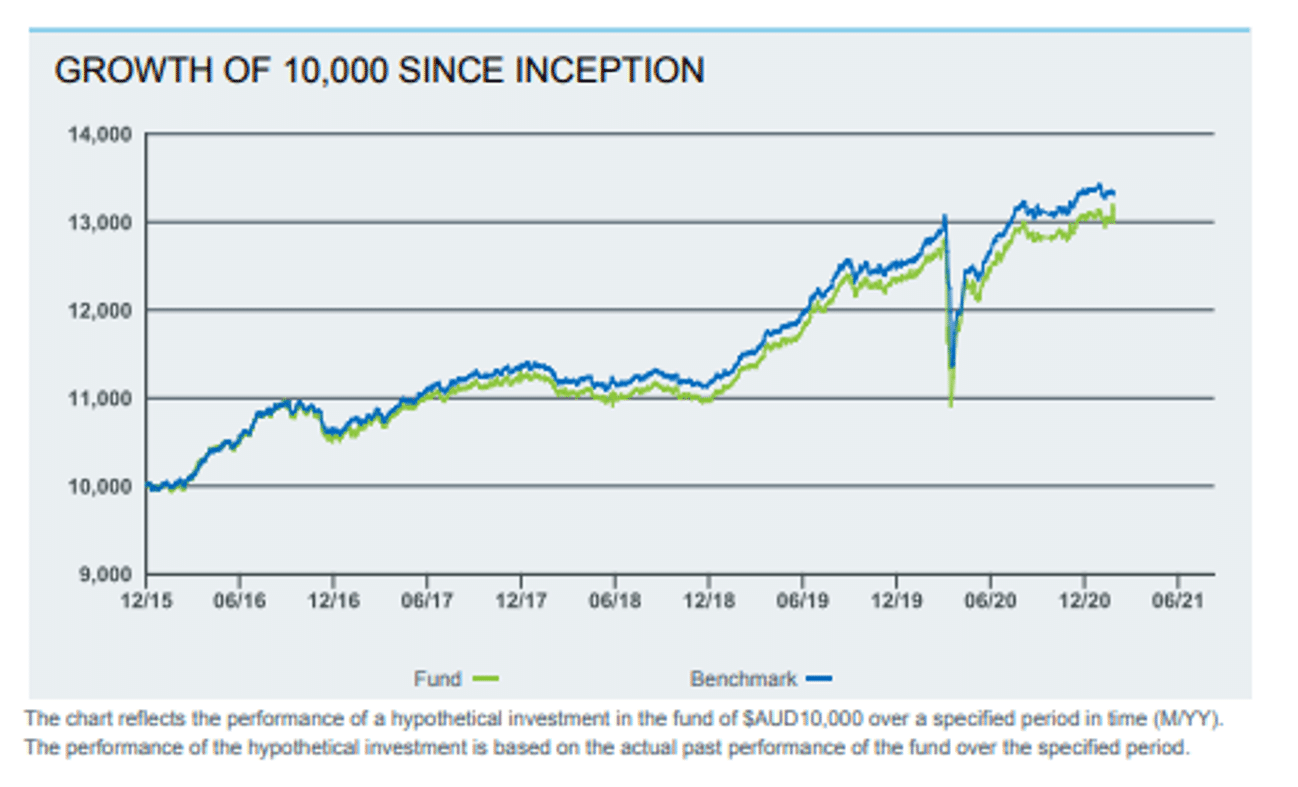

Given this fund is lower risk its average yield to maturity is lower at 1.46%. Prospective investors should also know the lower risk fund still suffered in March when the pandemic hit, as shown in the graph below, showing the hypothetical growth of a $10,000 investment made in December 2015.

Source: iShares website

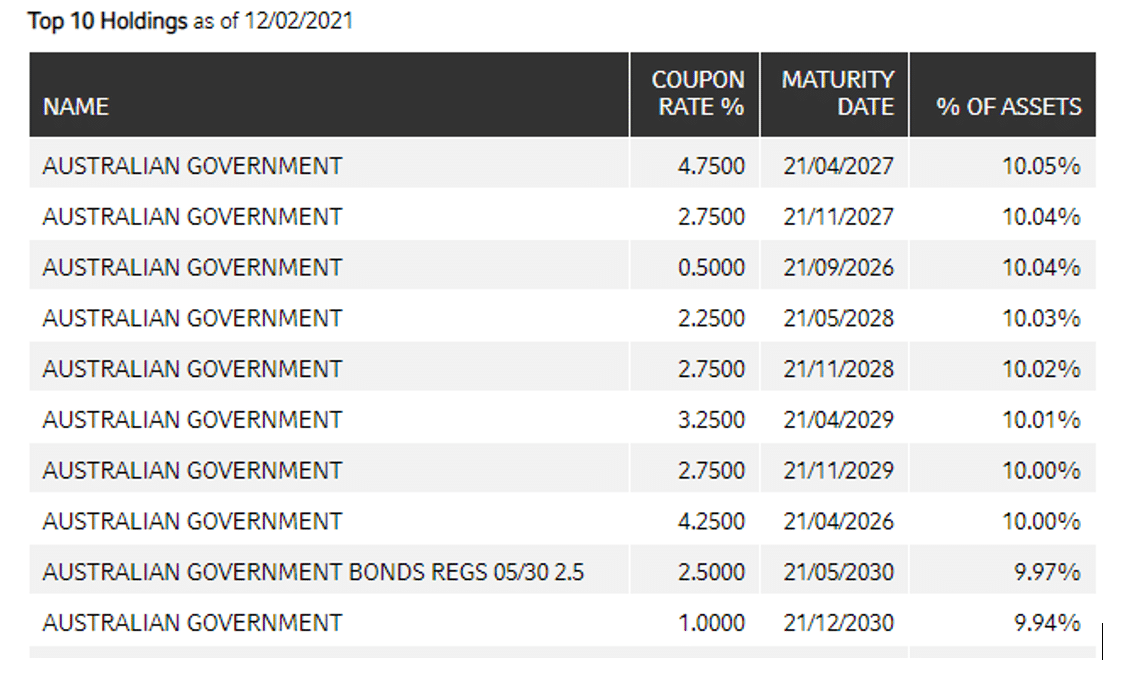

Forth on the list is a government bond portfolio, the Russell Investments Australian Government Bond ETF (RGB). This fund has just ten investments, all Australian Commonwealth government bonds with close to equal weighting of around 10% each.

As fixed rate government bond yields have contracted over many years, so too the fund has outperformed since inception. However, as longer dated government bonds yields have started to increase, the fund has shown a three month return of -1.2% to 31 January 2021.

The fund benefits from holding the bonds over the longer term as can be seen with a 2.30% running yield. However, the yield to worst is just 0.78%. Investors should note this is a very low risk investment as the Commonwealth government will pay its coupons on time and return principal at maturity. The risk lies in expectations of higher interest rates – if the market expects higher rates the bond prices will fall with the potential for further negative returns on the fund.

Source: Russell Investments website

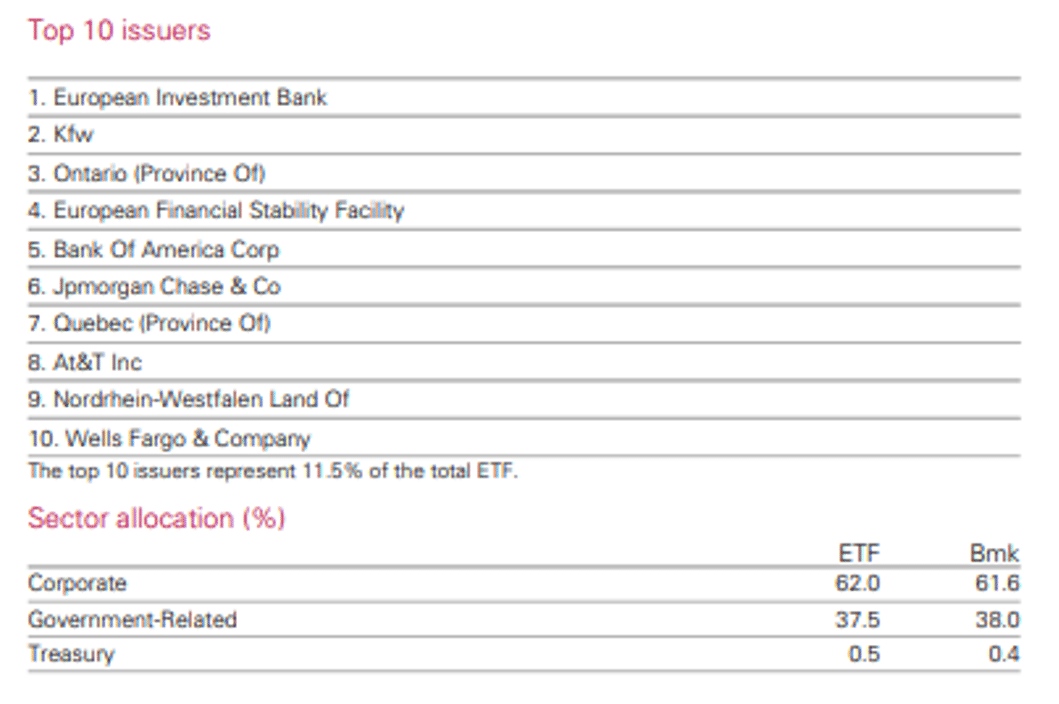

Rounding out the five funds is the Vanguard International Credit Securities Index (Hedged) Fund ETF (VCF). This fund is also a fund of funds but with a very diversified base of more than 6,000 securities. The fund includes global government and corporate bonds and is a high quality fund with a weighted average credit rating of single ‘A’. Like the high quality RCB fund above, yield to maturity is low at 1.14% and running yield 2.41%. The fund has longer dated fixed rate securities so that the weighted average maturity is 9.9 years. This fund might also suffer loss in value if interest rates are expected to rise.

The fund has a 46% allocation to North American securities and 30% to Europe as at 31 January 2021.

Source: Vanguard website

The remaining four fixed income ETFs

These ETFs haven’t traded for at least five years but still had a yield since inception of over 5%:

- BetaShares Investment Grade Corporate Bond ETF (ASX: CRED) that has been operating for at least a year but not yet three years and has a since inception return of 8.7%

- BetaShares Legg Mason Australian Bond Fund (ASX: BNDS) with 12 months performance history and a return since inception of 6.69%

- Vanguard Ethically Conscious Global Aggregate Bond Index Fund (AUD Hedged) (ASX: VEFI), that has also been trading for a least a 1 year and has a return since inception of 6.02%

- VanEck Vectors Australian Corporate Bond Plus ETF (ASX: PLUS) that has been trading for at least three years with a return since inception of 5.81%

None of the ETFs mentioned in this article are recommendations. Before you invest you should understand the underlying securities and risks with the fund and, in terms of future expected returns, check the ‘yield to maturity’ and the ‘running yield’.

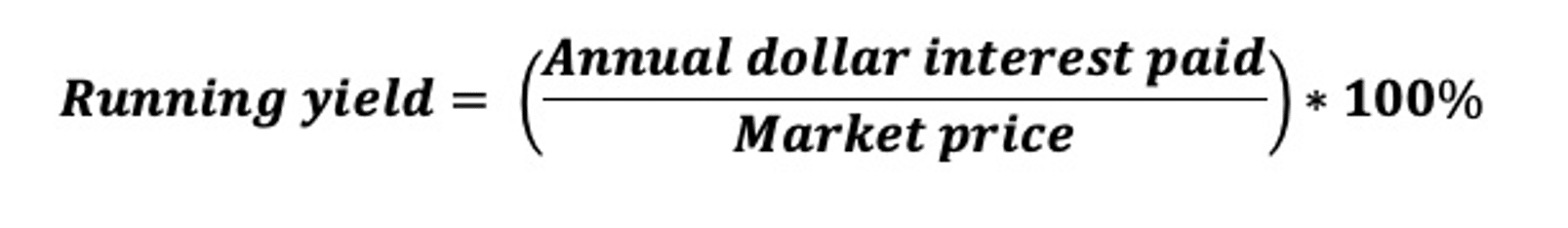

Running yield – Running yield uses the current price of a bond instead of its face value and represents the return an investor would expect if he or she purchased a bond and held it for a year. It is calculated by dividing the coupon or distribution by the market price.

Yield to maturity – (YTM) includes the capital gain or loss on the bond price, as few bonds trade at the par value of $100 except at first issue, plus the interest until maturity.

Yield to worst (YTW) is commonly used for bonds with a call date, or multiple call dates where the bond can be repaid prior to final maturity and is the worst yield an investor can expect over the life of a bond.