“Bonds are the underwear in your portfolio – unexciting and not much thought about, but select the wrong pair and you’ll be surprised at just how uncomfortable you are.” – Dr William Bernstein

Like a good foundation garment, bonds should be the boring but predictable base of every investment portfolio – bonds such as Australian Government bonds, or those issued by quality companies.

Some investors may be tempted by the ‘sexier’ version, the junk bonds or look beyond bonds to hybrids, but it’s the old fashioned, traditional bonds that should be the foundation of a well-diversified investment portfolio.

Many Australian investors ‘go commando’

That’s right! Surprisingly, a substantial number of Australian investors are ‘going commando’, without the appropriate foundation, namely bonds, in their portfolio.

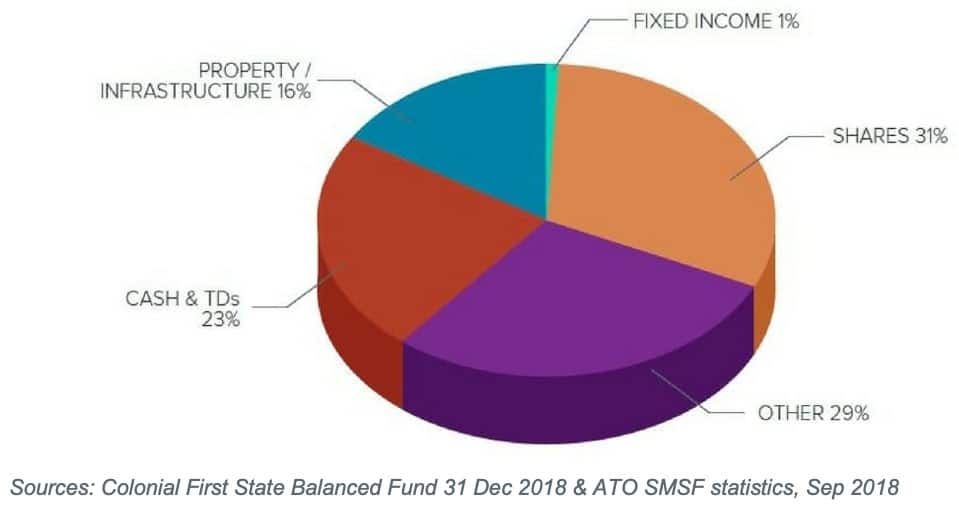

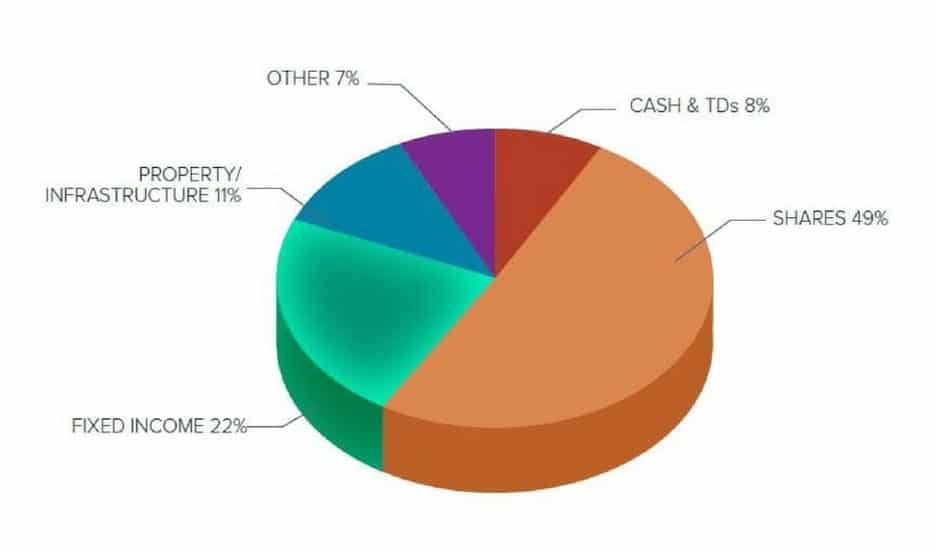

As illustrated in figure one, the typical institutional portfolio, based on a fund manager’s ‘balanced’ portfolio option, is well diversified across the major asset classes. The average SMSF portfolio shown in figure two has a similar exposure to shares and comparable exposure to property/infrastructure – but that’s where the similarities end. The fixed income exposure of SMSF investors is significantly smaller, and cash and term deposits substantially higher.

Figure one (above): Typical Institutional Portfolio Composition

Figure one (above): Typical Institutional Portfolio Composition

Figure two (above): Typical SMSF Portfolio Composition

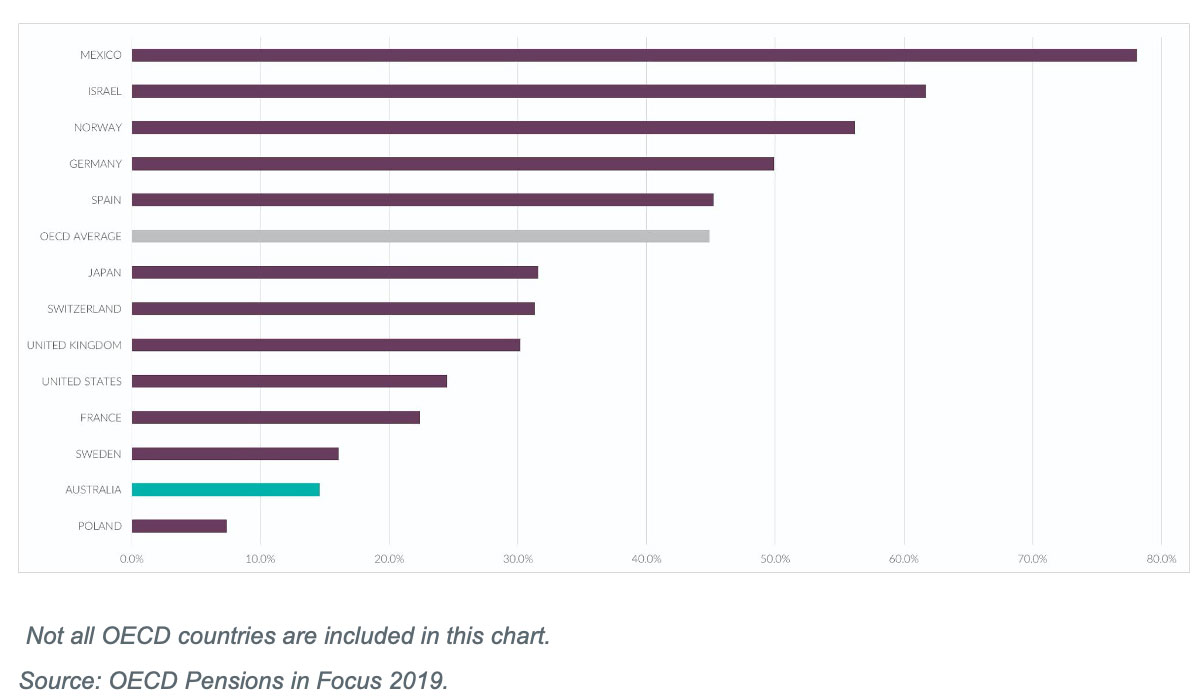

Figure three compares Australian and global investors; using pension funds as a proxy, you can see Australian investors are typically overweight equities, unlike the equivalent funds in other parts of the world. Even the US, with its sustained sharemarket bull run in recent years, has a more balanced allocation between shares and bonds. When you consider both the weighted average and simple average, along with the average SMSF asset allocation, Australian investors are significantly underweight bonds. What then, is the foundation of their portfolios?

Figure three: Allocation of private pension assets in selected OECD countries, 2019

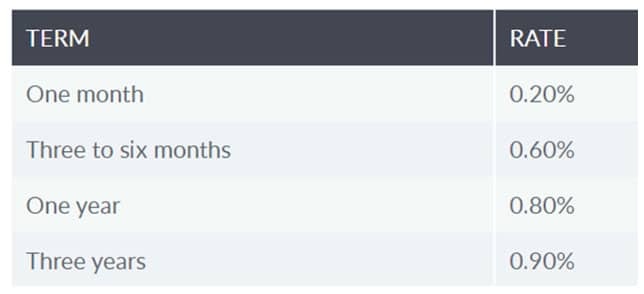

Term deposits alone do not make a good foundation…When the cash rate was first reduced 25 basis points to 2.75% on 7 May 2013, it heralded an era of unprecedented low rates. Following this rates continued to drop to the historical low of just 0.25% today. Despite this, Australian investors continue to pour money into savings accounts and term deposits¹. By end of June 2020, APRA data shows Australians had more than $1 trillion on deposit. Stop and consider the returns that money on deposit earns, as presented in figure four.

Source: RBA Retail Deposit and Investment Rates, August 2020.

Note: TDs have the benefit of the Commonwealth Government’s support under the Financial Claims Scheme, making them less risky than bonds.

Figure four: Average TD rates on $10,000 deposit

Given a current inflation rate of 1.4%, once tax is paid on the interest income received, earnings would barely keep pace with inflation. In real terms, each dollar of income received would be worth less than when it was invested. That does not sound like a good foundation for an investment portfolio.

…nor do ‘sexier’ fixed income or hybrid investments

Other investors may chase the higher return and opt for junk bonds or hybrid investments.

Junk bonds refer to bonds issued by companies that generally have a low credit rating and a higher risk of default; as a result, the bonds need to provide a higher yield to compensate investors for the greater risk associated with the investment.

Hybrid securities are said to ‘have bond-like returns with equity-like risk’, and have characteristics of both securities:

- The promise to pay a fixed or floating rate of return, at specified times, until a given date. This provides the bond-like features.

- The potential for the security to be converted into equity at a future time, or the security holder being subordinate to other creditors in the event of liquidation. This provides the equity-like features.

While these more flamboyant products may be an appropriate accessory for investors with the appropriate risk profile, they don’t qualify as a fitting foundation for the average investment portfolio.

Bonds make the best foundation garment

With good reason, Dr William Bernstein referred to bonds as the underwear – or foundation garment – of an investment portfolio. Bonds have traditionally fulfilled three important roles in an investment portfolio:

- An income stream

Bonds provide income from regular coupon payments, which are generally quarterly or half-yearly and occur on set dates. As a result, you can accurately plan to match outgoings with the income you know you’ll receive from bonds. Most other investments don’t enable you to forward plan with such accuracy.

- Capital preservation

Bonds can provide capital stability. At maturity a bond’s face value is returned to the investor. This makes a bond an effective capital preservation tool – assuming of course that the issuer doesn’t default.

- Diversification of returns

Bonds are classified as a defensive asset, with a different risk and return profile to shares; it’s this difference that provides the diversification benefit. While the prices of bonds will fluctuate according to interest rates and the economic cycle, historically bond prices have not been as volatile as share prices.

Bonds help you sleep at night

Bonds are not exciting. You won’t get the crazy highs of the sharemarket, nor the sweat-inducing panic of a sharemarket rout. Bonds generally avoid the rollercoaster associated with shares. While it’s possible for a bond market to crash, investors generally lose money only when they sell, before maturity.

If you hold a good quality bond – such as those from a top ASX company to maturity, the principal is repaid, and income (coupon) is paid for the duration of the investment term. Boring maybe, but a great foundation for any investment portfolio.

About William J Bernstein:

William J. Bernstein (born 1948) is an American financial theorist and neurologist. His research is in the field of modern portfolio theory and he has published books for individual investors who wish to manage their own investment portfolios.

¹Term Deposits may enjoy the benefit of protection under the Financial Claims Scheme.

Contributing author – Richard Murphy, Co-Founder and CEO, XTB

XTBs provide access to senior bonds of top 100 ASX companies. This makes them a capital stable and relatively safe investment. Compared to government bonds, TDs or cash management accounts, XTBs provide the same steady and predictable income but also offer potentially higher returns.

Disclaimer:

The information in this article is general in nature. It should not be the sole source of information. It does not take into account the investment objectives or circumstances of any particular investor. You should consider, with or without advice from a professional adviser, whether an investment is appropriate to your circumstances. Australian Corporate Bond Company Limited is the Securities Manager of XTBs and will earn fees in connection with an investment in XTBs.

Figure one (above): Typical Institutional Portfolio Composition

Figure one (above): Typical Institutional Portfolio Composition