From Principal Asset Management’s second quarter 2025, Fixed income perspectives.

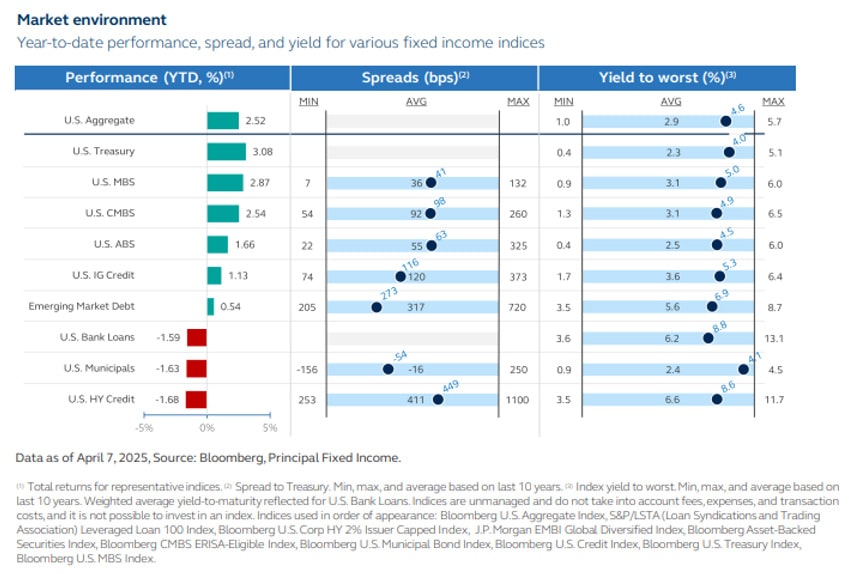

Markets are being reshaped by a sharp shift in policy dynamics, while the US Federal Reserve is cautiously progressing through its rate-cutting cycle. The implementation of broad-based tariffs and rising geopolitical uncertainty have added new macro headwinds, intensified volatility and clouded both inflation and growth expectations. Despite the evolving backdrop, elevated yields, improving valuations, and strong underlying credit fundamentals continue to make fixed income a compelling opportunity.

- Policy volatility drives repricing. Markets are grappling with the competing forces of inflation resilience and growth risk as the Fed balances its dual mandate. Tariff actions have introduced a stagflationary tilt to the outlook, prompting steepening in the U.S. yield curve and renewed focus on policy signaling. Global central banks are also diverging in response to fragmented economic conditions and fiscal policy shifts.

- Credit fundamentals remain resilient. Investment grade, high yield, and municipal sectors remain supported by strong balance sheets, healthy coverage ratios, and manageable maturity profiles. However, headline risk and trade sensitivity are creating wider dispersion—making issuer selection and credit discipline increasingly important.

- Valuation resets create opportunity. Spread widening and rising all-in yields are enhancing forward return potential across credit sectors. While traditional safe havens like Treasurys and agency MBS face pressure, emerging markets, securitized assets, and private credit present attractive risk-adjusted opportunities for long-term investors. Active management is critical to navigate volatility and uncover value.

While inflation data remains elevated, the Federal Reserve appears increasingly focused on protecting growth and labor market stability, even if that means tolerating inflation above its 2% target. With policy credibility under pressure and recession risks rising, the Fed may be forced to act more aggressively than markets previously anticipated. A meaningful deterioration in employment could catalyse a faster response, including more significant cuts than forecasted, or ending quantitative tightening. The Fed now finds itself in a “Sophie’s choice” environment— caught between inflation control and economic stability.

For fixed income investors, this shifting macro backdrop demands a recalibration of both risk and opportunity. The historical safe-haven status of Treasurys and agency MBS has been tested, with both sectors showing signs of stress as global investors reassess the credibility of the U.S. policy framework. Correspondingly, global counterparts such as German Bunds and Japanese government bonds have outperformed, suggesting investors have already begun to diversify safe-haven exposure away from only the U.S. – a trend that may endure. The steepening of the U.S. yield curve reflects a meaningful repricing of long-end risk, increased supply expectations, and a potential shift in Fed policy tools. We view duration as a tailwind for fixed income in the quarter ahead and anticipate further curve steepening.

Also read: Understanding Credit Ratings: A Guide for Fixed Income Investors

Summary of investment implications

INVESTMENT GRADE CREDIT Investment grade (IG) credit continues to offer relative stability amid increased market volatility. Yields remain above long-term averages, supported by strong corporate fundamentals and declining net supply. While new tariffs have introduced macroeconomic uncertainty and modest pressure on spreads, technicals remain supportive. Investors should prioritize high-quality issuers and remain focused on relative value across the curve and credit spectrum.

HIGH YIELD CREDIT High yield spreads have widened sharply following the announcement of new tariffs, marking the most significant repricing in over a year. While macro uncertainty has risen, fundamentals remain strong, with healthy credit metrics and manageable maturities. Volatility may weigh on issuance, but valuations are becoming more attractive. Yields are now approaching 9% at time of writing, levels that have historically signaled attractive entry points. We remain focused on higher-quality issuers and maintaining flexibility amid a fluid policy landscape.

STRUCTURED CREDIT Structured credit faces near-term headwinds from policy uncertainty and softening consumer and corporate fundamentals. Rising delinquencies in consumer debt and ongoing challenges in commercial real estate are contributing to weaker sentiment. However, Fed rate cuts later in the year could provide support. Investors should focus on high-quality, fundamentally strong segments of the market, where technical dislocations present selective opportunities.

EMERGING MARKET DEBT Emerging markets (EM) face increased uncertainty due to evolving U.S. trade policy, which has clouded near-term growth prospects. Despite strong corporate fundamentals and favorable technicals, volatility in EM currencies and sovereign credit could lead to selective underperformance. However, carry remains attractive, particularly in regions benefiting from domestic demand resilience. Investors should prioritize high-conviction, idiosyncratic opportunities in EM sovereign and corporate debt.

PRIVATE CREDIT Private credit remains resilient despite shifting policy dynamics. Middle market direct lending continues to offer strong relative value, supported by improved deal flow and robust investor demand. Elevated dry powder and recovering M&A activity are driving steady transaction volume, even as tariff-related uncertainty weighs on sentiment. Credit structures remain sound, with default rates well below historic norms. As spreads tighten in public markets, private credit stands out for its yield premium, structural protections and portfolio diversification benefits.

MUNICIPALS Record issuance has created a temporary supply-demand imbalance, leading to attractive relative valuations. Underperformance versus Treasurys at the start of the quarter has pushed municipal ratios to their cheapest levels in years, making tax-exempt munis particularly compelling for crossover investors. Extending maturities within the municipal curve presents an attractive risk-reward tradeoff.