This article is an excerpt from the Federated Hermes 1H2025 360 Degree Fixed Income Report

Our outlook for macro, fundamental and technical forces is generally supportive of credit, meaning our overall appetite for higher-quality credit risk remains sound.

Although we have been impressed with the market’s resilience – or perhaps insouciance – when faced with some pretty dramatic headlines out of the US, 2025 will continue to be a year of more volatility, more often. This makes us somewhat hesitant to roll up rates and credit curves.

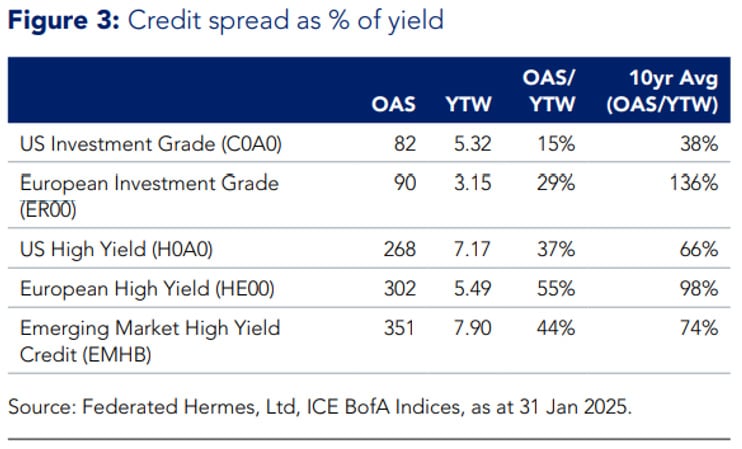

Credit spreads are relatively tight versus their ten-year history and versus all-in yields. This has three important implications. First, capital appreciation driven by tightening spreads, which supported total returns in 2024, will be tougher to come by in 2025. Secondly, given the relatively low proportion of spreads versus all-in yields, performance in credit will be more sensitive to changes in interest rates than is typically the case. Thirdly, despite this gap between yields and spreads, all-in yields remain attractive and would require meaningful widening to hit break-even levels of returns.

Against the backdrop of supportive macroeconomics, fundamentals, and technicals, we think it will be a decent year for credit spreads and total returns if positioned in higher-quality credits. That said, we are a little more cautious on emerging market (EM) credit predicated on concerns about the effects of US trade and industrial policies.

For strong deal structures, given the health of the structured credit market, both asset-backed securities (ABS) and collateralised loan options (CLOs) remain attractive at the right rating level. While we don’t see an obvious run in spreads, we are mindful that the market could have a ‘Trump tantrum’ of its own. For potential downside protection, our options book has been deploying put options on CDS indices, which have become cheaper, as the most efficient way to protect against a violent move wider.

What do spreads as a portion of attractive all-in yields signify?

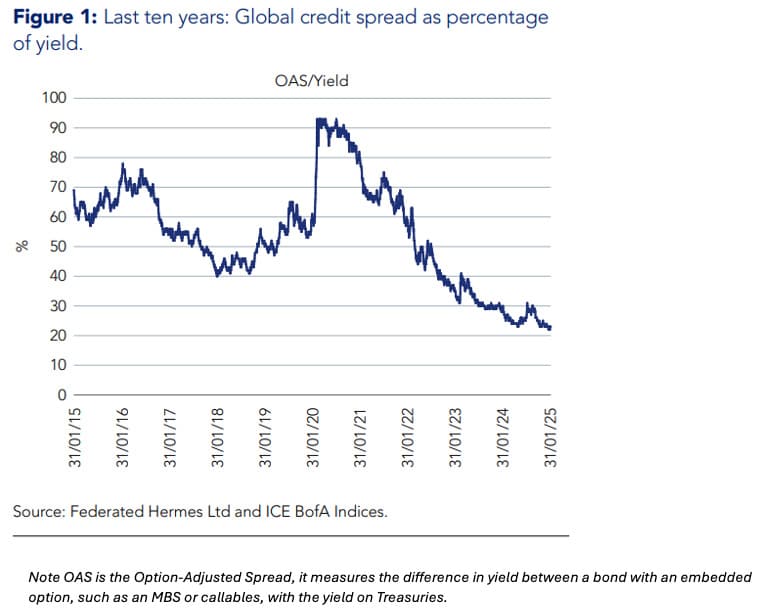

Since global credit spreads hit their wides at the start of the Covid-19 pandemic in March 2020, spreads as a percentage of yield have been collapsing as illustrated by Figure 1, below. During the pandemic, the percentage was at its widest because risk premia gapped violently on a myriad of fears. In the meantime, central banks started to cut rates to stimulate growth in response to collapsing economic activity and to reduce the cost of capital to people and corporates. Consequently, spreads comprised the vast majority of all-in yields.

Also read: EM Resilience and Potential Despite Chaotic US Tariffs

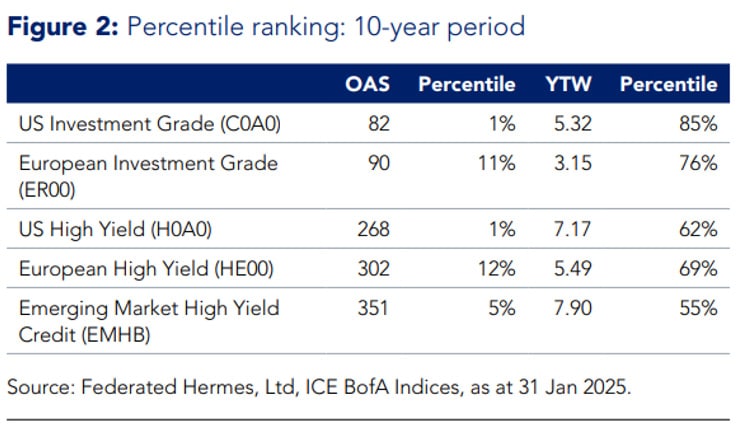

A combination of fiscal and monetary policies across the globe provided stimuli to drive a post-Covid-19 economic recovery, which then led to a collapse in risk premia. At the same time, inflation spiked and rates remained elevated to cool inflation. This brings us to the present day where risk premia are at, or are close to, lows versus their 10-year history as shown in the first section of Figure 2.

At the same time, rates remained wider as global central banks reversed their course with tighter monetary policy from 2022. Today, interest rates remain wide on concerns about fiscal deficits, government borrowing costs, and probability of reflation. Supportive credit fundamentals and market conditions, combined with elevated risk appetite following the US election, mean that spreads are tight relative to their past. Consequently, as shown in Figure 1, we are at 10-year lows in spread as a percentage of all-in yields.

This widening of the gap between spreads and yields is presented in greater detail across various sub asset classes in Figure 3. Compared to a 10-year history by sub-asset class, we are at tights versus yields across markets, with investment grade (IG) being the most acute.

That being said, we can also see that all-in yields are nowhere near their all-time tights relative to their past (Figure 2). In fact, yields are looking very attractive. Given supportive credit fundamentals for credit risk, we think this is why the credit asset class remains very appealing to investors.