Hamilton Lane has released its 2025 Private Market Overview report. The findings show areas of concern in private markets in the short-term, with positive tailwinds across long-term fundamentals and runway for growth within evergreen.

Mario Giannini, Executive Co-Chairman and author of the Market Overview, commented: “… As we look at the year ahead, investors need to come to terms with the reality that there appears to be a recalibration in certain pockets of the global private markets, despite the fact that overall, the private markets are neutral right now. Longer term, we continue to have high conviction in the value of this asset class, and we urge investors to read, study and think carefully about portfolio construction and the diversification benefits that private markets have consistently demonstrated.”

WHERE TO INVEST

- Credit, infrastructure and secondaries: Each of these sectors is set up for success.

- Venture and growth: Investors should have exposure to these areas. AI applications will likely sweep the business landscape and many of those companies will be incubated and developed in the private markets sphere.

- Equity: In particular, the co-investment side where investors can be selective.

- U.S.: The U.S. market is expected to be relatively more attractive than all other geographies over the next 4-5 years.

- Data and technology: Invest in portfolio analytics, whether for construction or analysis.

AREAS TO WATCH

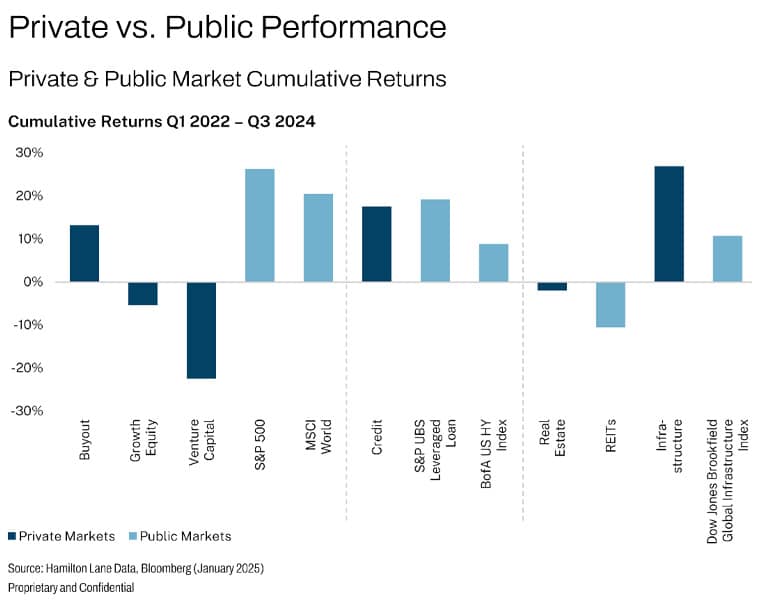

- Short-term performance: Infrastructure and real estate have done very well compared to their public counterparts; private credit has remained stable, while private equity has underperformed. But does this short-term view signal the end of private equity’s historical outperformance?

- While recent vintages will likely face challenges, manager and asset selection will play a crucial role, perhaps more so than in most market conditions. The factor that might make the biggest difference for future private equity performance is the public markets. Private markets’ outperformance is least pronounced when public markets see continued four-year annualized returns greater than 15%.

- Fundraising prediction: The next 12 months will likely bring increased challenges. Exit activity must see a meaningful rebound for fundraising to pick up. Competition is expanding, and the race to retail is on. The firms who are successfully accessing the fundraising market today are those who are investing in technology and innovative investment structures that address the demands of new audiences.

- Valuations: Hamilton Lane believes that valuations from 18 months ago more accurately reflected true values, with public markets increasing to meet the private valuations. However, the opposite trend could unfold over the next 18 months.

Also read: Global Asset Allocation: The View From Australia

STRONG LONG-TERM FUNDAMENTALS CONTINUE

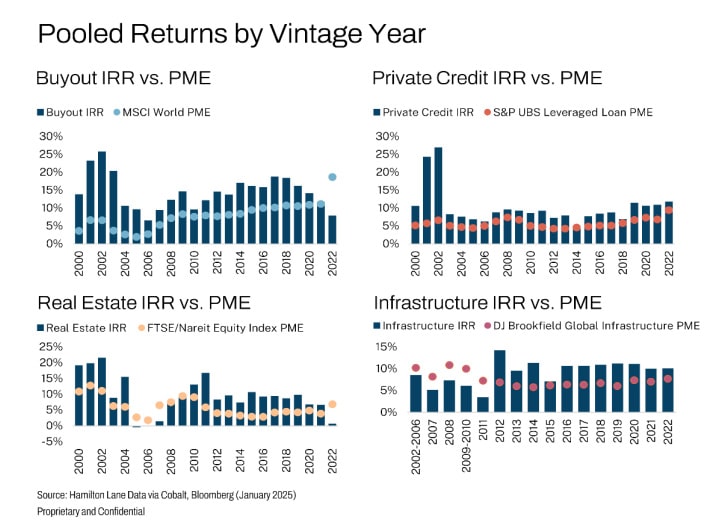

- Long-term performance: As shown in the chart below, private credit has remained undefeated: 23 straight years of outperforming the public markets. Infrastructure and real estate have also maintained this trend for the past 12 or 13 years. It is only private equity buyout and real estate that saw the streak end in the last year. Hamilton Lane expects that this one-year dip is an anomaly and that, in five years, when looking at the vintage returns, the buyout IRR will have outperformed public returns in every year. Investors assuming that the last year is a window into future performance are ignoring the prior 30 years.

-

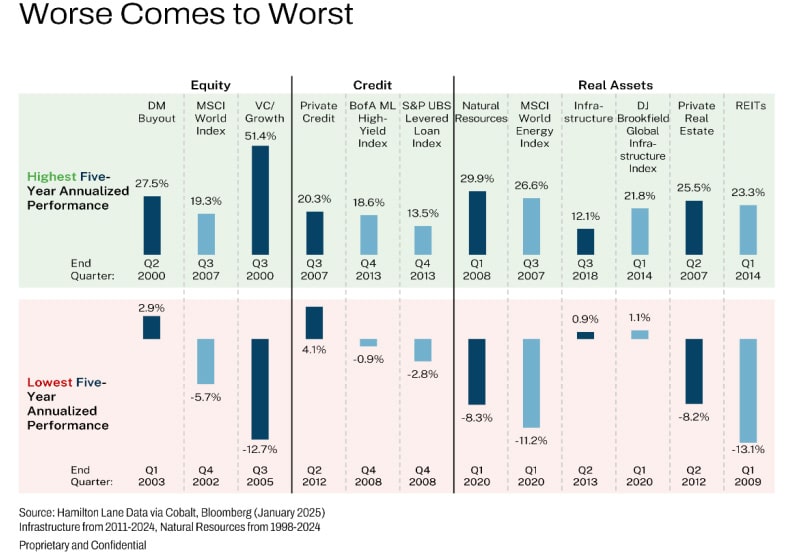

- Portfolio construction / diversification

- Over no five-year period highlighted in the chart above did investors lose money in buyout, private credit or private infrastructure. This is one of the most unappreciated benefits of private markets exposure in a portfolio: the protection against downside risk. A reasonably diversified buyout or private credit or private infrastructure portfolio would be hard pressed to lose money. The risk in these markets does not typically stem from losing money.

- Co-investment and secondaries uptick: Co-investment activity continues to increase, driven by several factors: fewer co-investment players in the market, a desire by general partners to conserve capital in a tough fundraising environment, increased acceptance by the market of co-investment as a standard practice of doing deals, and strong returns for funds and investors who have done co-investments on a regular basis. There has been an increase in secondaries activity for some of the same reasons, as well as interest from both LPs and GPs in secondary deals as a liquidity solution.

EVERGREEN PREDICTIONS

- Today, evergreen funds account for roughly 5% of the overall private markets. That’s about $700 billion. Hamilton Lane’s view is that, 10 years from now, evergreen will be at least 20% of total private markets. To reach that level, and assuming private markets continue to grow at their historic 11% growth rate, evergreen would need to grow almost triple that rate, nearly 30% annually.

- The U.S. high-net-worth channel has about 1% allocated to evergreen structures today. If that figure rose to 5% or 6% over the next 10 years, that 20% overall share of private markets would be achieved.

- When it comes to evergreen, Hamilton Lane expects the following to be true:

- Evergreen funds will grow faster than the overall rate of public markets over the next five years;

- Institutional investors will become bigger players in the evergreen space;

- Evergreen fund fees will decline over time;

- Closed-end funds in certain strategies will decline and largely disappear; and

- The growth of evergreen funds will result in the largest private markets firms getting larger and smaller private markets firms struggling to get any market share.

To access the full 2025 Hamilton Lane Market Overview, click here.

*as of 12/31/24.