Donald Trump is disastrous for economic prosperity. In a few short months, he’s created much uncertainty and with heightened uncertainty, consumers and businesses typically rein in spending. I can’t remember too many times when I’ve felt more apprehensive about the future than now. So, when Greg Gibbs from Amplifying Global FX Capital sent me his article on the big global struggle, much of it resonated. If you want to apply his theories to investment markets skip to the end.

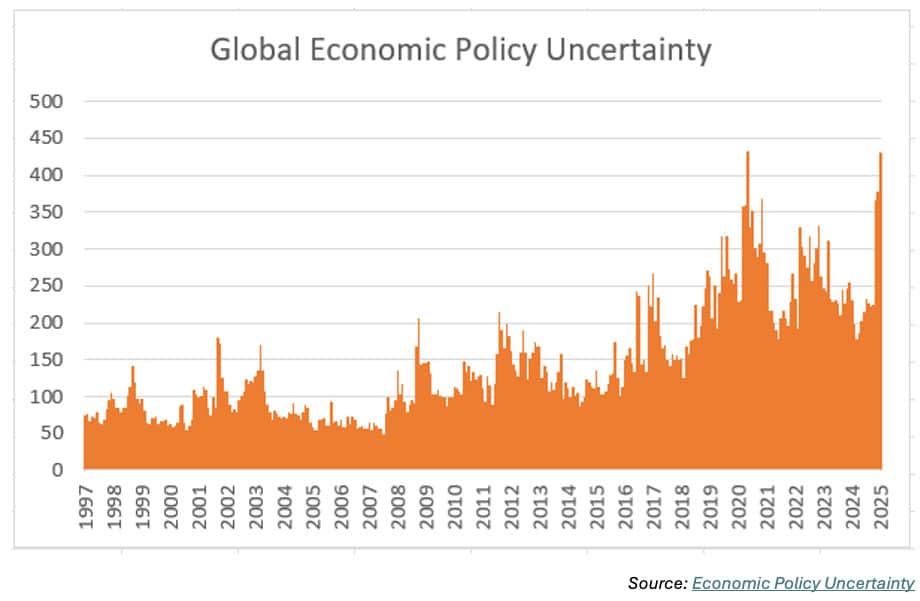

I wondered if there was a measure for global uncertainty and uncovered the Economic Policy Uncertainty website. The Global Economic Policy Uncertainty (GEPU) index is a GDP-weighted average of national economic policy uncertainty indices for 21 countries, including Australia.

The index began nearly 27 years ago, and in January 2025, the index was 429 points, just below the 431-point high due to the global pandemic in March 2020.

Researching Trump and uncertainty, I found an eye-opening perspective from the New York Times’ Ezra Klein, ‘Don’t Believe Him’.

Our lead article this week assesses which US fixed income sectors worked well in 2024 and which didn’t. John Lloyd and John Kerschner, from Janus Henderson Investors show that some sectors are fully valued and uncover a few where they see value.

IAG has come to the market with a new subordinated debt Tier 2 transaction. Other new issues this week include:

- Banco Santander is taking indications of interest (IOIs) for 10NC5 Kangaroo Tier 2 notes with price guidance of 210 basis points over swap

- Liberty is taking IOIs for a five-year senior FRN with price guidance of 220 basis points over 3-month BBSW

- Port of Brisbane has launched a seven and or 10-year fixed rate deal. Price guidance is 135-140bps over semi quarterly swap and 155-160bps respectively

- Firstmac, Pepper and Latitude are in the market with asset backed securities.

Finally, ASIC has announced its preliminary views on the opportunities and risks emerging from shifts in public and private capital markets and called for feedback on key questions.

Have a good week!