Emma Lawson, Fixed Interest Strategist – Macroeconomics in the Janus Henderson Australian Fixed Interest team, provides her Australian economic analysis and market outlook.

Market Review

The market moved to price a definitive near-term Reserve Bank of Australia (RBA) easing. The Australian bond market, as measured by the Bloomberg AusBond Composite 0+ Yr Index, rose +0.19%.

Amid another volatile month, the Australian market now sees near term RBA easing.

Australia’s three-year government bond yields ended the month flat at 3.82%, while 10-year government bond yields were 7 basis points (bps) higher at 4.43%. Against the current cash target rate of 4.35%, three-month bank bills were down 17bps at 4.25%. Six-month bank bill yields ended 19bps lower at 4.31%. The Australian yield curve steepened.

It was yet another month characterised by volatility, which saw a round trip higher, then lower, for bond yields. Focus remains on the uncertainty surrounding the US, amid a new Administration and the potential for significant changes in policy. The US economy is strong, and a robust labour market print pushed most yields higher in early January. This was the end for any market expectation of near-term US Federal Reserve (Fed) easing. That came to pass, as the Federal Open Market Committee (FOMC) chose to keep rates on hold in late January. Other central banks, including the European Central Bank and the Bank of Canada continue to lower interest rates, although there is now a degree of caution surrounding the future inflationary impact of tariffs. The Australian market has been buffeted by these cross currents.

Domestically, however, a lower-than-expected quarterly inflation print, showing lower trimmed mean inflation, and a headline at 2.4% year-on-year, opens the way for a February interest rate cut. While the labour market remains solid, an unemployment rate at 4% does not preclude the RBA starting the process of less tight monetary policy. There continues to be signs of sluggish household consumption, despite rising real incomes. House prices are softening, and business confidence remains below trend.

Also read: Australian Securitisation – 2024 Another Record-Breaking Year

Market outlook

The Australian economy is sluggish, and while no recession is forecast, the pressure of higher interest rates is shown across a number of sectors of the economy. Core inflation continues to moderate. Tight monetary policy is no longer necessary. An extended period of policy at restrictive levels will slow growth further and risk a policy mistake if held for too long. The global economic backdrop shows a strong United States but weakness elsewhere. There are also growing risks which generate volatility, such as trade wars and geopolitical events.

Our base case is for the RBA to commence an easing cycle in February 2025. We price a more modest than the historically average easing cycle, of around 110bps, spread across 2025. We presently have no tilt to the high or low case. The low case is for more easing over the whole cycle. The high case looks for just 85bps of easing. The market brought forward an RBA easing cycle, commencing in February, with 84bps priced over ten months. We believe there is limited value in targeted parts of the curve. We hold a modest duration position and look to adjust the position through market volatility.

Monthly focus – Thematic turns cyclical: Climate change is a near term variable

Climate change has been on economist’s radar for some time now, entering the structural outlook for both GDP growth and inflation. But it has become clearer that the long-term factor is impacting near-term cyclical macro variables. It is time to incorporate climate change into our near-term economic and financial forecasts.

The macroeconomics framework for climate variables can be broken into a number of categories. These include the impacts from warming itself, as well as the transition to a lower emission economy. When we think about the first, warming, this can be categorised as impacting from weather events, which interrupt the normal economic functioning, as well as the changes arising from warming itself. Weather events lower economic output initially as infrastructure and lives are damaged, then growth increases above trend in the repair phase. A generalised rising in temperatures can limit productivity, decrease economic output and divert resources.

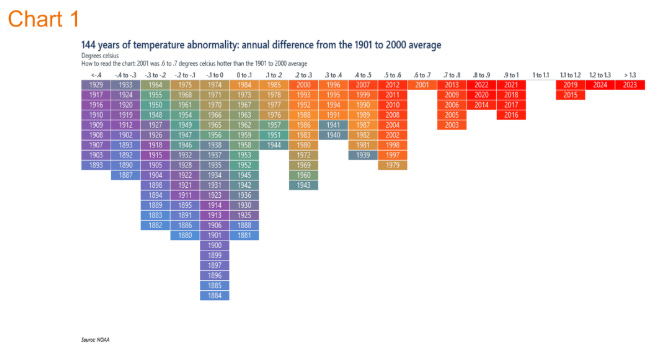

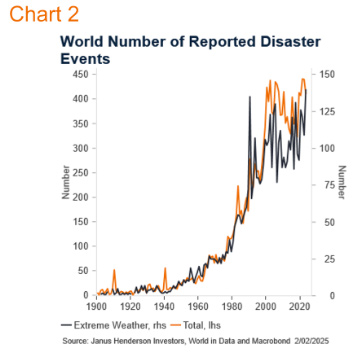

The last few years, and 2024 is no exception, has seen both a rise in generalised temperatures across the globe and an increase in weather related disasters. Chart 1 shows the difference in yearly temperature to the 21st century average. 2024, neared 2023, in recording 1.2-1.3 degrees warmer temperatures, the highest in the study since 1901. There has also been an elevated number of total disaster events over recent years, increasingly these are weather related events such as floods and drought (Chart 2).

We see the direct impact of this in the Australian economic data.

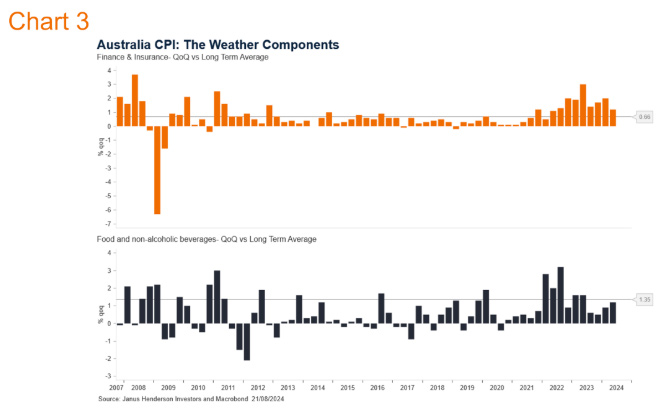

In the CPI there has been an increased price levels for fruit and vegetables (Chart 3), where supply is hampered by adverse weather. The long-term average quarterly increase is 0.8%qoq, but the last few years have seen a pronounced average quarterly rise of 1.2%qoq. This is likely to be some pandemic demand distortions, but equally, weather has played a part. The Australian Bureau of Statistics (ABS) notes that “weather” has featured in the rise in fruit and vegetable price increases in the outsized quarters over the past three years.

We also see a higher rate for insurance services in the CPI, where an elevated number of weather events is raising premiums (amongst other factors). The ABS reported in the June quarterly CPI release “Higher reinsurance, natural disaster and claims costs continued to drive higher premiums for motor vehicle, house and home contents insurance.” (June Quarter, 2024 CPI).

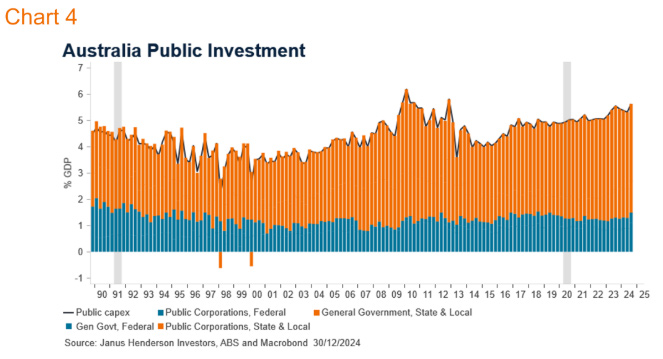

The transition is also playing a part in the cyclical, domestic economy. Investment in transition infrastructure is an integral part of the significant capital expenditure programs seen from State Governments, particularly Queensland. Queensland’s capital program sees around a quarter of the $107 billion over four years being spent on energy transition. The Federal Government’s “future made in Australia” program is aimed at facilitating the transition to a net zero economy and aims to spend $22.7 billion to promote transition investment.

Higher investment boosts cyclical GDP, and in-turn results in a potentially higher interest rate than otherwise. We may see some crowding out of the private sector investment, as resources are diverted to these projects. This mutes the GDP impact somewhat.

The rise in demand for savings over time, to fund transition investment, will require a higher interest rate. This is a long held expected outcome of climate change and transition. The current intense spending plans by multiple levels of government, and support from the private sector, on capital works to facilitate transition and mitigate disasters suggests that that time is now.

We have factored in a higher level of inflation and nominal GDP levels in our long-term fair value model for the Australian yield curve, partly attributable to climate change. We now also factor the impacts on the economy in the near-term cyclical variables, which drive the RBA’s policy and in turn, the expected yield levels across the curve.

Views as at 31 January 2025.